Column: The Rise of Liquid Alternatives

As institutional investors have decreased equity allocations, the biggest investment management trend in recent years has been around systematically capturing alternative risk premia. This has benefited so-called “marketable” and “liquid” alternatives.

Let’s take endowments and foundations (E&Fs) as an example of sophisticated long-term investors and trendsetters, first by examining their exposure to alternatives, and then by breaking down their specific alternative asset allocation.

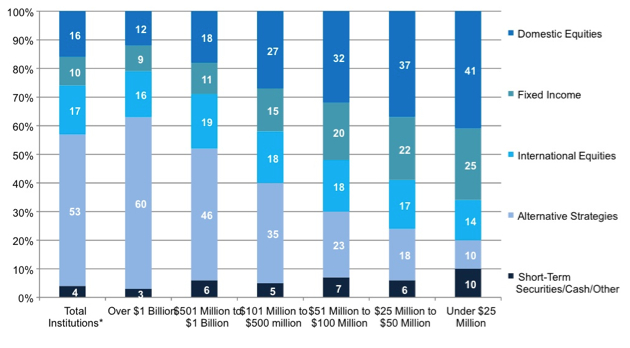

Our research shows a huge discrepancy in alternatives allocation for E&Fs by size and sophistication. Large endowments with more than $1 billion in assets under management have 60% of their assets allocated to alternative strategy.

Given the resource and research requirements to adequately allocate to alternatives, the allocation drops in linear fashion down to 10% exposure to alternatives for endowments with less than $25 million in assets.

However, allocations to alternatives overall have grown in recent years for endowments of all sizes, with alternatives accounting for 53% of E&F assets overall.

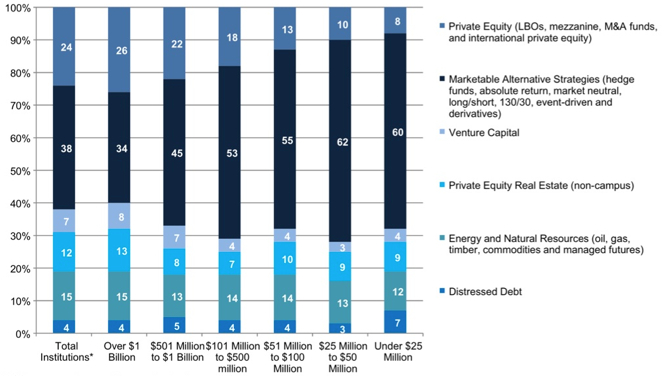

Importantly though for liquid alternatives, marketable “liquid” alternative strategies account for 60% of alternatives exposure for small endowments. This number decreases to 34% for the largest endowments.

As smaller institutions have to deal with their boards on liquidity and the overall comfort of alternative exposures–and also have less staff and resources to dedicate to alternatives–liquid alternatives have benefited greatly.

This is not only true for E&Fs. Public and corporate pension plans increasingly are looking to capture alternative risk premia at long-only fees, and their trustees and boards are more comfortable to start out with liquid forms of alternatives.

As traditional and alternative investment products are converging globally, the net flows to hybrid vehicles are becoming meaningful. Here are a few examples:

1) AQR in the last few years has amassed $12 billion in liquid ’40 Act funds, close to 15% of total assets. Managed futures and diversified arbitrage each have around $3 billion in assets, but there are now four risk parity funds growing fast.

Standard Life has raised $30 billion in their Global Absolute Return Series since 2008, transforming an internal defined benefit investment strategy first into UK and then a cross-border global product with a majority of assets lately coming through higher fee external assets.

And then there is the PIMCO commodity real return strategy with $20 billion in assets, which has been around in the US for more than a decade with a portable alpha approach.

We will likely see much more activity as alternatives move from satellite to core allocations in institutional, high net worth and even retail portfolios.

Endowments’ Asset Allocation by Size of Institution

Source: 2011 NCSE survey of 823 endowments

Notable recent examples include Franklin Templeton buying K2 to build alternative investment solutions, GCS in Hong Kong purchasing Dexia in Europe to introduce broad capabilities in Asia with the Industrial and Commercial Bank of China, Legg Mason buying Fauchier Partners, and KKR selling its flagship strategies through Charles Schwab.

Smaller hedge funds and alternative managers will especially be trying to combine their expertise with long-only or more liquid strategies, because they are dealing with fee and other pressures in discussions with clients.

Challenges are mostly around product design, regulatory constraints and finding the right people to implement liquid alternative strategies and manage derivatives. As a result, most of the top liquid alternative funds spend a lot of time on educating clients and advisors on leverage and derivatives.

The top 15 liquid alternative funds both in the US and globally each manage a total of $180 billion in 30 funds, while many other funds have not been able to attract meaningful assets.

In other words, the main trends discussed in my prior columns–the blockbuster phenomenon (winner takes all) and the era of multi-convergence (convergence of products, distribution, regulation and geographies)–very much apply to the liquid alternatives discussion.

A handful of managers will gather large amounts of assets and establish strong brands with institutions, private clients and key consultants, while many others will struggle. The good news is that the secular shift for alternatives from satellite to core allocation is just beginning.

Time to develop a simple story for a complex proposition.

Daniel Enskat is senior advisor to Asset International and founder of Enskat & Associates

Endowments’ Alternatives Allocations by Size of Institution

Source: 2011 NCSE survey of 823 endowments