Are You Paying Too Much for Your Property Exposure?

Investors in open-ended property funds could be paying twice the cost when using a certain pricing method, research from Willis Towers Watson has found.

The consultant said it was “concerned” that funds spreading trading costs across several years actually charged investors more than those that invoice transaction costs up front.

“We are concerned about the way in which the cost of investing in open-ended real-estate unlisted funds is being built into fund pricing,” the research paper said. “Whilst it is accepted that there is a cost when investing new capital in buying buildings, how this cost is passed on to the investor is important.”

Charging investors an up-front transaction fee based on the bid-offer spread of units can be an expensive option, Willis Towers Watson admitted, as it immediately erodes several percentage points of investable capital.

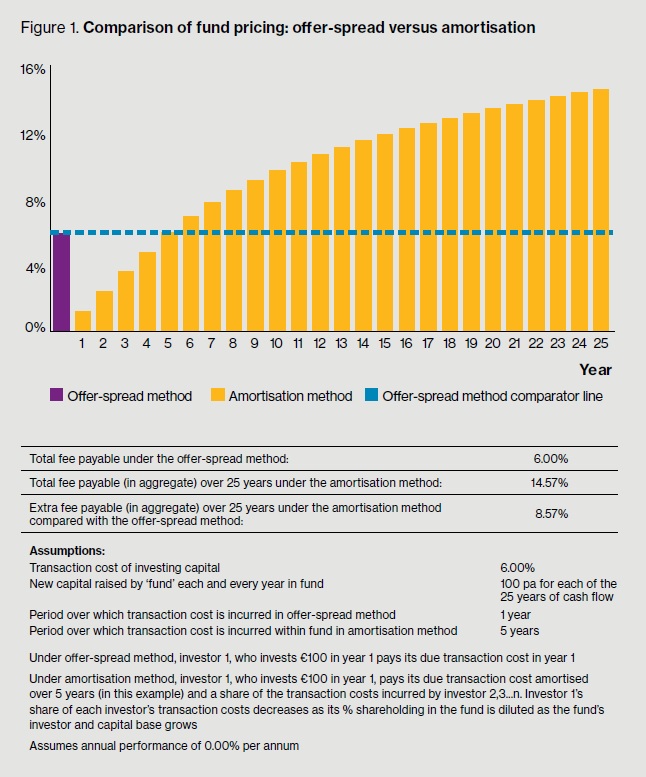

However, spreading costs over several years through amortization often results in all fund investors picking up the tab, regardless of when they bought in. After the initial transaction’s cost has been paid off after five years, investors would continue contributing to newer buyers’ transaction charges, the consultant said.

“This means that over the life of an investment (unless short), the investor in effect ends up paying more in aggregate by investing in such a pooled fund than it would if it bought the building direct through, say, a segregated account or via a fund that used [bid-offer] spread pricing,” the research paper said.

Willis Towers Watson estimated that an investor remaining in a property fund for 25 years would pay 14.6% through amortization, compared to an equivalent of 6% up front with bid-offer spread pricing.

In addition, the amortization approach could encourage short-termism among investors as they move from one fund to another more frequently to take advantage of lower charges in the first few years of an investment.

While the bid-offer spread pricing method is preferred in the UK, Willis Towers Watson said, investors across Europe and the US are not accustomed to this model.

“Investors should be aware of this issue when considering fund investments and assess the additional cost the end investor will ultimately bear for subscribing to a fund that prices using the amortization methodology,” the research paper concluded.

Source: Willis Towers Watson

Source: Willis Towers Watson

Related: CalPERS Leads Record Year for Unloading Real Estate & European Pensions Refocus on Property