Winning OCIO, One 401(k) at a Time

It’s a tough world for outsourced-CIOs (OCIOs). In that

eat-or-be-eaten arena, even the biggest names in the business get into trouble.

August 2014: The Christ Church Cathedral of Indianapolis sues its OCIO JP

Morgan for breach of fiduciary duty. January 2015: Boutique firm Fiduciary

Research announces it is closing after losing its sole client. Most recently,

in July: San Diego County’s retirement system fires Texas-based Salient

Partners after six tumultuous years of discretionary management. Signs of a

much-anticipated shakeout have also emerged: Goldman Sachs Asset Management

bought Pacific Global Advisors in April, and Verus Advisory (formerly Wurts)

swallowed Strategic Investment Solutions just last month.

It’s a tough world for outsourced-CIOs (OCIOs). In that

eat-or-be-eaten arena, even the biggest names in the business get into trouble.

August 2014: The Christ Church Cathedral of Indianapolis sues its OCIO JP

Morgan for breach of fiduciary duty. January 2015: Boutique firm Fiduciary

Research announces it is closing after losing its sole client. Most recently,

in July: San Diego County’s retirement system fires Texas-based Salient

Partners after six tumultuous years of discretionary management. Signs of a

much-anticipated shakeout have also emerged: Goldman Sachs Asset Management

bought Pacific Global Advisors in April, and Verus Advisory (formerly Wurts)

swallowed Strategic Investment Solutions just last month.

Providers managing to stay afloat—even thrive—in this cutthroat business are doing so by, dare we say, innovating. “The OCIO world is talking about the advent of a 2.0 phase,” Alexi Maravel, associate director at research shop Cerulli Associates, said in April. “Many established providers acknowledge a new generation of firms providing more comprehensive customized services.” It’s only a matter of time, Maravel said, before the forces of supply and demand take over. “The winners of OCIO version 2.0 are likely to be well-resourced,” he concluded. The new age doesn’t stop at customization for lower fees. These new masters of the universe are looking beyond the traditional small endowment and foundation mandates, eyeing the next big thing for outsourcing: defined contribution (DC) plans.

“The DC landscape means something quite different than DB [defined benefit] plans,” says John McCareins, practice leader for Northern Trust’s OCIO arm. “Over the last three years, RFP [request for proposal] activity in the OCIO business has gone up 60%. For the DC space, it’s up around 200%. Plan sponsors are asking how to better manage risks associated with DC plans. They’re thinking critically about how to achieve better investment outcomes on behalf of participants. And they’re turning to OCIO providers.”

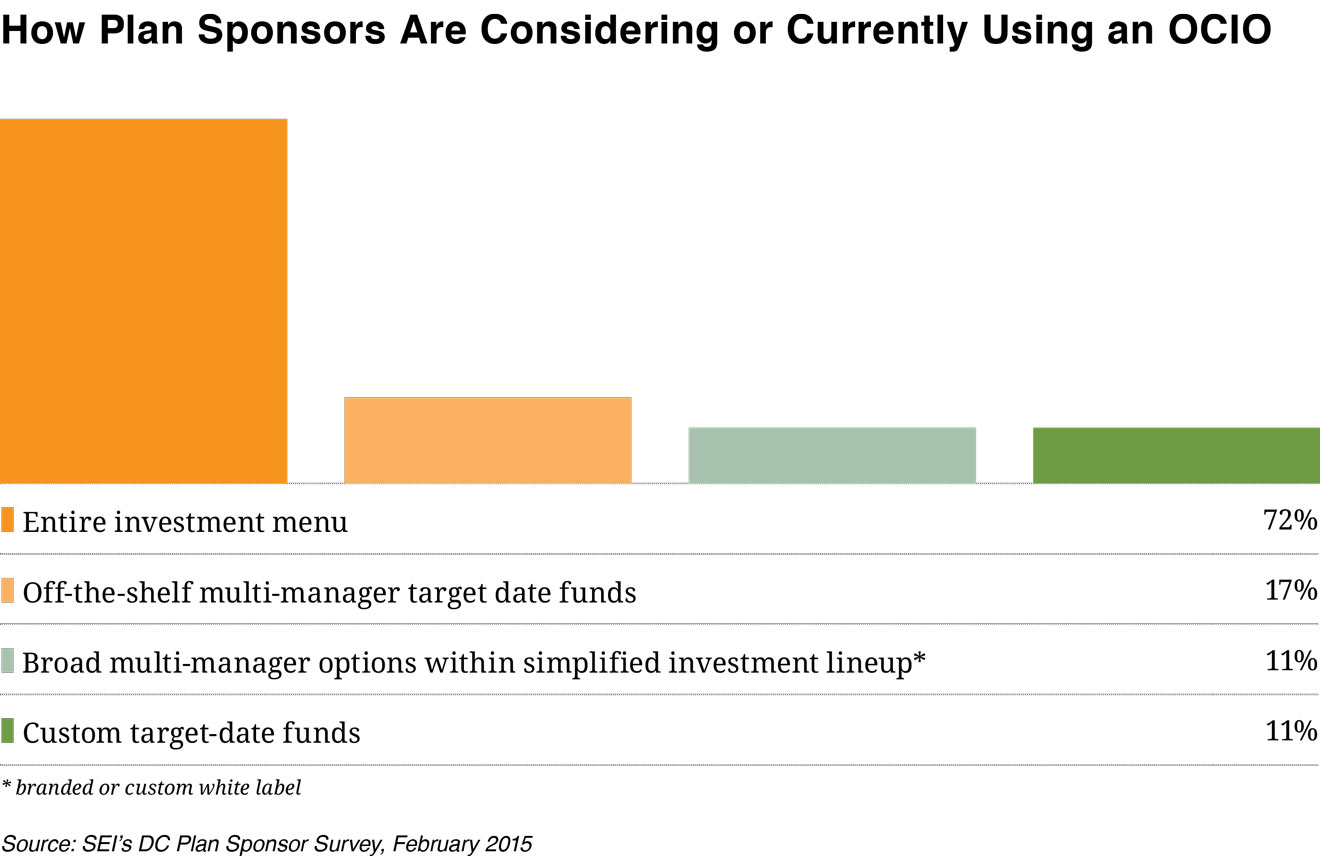

Results from CIO’s 2015 OCIO Survey support these statistics. The percentage of already-outsourced respondents who handed over their entire portfolio to a third-party manager rose from 48% to 57% this year. The number of investors that outsourced less than 25% of their assets also dropped significantly. Not to mention, nearly half (42%) of OCIO providers surveyed by Cerulli anticipated at least moderate growth in total DC outsourcing.

Sponsoring a DC plan is a lot of work. The days of putting 15 mutual funds on a platform and forgetting about them are long gone, according to McCareins. “DC plans are becoming the primary retirement vehicles and plan sponsors are searching for ways to apply DB risk management practices to DC plans. They’re looking at outcome-oriented de-risking approaches, and introducing different asset classes.” In other words, capital preservation and growth is key; It’s time to sophisticate 401(k)s. The trouble is that plan sponsors also have businesses to run.

“DC fiduciary is a hard job,” says Russell Investments’ Josh Cohen, head of institutional DC for the Seattle-based firm. “There are a lot of investment complications, additional scrutiny from participants and regulators, and increasing pressure on plan sponsors—in addition to the recognition that DC plans need to be better. These plans are institutionalizing. They’re moving into multi-manager and white-label funds. But plan sponsors often lack the necessary resources and scale—very few can actually create them on their own.”

OCIO providers are natural players to fill the gap, according to McCareins from Northern Trust. By handing off manager selection, portfolio construction, and ongoing oversight, plans could gain better access to particular investment styles, strategies, and a structure that optimizes both. White-label funds could offer smoother returns and greater levels of comfort with performance, he argues, given OCIOs’ “strong insight into factor-based exposures, return patterns, and seamless operations. The worst thing for DC plans is to have a big negative surprise.”

DC outsourcing is already happening piecemeal, Cohen points out. Plan sponsors are turning over investment decisions and administrative duties in creating custom target date funds, for example. In that instance, a specialty manager takes responsibility for asset allocation and creating a glide path to arch across the target-date spectrum. Plan sponsors still have to account for participants’ demographics and the unique fund line, Cohen notes. “But most plan sponsors have not yet felt comfortable working on all of these factors. The OCIO can take care of the implementation component: Working with the record keeper, custodian, and trustees, managing asset values, rebalancing cash flows, overseeing transitions, etc. It takes a heavy dose of operational oversight.” Even with all of that taken care of, someone still has to run participant communication and education.

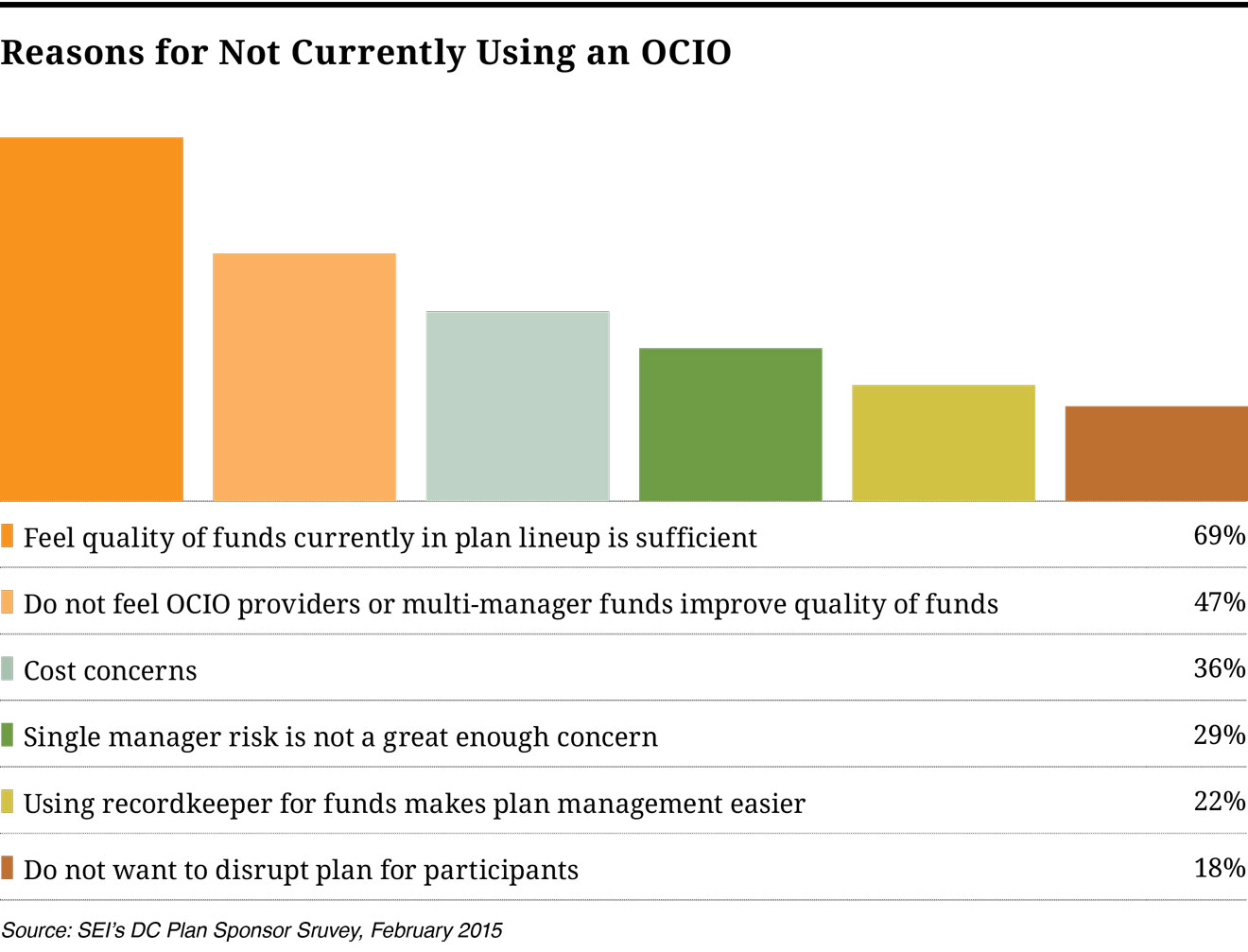

These myriad responsibilities—many of them member-facing—make a defined contribution OCIO role unlike others in the business. Rather than a board of trustees or CFO, the DC provider has to please thousands of non-expert participants. “The biggest hurdle for OCIOs in the DC landscape is experience,” says Meketa Investment Group’s Co-CEO Stephen McCourt. “Advising 401(k) plans is very different from advising DB plans or endowments. You’re working with a lot of mutual funds, institutional funds, and separate accounts, to name a few groups. To monitor all of these options, you need strong research capabilities and awareness of changing regulatory environments.”

Even more difficult would be taking discretion over retirement income products—hailed as the next great advance for DC—McCourt adds. “Providers have been involved in advising plan sponsors on annuities—and highlighting the risks in them—but have yet to offer actual solutions. There aren’t many firms willing to take on the discretion of hiring an annuity provider to embed in the plan.” A provider that solves the annuity problem could win OCIO along with DC servicing in general.

But there’s an even bigger dream for DC outsourcing. If OCIOs can replace an endowment or pension’s investment operation, couldn’t they in fact replace plan sponsors themselves? As Russell’s chief research strategist, Bob Collie is paid to think about these kinds of questions. “The ultimate outsource model is the multi-employer plan,” Collie speculates. “It paints the plan sponsors out of the picture as a third-party OCIO provider becomes part of the pension plan. Instead of an employer managing the plan as a fiduciary, employees could actually take part in pension plans of other corporations.” Total offloading could mean the only job left for an employer is selecting and monitoring the plan provider. That, and their actual job.