Dry Powder Stacks Up in Distressed Debt

Distressed debt funds accumulated record levels of dry powder in 2015, Preqin has reported.

Managers focused on North America and Europe raised an aggregate $21 billion over the year, a slight increase from the $20 billion raised in 2014. However, unused cash grew by $9.1 billion to $55 billion, the largest uptick in dry powder levels since 2010.

“Although fundraising has been consistent, levels of unspent capital available to fund managers have been rising steadily, and stand at record levels as of the end of 2015,” said Ryan Flanders, head of private debt products at Preqin.

Source: Preqin’s “Distressed Debt in North America and Europe“Nearly a third of institutional investors also said they are targeting further allocations to distressed debt funds in 2016, according to a separate survey conducted by Probitas Partners last year. Thanks to big firms with the ability to raise multi-billion dollar funds “relatively quickly” dominating the landscape, Flanders said 2016 is likely to be “another strong year for distressed debt fundraising.”

Source: Preqin’s “Distressed Debt in North America and Europe“Nearly a third of institutional investors also said they are targeting further allocations to distressed debt funds in 2016, according to a separate survey conducted by Probitas Partners last year. Thanks to big firms with the ability to raise multi-billion dollar funds “relatively quickly” dominating the landscape, Flanders said 2016 is likely to be “another strong year for distressed debt fundraising.”

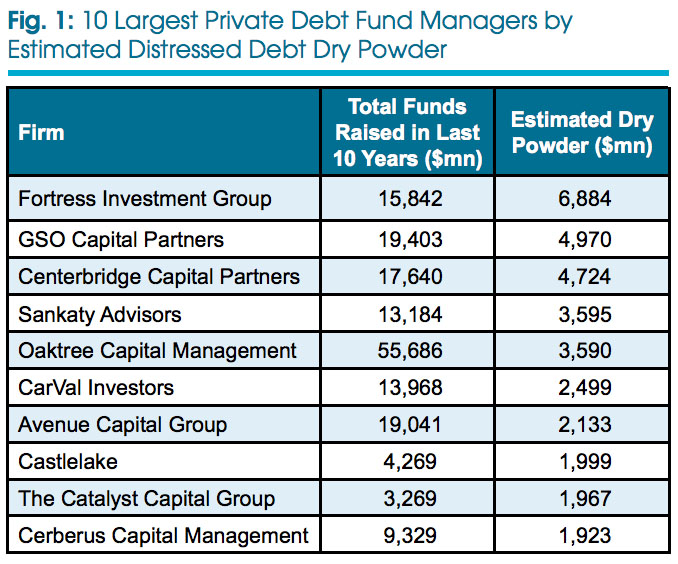

Of the 30 funds recorded by Preqin, the 10 holding the most cash accounted for 65% of the total capital available for investment in North America and Europe.

“Several funds from these managers are currently being marketed to investors,” Flanders said. “This in turn may increase pressure on managers to make use of the capital at their disposal.”

And it’s not just distressed debt that’s flushed with cash. Preqin reported last summer that private debt funds as a whole held a record $185 billion in dry powder as of July 31, with distressed debt accounting for just 29% of private debt capital raised in 2015.

Other private capital sectors, including private equity and real estate, also hit record highs in 2015 for unspent capital.

“Fund managers will be keen to demonstrate they can put capital to work to ensure they can continue to attract future commitments from investors,” Flanders said in August.

Related: Private Debt Funds Awash with Cash, Not Opportunities; Alternative Investing’s Slowdown; Valuations Fail to Deter Private Equity Investors