Consultant: Hedge Funds ‘Integral’ to Corporate Pensions

Hedge funds may have been getting a lot of criticisms lately—but the investment vehicle still has at least one supporter.

A new report from consultant Cambridge Associates has argued that hedge funds remain “integral” to pension investment strategies, especially as plan sponsors struggle with mounting funding deficits.

“For some pension sponsors, the hedge fund solution may sound counter-intuitive, based upon their earlier experiences with hedge funds,” said Managing Director Joseph Marenda. “Many sponsors went into hedge funds that had done well during the crisis—but they were essentially too late. They were chasing what had worked in the last cycle, but they were actually in a different cycle.”

As a result, he added, these pension funds saw poor risk-adjusted returns.

But according to Cambridge Associates, hedge funds can still offer a source of alpha and risk reduction for plans in need of bigger investment returns to counter rising liabilities.

“A carefully selected group of hedge funds, diversified across different strategies, may produce alpha and play a key role in risk reduction and return enhancement—not just in bull markets but across all market cycles,” Marenda said.

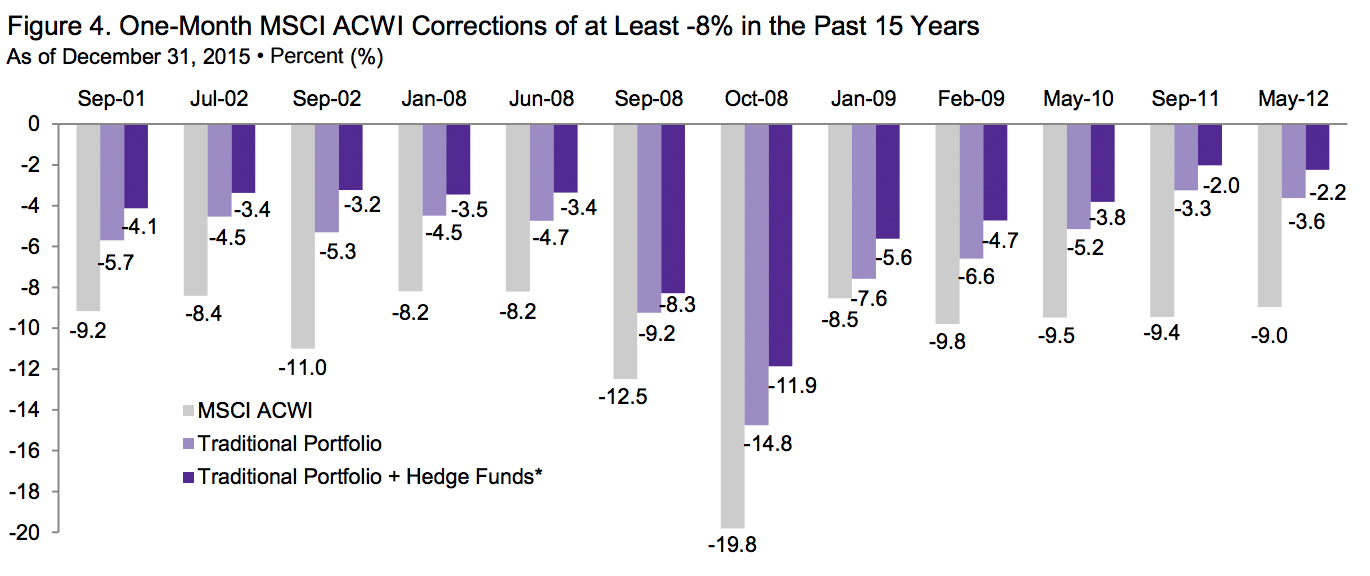

Cambridge Associates clients’ hedge fund programs have outpaced global equities by 48 percentage points cumulatively over the last 15 years after fees, with one-third of the volatility of public markets. According to the report, a hypothetical 10% market correction would set a traditional portfolio back 5.9%, while a similar portfolio including hedge funds would lose a more modest 4.4%.

The key, Marenda said, is choosing the right managers. Of the 11,000 hedge funds on the market, less than 5% actually merit institutional capital, according to Cambridge Associates. Pension funds should therefore carefully consider hedge fund investments—both as individual allocations and within the context of the total portfolio.

“Choosing managers and creating a program that truly benefits a pension portfolio is as much art as science,” he said. “If you know the people running the investments, how they think and how they manage their risk profiles, there is a much greater likelihood that you will be successful in building a winning portfolio.”

Source: Cambridge Associates’ “Hedge Fund-ing the Pension Deficit”

Source: Cambridge Associates’ “Hedge Fund-ing the Pension Deficit”

Related: Public Pensions Still Hungry for Hedge Funds & Pensions Should De-Risk with Hedge Funds, Consultants Say