‘Multi-Asset’ Means Overcharging for Beta, Says Consultant

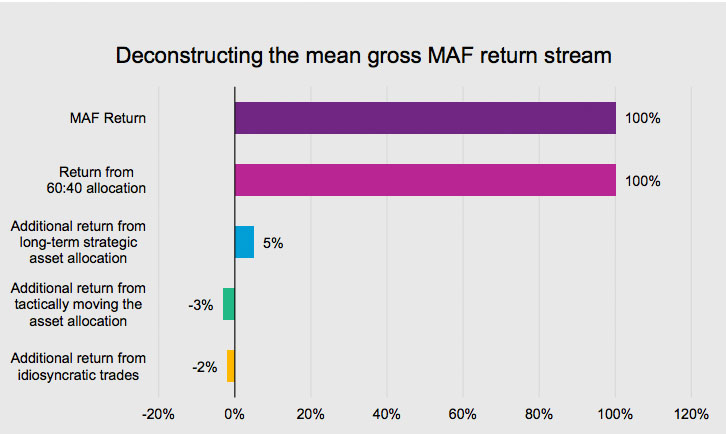

The dynamic asset allocation capabilities that make multi-asset funds unique have so far detracted from fund returns, according to Willis Towers Watson.

Multi-asset funds—which allow investing across asset classes under one mandate—theoretically should benefit from managers’ freedom to play tactically in response to economic conditions. But those very tactical asset allocation decisions, along with other forms of active management, have on average been detrimental to multi-asset funds, the consultant argued in a recent report.

Source: Willis Towers Watson’s “Multi-Asset Funds: Targeting Their Future Value” “Continuously changing the asset allocation through tactical and idiosyncratic trading has generally proven to be a drag on performance,” the report stated.

Source: Willis Towers Watson’s “Multi-Asset Funds: Targeting Their Future Value” “Continuously changing the asset allocation through tactical and idiosyncratic trading has generally proven to be a drag on performance,” the report stated.

Risk management, too, was lacking, with Willis Towers Watson noting that many multi-asset funds had not “sufficiently incorporated” risk controls into the design of their products.

Yet the consultant found that the majority of multi-asset funds had generally good risk-adjusted performance, and additionally achieved positive performance in line with their return targets since inception. These results, the consultant determined, derived not from active management, but from equity and credit beta.

“The majority of multi-asset fund managers have thus far shown limited ability to add alpha through active management, so we struggle to believe they will suddenly start to do so in the future,” the report continued.

As a result, multi-asset funds will “find it challenging to achieve their performance objectives if the future is an environment of depressed and volatile returns,” the consultant said.

Additionally, given the lack of alpha generated by multi-asset managers, Willis Towers Watson argued that the fees charged by these funds were “generally too high.”

“We believe many multi-asset funds have created the illusion that their insights and tactical asset management are valuable, whereas so far most have only delivered market beta (which is almost freely available) through their long-term strategic asset allocation,” the consultant wrote. “If managers lowered their fees, their products would have a better chances of delivering closer to their targets in the future.”