The Argument for Private Equity

Pension funds with even a limited amount of capital should be investing in private equity, argues a recent research note from Cambridge Associates.

While private investments can entail higher fees, illiquidity, complexity, and a lack of transparency, the research showed that they also offer opportunities for increased returns, greater diversification benefits, and dampened volatility.

The average private equity allocation among US corporate and public defined benefit pension funds is 5.5%, according to the report, leaving an opportunity for many pension funds to increase their private market allocations.

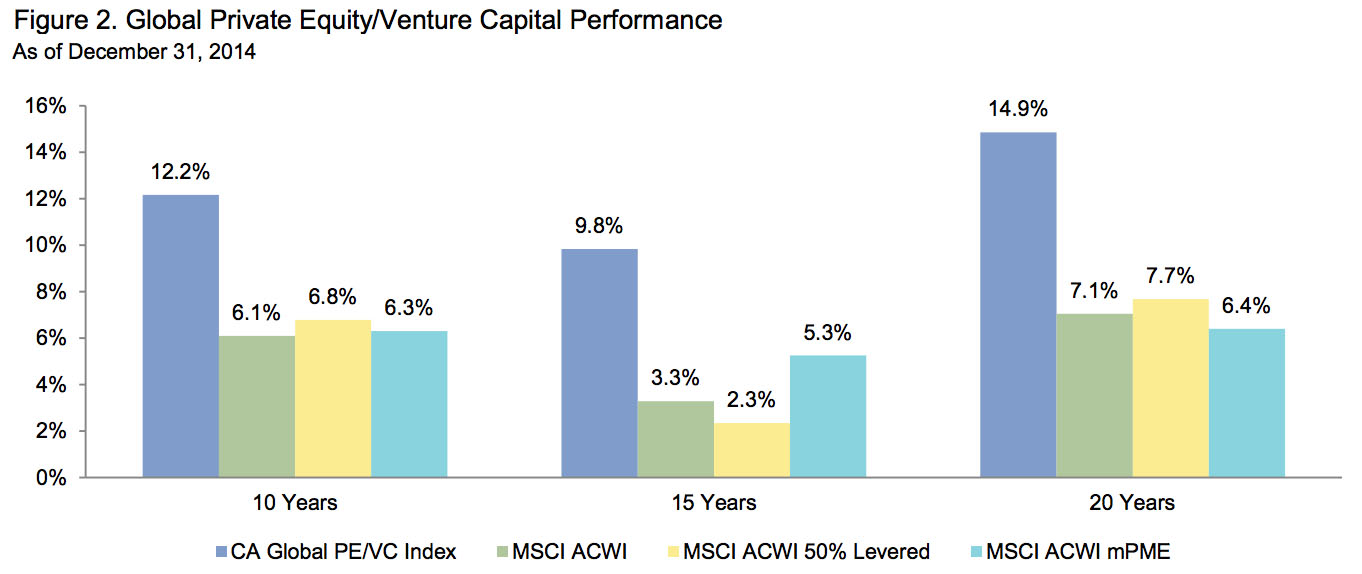

According to Cambridge Associates, private equity strategies—including venture capital, growth equity, buyouts, and debt-related and real assets strategies—outperform public equities over the long term, even after fees, expenses, and carried interest are subtracted from returns. The Cambridge Associates Global Private Equity/Venture Capital Benchmark has generated long-term returns exceeding public equities by 300 bps or more.

By the consulting firm’s estimates, a pension fund that shifted 15% of its assets from public to private equities could boost its total return by 45 bps per year.

However, because dispersion between manager returns is “substantial,” manager selection and portfolio construction are essential to capturing returns, the report said.

Additionally, the research showed that the typical private investment fund takes six or seven years to produce meaningful results. Therefore, it is necessary for investors to maintain a long-term mindset.

Other characteristics of private investments, such as complexity and lack of transparency, can require more monitoring and governance than investments in public equities. However, Cambridge Associates argued the return potential of private equity merited the additional resources and effort.

Source: Cambridge Associates

Source: Cambridge Associates