What CIOs Want and Need from Asset Managers

Beyond investment management, CIOs are looking for their asset managers to become partners in setting strategy and managing risk.

Neil Blundell of Invesco

Financial markets have turned volatile, oil prices have plunged and interest rates are on the upswing. It’s a challenging investment environment by any measure. To find out how CIOs are responding and how they can build for the future, Chief Investment Officer spoke recently with Neil Blundell, global head of client solutions at Invesco, who’s been crisscrossing the globe meeting with CIOs at some of the world’s largest asset owners.

Q: What do the CIOs you’ve been talking to see as their biggest challenge right now?

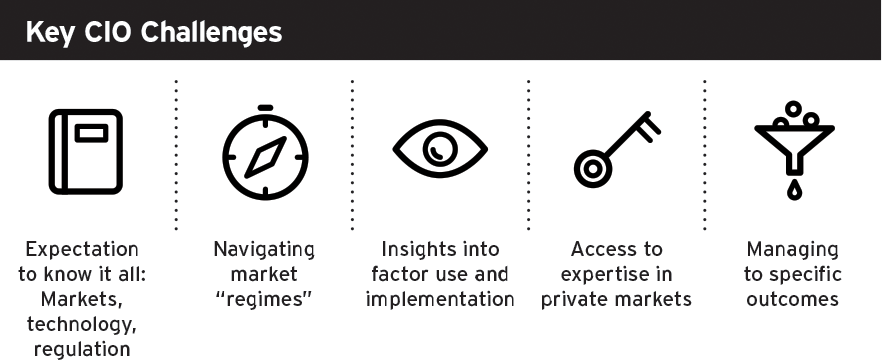

Neil Blundell: The markets are at a bit of inflection point, which is always a test. But at a high level, what we’re hearing is that CIOs are now expected to be “expert generalists.” By that, I mean they’re supposed to have deep knowledge across a wide range of topics, from strategic asset allocation, to manager selection, to portfolio risk, to technology, and even human resources. That’s a lot to navigate, especially in light of the pervasive staffing constraints at many institutions.

Q: What’s the solution?

Q: Are CIOs typically looking for just one partner to do these things, or several?

Blundell: With larger institutions, we’re seeing that they’ll lean on what they consider to be their four or five best managers/partners. They’re working with those managers in a very collaborative way to get insights into how they should be structuring their portfolios and managing their exposures. We see relationship consolidation as a next-generation approach that contrasts pretty significantly with the legacy approach, where you might see asset owners maintaining 100-plus relationships and struggling to manage all the due diligence and navigate the operational and reporting complexity.

Q: Where can asset managers provide the most help to CIOs right now?

Blundell: Certainly, one of the biggest areas is navigating market regimes—determining where we are in the market cycle and helping clients determine how to position their portfolio in response. Our thinking on this issue revolves around our capital markets assumptions which reflect our risk and return estimates both longer-term and shorter-term—longer-term for setting strategic asset allocations, and shorter-term, using our five-year forecasts, for more dynamic, tactical decisions.

Q: What about specific investment approaches? Where do you see opportunities for CIOs on that front, and what are they most interested in hearing about?

Blundell: Understanding factors and factor investing, and how they can be utilized, is coming up in a lot of our conversations. There are many ways to employ factor investing, of course, but one of the most straightforward is to build portfolios that seek to harvest the excess returns associated with positive factors rather than just trying to match a market-capitalization weighted index like the S&P 500. Another approach, after you’ve constructed your portfolio, is to look for residual factor exposures—any unintended bets in your portfolio—and eliminate them.

Q: How does factor investing help specifically during periods of regime change?

Blundell: Once we understand the drivers of risk and return in every asset class—which is a core tenet of factor analysis—we can help investors recognize their intended and unintended bets—uncover the hidden risks they may have missed. This can be incredibly helpful when markets are turning. To help manage environments like this, we’ve designed analytical systems that can take a portfolio or a strategic asset allocation strategy and decompose it into the fundamental drivers of risk and return. I’m primarily talking about factor-level decomposition in traditional, public markets. But we’ve also done a lot of research around private markets to make sure we’re understanding and modeling them properly. We’ve seen that there can be cross correlations between public and private markets, and understanding those cross correlations is critically important. All this allows us to generate forward-looking scenarios to see what’s likely to happen to a client’s portfolio in a particular regime, and to think about how we can add to or modify that portfolio to get to the desired outcome.

Q: Equities and fixed income have both been under a lot of pressure this year. For CIOs looking for alternatives, where do you see opportunities? Are private markets an attractive option at this moment?

Blundell: Our return forecasts for public markets are fairly tepid right now because valuations are high. So, if you’ve got higher liabilities—in the 6%to 7% range, as many institutional investors do—private markets are potentially an attractive alternative. In some areas, private markets valuations are rich, too, of course. But the private markets area as a whole continues to grow, and if you partner with the right firms that have the resources globally to source deal flow, which is critical in today’s environment, you’re able to find deals.

Q: How much of an issue is illiquidity in private markets, especially when we might be looking at regime change?

Blundell: There are, or course, liquidity constraints around private market investments, but that means they should offer a return premium relative to public markets. The challenge is figuring out how to capture the illiquidity premium and still make sure you’re getting the right desired mix of income assets and growth assets in your portfolio—especially if you’re trying to match your liabilities, as many CIOs are. In fact, we’re having a number of conversations right now about liability-driven investing, and, particularly in Europe, cash-flow driven investing.

Q: Is it harder to match assets and liabilities when you’re investing in private markets?

Blundell: Private market investments can actually be a great tool for asset-liability matching. Let’s say you’ve got liabilities that go out 15 years. Well, some infrastructure investments might have a 15-year duration, meaning they represent a nearly perfect hedge. You can layer into your portfolio this infrastructure debt that has stable cash flows, from a relatively uncorrelated asset, for the next 15 years and match those against your liabilities, while providing better diversification for the portfolio.

Blundell: Each client’s challenge is different. For a pension plan, funded status will play an important role in the answer. The amount of growth-oriented assets we would put into private markets would be significantly greater for a plan that’s underfunded, for example, than it would be for a plan that’s well-funded. If the client is an insurance company with regulatory constraints—maybe it’s assessed higher capital charges on private equity than private debt—we would take that into account to arrive at the mix of asset classes that is most capital efficient for that organization. Overall, our approach is to look at the client’s liabilities to create a complete, bespoke custom portfolio designed to match their liability profile. There really is no one-size-fits-all solution anymore.

Q: Diversification hasn’t been the investor’s friend for the past decade or so. What about now? Are there asset classes that have been overlooked or underutilized that may offer more opportunities over the next five to 10 years?

Blundell: Diversification is still important, but it needs to be pursued on an even wider scale, both in public and private markets. You have to be thinking not just about equity, growth and capital appreciation, for example, but also about income and geographic diversification. In real estate, that means looking not just at U.S. core real estate but also global core real estate and real estate debt. In private equity, you can’t just focus on large-cap buyout funds, you also have to consider funds that focus on small and mid-sized companies, and secondary offerings. You have to think about infrastructure equity and infrastructure debt, both investment grade and high yield. You have to consider special situations, private credit and direct lending. There’s layer upon layer of different opportunities, each with different underlying risk exposures, and you have to make sure you understand those exposures and model them correctly to design a portfolio that delivers the right outcomes.

Q: You’ve described a fairly expanded role for asset managers. What have you had to do or change at Invesco to offer the kind of service you’ve been talking about?

Blundell: We’re constantly evolving. As we’ve seen markets change and the needs of our clients change, we’ve built out our capabilities so that a team that was 10 people not too long ago is 45-plus today. We’ve brought in expert practitioners globally who have sat in the CIO seat and understand not only what our models are saying but how to implement them. That’s important because what a model says and what is implementable in the real world can be very different. We’ve also built out our analytics platform, and we’ll continue to build out and staff that platform to continuously model new sectors and better understand risk. What we look like today is different from what we looked like two years ago, and from what we will look like two years from now.

Learn more about the Invesco Solutions team.

Helpful resources:

- Invesco Capital Market Assumptions

- Who is Invesco Global Solutions?

- Basic concepts for understanding factor investing

Asset allocation, diversification and low or negative correlation do not guarantee a profit or eliminate the risk of loss.

Factor investing is an investment strategy in which securities are chosen based on certain characteristics and attributes that may explain differences in returns. There can be no assurance that performance will be enhanced or risk will be reduced for funds that seek to provide exposure to certain factors. Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. Factor investing may underperform cap-weighted benchmarks and increase portfolio risk.

All content provided by Invesco is for informational purposes only and is not an offer to buy or sell any financial instruments. Invesco Advisers Inc. is an investment adviser; it provides investment advisory services to individual and institutional clients and does not sell securities. This material is for Institutional Investor Use Only. The opinions expressed in this article are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.