PERSI’s Maynard: How Complexity Is Failing Investors

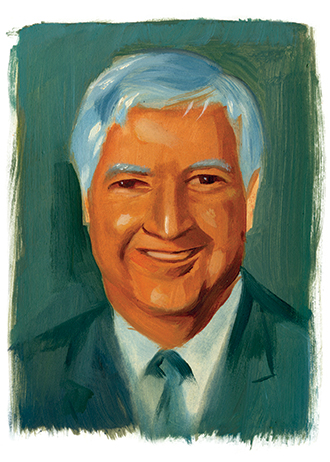

Bob Maynard, CIO, PERSI (Art by Chris Buzelli)If it’s too difficult to understand by just looking at, your

portfolio is probably too complex. So says the latest paper by Bob Maynard,

CIO of the Public Employee Retirement System of Idaho (PERSI) and 300 Club

member.

Bob Maynard, CIO, PERSI (Art by Chris Buzelli)If it’s too difficult to understand by just looking at, your

portfolio is probably too complex. So says the latest paper by Bob Maynard,

CIO of the Public Employee Retirement System of Idaho (PERSI) and 300 Club

member.

Maynard, who looks after $14.2 billion in public sector retirement assets, warns peers that developments in financial and risk modelling did not make investing any safer—or more likely to give better returns. Instead, they should think about returning to a traditional, simpler way of allocating capital.

“It has almost become an accepted truth that to be a ‘sophisticated’ institutional investor in a complex, interactive, tightly coupled, and adaptive world, one has to adopt a complex, interactive, tightly coupled, and opportunistic investment model (and organization),” says Maynard.

This new approach—embodied in some part by the endowment model, according to Maynard—emphasizes non-transparent and illiquid vehicles and relies on quantitative, detailed models of portfolio characteristics as their primary risk control devices.

“The more that detailed quantitative models of portfolio characteristics are needed to describe a portfolio and its behavior, the greater risk it will incur,” Bob Maynard, CIO, PERSI.However, a complex investment world does not require a complex response, either in the nature of the investment organization or the particular investment strategies chosen, the CIO—and three-time Power 100 member—says.

“The cockroach lives in a highly complex environment with one of the best long-term success rates of any creature,” the paper says. “Yet it has only one defense mechanism—running in the opposite direction from a puff of air. The equivalent for the investment world is, at the core, a very simple structure founded upon public market diversification with one basic defense mechanism: see a volatile movement, react in the opposite direction (i.e. rebalance into it).”

A simple structure and strategy, if adhered to, has one of the best chances of surviving for many decades, Maynard declares.

Transparency, daily public and independent pricing of public-market securities (with the attendant liquidity), managers with clear styles or concentrated portfolios, and a reasonable number of active manager relationships that can be easily followed and understood are what is needed, Maynard says.

PERSI employs 16 managers to run nine strategies over 20 mandates. There are no explicit allocations to “alternative” asset classes, according to its October investment update. Over the past 20 years, it has made a 8.4% return, the update states.

“The best risk control lies in knowing what you have, what it is worth, and how it is behaving,” Maynard concludes. “The more that detailed quantitative models of portfolio characteristics are needed to describe a portfolio and its behavior, the greater risk it will incur.”

The paper is available for download.

Related Content:Power 100 #67 Bob Maynard & The Power Lunch