Capacity Concern as Insurers Turn to Asset Management Sector

Regulation and poor returns are forcing insurers to consider outsourcing investment posing questions on the capacity in the asset management sector.

A survey of key players by Standard Life Investments showed 44% of European insurers were considering outsourcing one or more asset classes, reversing a tradition of in-house investment in the sector.

“European insurers’ business strategies and traditional business models are being fundamentally challenged due to the combination of the long-term low return environment, Solvency II, and the ongoing need to deliver on promised guarantees,” said Stephen Acheson, executive director at Standard Life Investments.

In Germany, some 83% of insurance assets are invested internally, Standard Life Investments said. In northern Europe, this figure was 76% and in southern Europe it fell to 56%. The lowest level of in-internally managed assets were in the UK at 44% at the time of the survey.

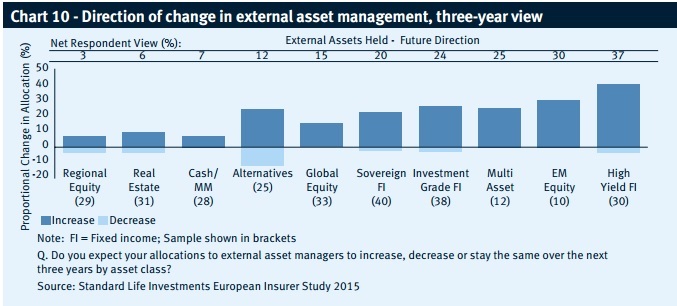

However, insurers predicted an increase in the level of assets being farmed out to third-party managers over the next three years, with double-digit percentage rises in what may be invested externally.

“The survey highlighted a clear theme of insurers looking to outsource to the external asset management industry,” said Acheson. “However, it also highlights a belief among insurers that the number of credible outsourcing partners is declining.”

Insurers cited in the report said they needed their asset management partners to understand their specific needs—and many were found wanting.

“While asset managers are partnering with insurers to meet short-term deadlines, respondents explained that few managers really understand their liabilities and the capital implications on portfolios from Solvency II,” the report said.

Over 30% of respondents were interested in insurance and regulatory expertise, and 27% cited liability management advice as key value-add services from asset managers. Large fixed income managers and specialist (typically insurer-owned) managers were most frequently cited as partners who could offer regulatory and liability management advice.

“Asset managers will increasingly need specialised skills to work with insurers, understanding how our liabilities and balance sheets work, which plays to larger managers and those owned by insurers,” one large life insurer told the survey. “Having said that, there is some internal reluctance to work with asset managers owned by direct competitors.”

Additionally, specialist equity managers were expected to de-prioritise the sector as the bespoke nature of insurer mandates was seen as “frustrating” for managers who can reach capacity via other channels.

“Fewer managers are going to be interested in dealing with insurers going forward,” one UK life insurer told Standard Life Investments. “Servicing costs are now very high. I think larger and specialist insurance-focused asset managers are better placed to remain. Unless managers can get real scale, management fees will have to rise.”

Standard Life carried out more than 60% of executive interviews with Chief Investment Officers across 56 different European insurers covering €2.4 trillion in assets, more than 30% of total insurer balance sheet assets across Europe.