How Much Sharper is Smart Beta?

Double-digit Sharpe ratio uplifts were the reward for taking a smart beta approach to equities over the past 10 years rather than retaining a market capitalisation benchmark, research has found.

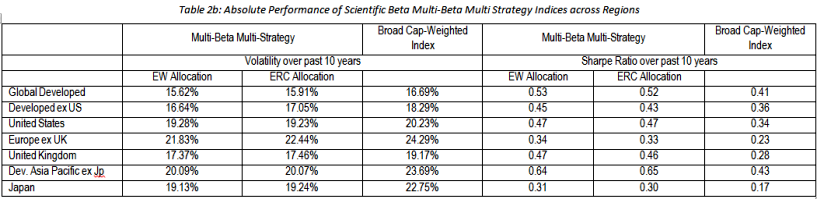

Sharpe ratios based on absolute performance of multi-beta multi-strategy (MBMS) equity indices over a range of geographies were considerably better over the decade to the end of October than strategies based on traditional portfolios, according to academics at Edhec.

The MBMS indices used by the researchers were a combination of “smart factor” indices and provided allocations to well-documented risk premia in equity markets, including value, momentum, size, and low volatility.

Improved Sharpe ratios were partially due to lower volatility in these indices, Edhec’s research showed. Volatility in US equity portfolios using a traditional benchmark measured 20.23%, whereas the equal-weighted MBMS index was 19.28% and the equal risk contribution MBMS was 19.23%. This lead to a Sharpe ratio for both smart beta indices of 0.47, compared to a traditionally-weighted portfolio producing a reading of 0.34.

The most marked difference occurred in developed Asia-Pacific markets ex-Japan. In this instance, Sharpe ratios were improved by at least 0.21 from the traditional benchmark’s reading of 0.43.

Source: Edhec

Source: Edhec

Related content: AQR’s Asness: How I Learned to Stop Worrying and Love Smart Beta & Smart Beta: Snake Oil or Saviour?