Manager Fear Number One: China

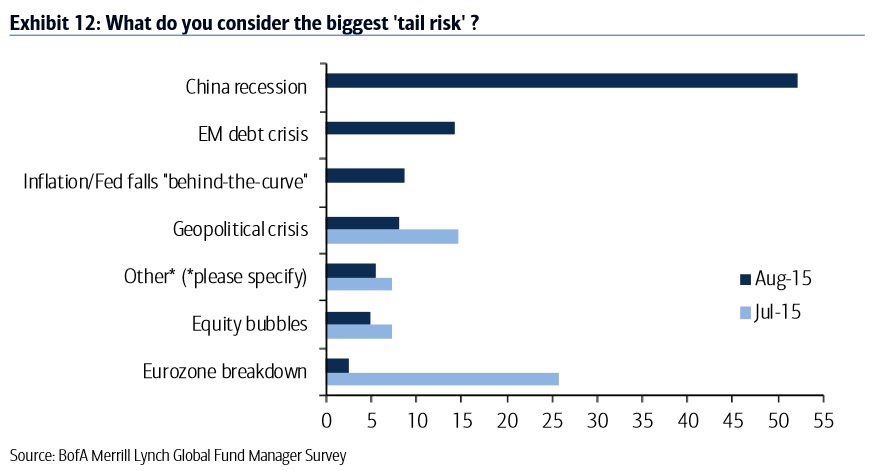

A recession in China is the biggest tail risk to global investment portfolios, according to Bank of America Merrill Lynch’s (BoAML) latest survey of fund managers.

More than half of the 202 managers surveyed said a collapse in China’s economic growth was their chief concern.

“Investors are sending a clear message that they are positioned for lower growth in China and emerging markets.” —Michael Hartnett, BoAMLLast week, the People’s Bank of China allowed the yuan to depreciate by 2% against the dollar, in an attempt to boost exports.

Chinese authorities maintain that the country’s economy will grow by 7% this year. Economic growth has been falling steadily in recent years, according to World Bank data, from 10.6% in 2010 to 7.4% in 2014.

Investors are sceptical: BoAML reported that a net 32% of fund managers were underweight to emerging markets relative to their benchmarks, the most negative positioning to this region in the survey’s history.

“Investors are sending a clear message that they are positioned for lower growth in China and emerging markets,” said Michael Hartnett, chief investment strategist at BoAML Global Research.

The Hang Seng stock index is down 2.3% since the start of this

year after a period of losses over the summer. This is despite a rally of

roughly 19% during the first four months of 2015.

The Hang Seng stock index is down 2.3% since the start of this

year after a period of losses over the summer. This is despite a rally of

roughly 19% during the first four months of 2015.

Dutch asset manager NN Investment Partners last week warned that some investors may be underestimating the wider effects of the stock market decline on other Asian and emerging markets.

The BoAML survey results marked a dramatic change in sentiment compared to last month’s survey, when the main tail risk—cited by a quarter of managers—was a break-up of the Eurozone.

When questioned earlier this month, Europe was the region in which most equity managers wanted to allocate more capital.

James Barty, head of European equity strategy at BoAML, said investors in European stocks preferred “domestically-focused names and are avoiding anything exposed to China or commodities”.

Managers are still holding near-record levels of cash, BoAML found. Last month’s average cash position of 5.5% was the highest since September 2008, and this month managers reported an average cash allocation of 5.2%.

Related: Investors Underestimating China Risk, Manager Warns & Ray Dalio: We’re Not Bearish on China Yet