Opinion: How not to Get Sued for your DC Plan

Arun Muralidhar shares his thoughts on how corporate pension CIOs can dodge litigation.

Every corporate or endowment defined contribution (DC) plan sponsors’ biggest nightmare is to be the target of a class-action lawsuit, alleging excessive/hidden fees, or improper investments/revenue sharing deals. In 2017, there were apparently over 30 such lawsuits and there is no indication that this trend is likely to abate anytime soon as many plans settle rather than go through the headache of contesting these lawsuits. As one chief investment officer (CIO) told me, a law firm had been examining their documents for the past 10 years and it was only a matter of time before the lawsuit landed.

While some lawsuits probably have merit, others are opportunistic. But the larger questions include: How is it that an employer’s (voluntary) attempt to help an employee save for retirement could become easy prey for law firms? Is there a way for plan sponsors to avoid such lawsuits? If there is no respite, sponsors may choose to not offer these plans at all, thereby hurting employees.

According to a 2017 GAO report, close to one-third of private-sector workers do not have access to an employer-sponsored pension plan, and even those who do have access may not have saved enough or are financially illiterate and unable to make key decisions. This is an issue with massive societal ramifications and begs the larger questions: How did we get here? Is there a way out of this conundrum? We will argue that there is a potential path, but it will require US Treasury (and other entities) to introduce an innovation to financial markets, and more importantly, for the CIOs of these funds and the larger financial services industry to lobby for such an innovation (or leave themselves open to lawsuits).

The days of employer paternalism in offering defined benefit (DB) plans to staff are long behind us for a host of reasons (including increased regulation and risk for the sponsor), and DC plans have fast become the primary employer-sponsored retirement offering. But DC plans transfer the risk of ensuring a safe retirement to the employee. Very simply, individuals seek a guaranteed, real income, ideally from retirement through death, and to lead a lifestyle comparable to pre-retirement. Chart 1 visualizes the retirement saving goal—a 25-year-old woman desires basic/comfortable $50,000/year guaranteed retirement income, starting at age 65, for about 20 years. This guaranteed income secures the retiree’s pre-retirement standard-of-living in retirement.

A major challenge to achieving this goal is the individual’s lack of financial knowledge to determine how much to save, what assets to invest in, and how best to decumulate. Few adults can answer basic questions about compound interest, effect of inflation, or the benefit of diversification. They are overwhelmed by the information provided in their portfolio reports and are not able to effectively invest during the accumulation phase, and equally confused about planning for decumulation. Plan sponsors who recognize this initial challenge and try to address it often open themselves to lawsuits.

The next challenge is that few, if any, of the traditional assets or products, unless heavily financially engineered (raising costs), offer this desired cash-flow profile. Deferred life annuities offer this specific cash-flow profile, but are complex, illiquid, inflexible in providing survivor benefits, and often costly and not commonplace. These unattractive facets of annuities open plan sponsors to lawsuits. Moreover, many of the lawsuits against endowments have alleged that offering annuities has created a second layer of fees (as annuities are offered by companies other than those offering the investment options).

Interestingly, the one product that provides safe harbor to plan sponsors, target date funds (TDFs), are risky relative to the cash-flow profile in Chart 1—putting the employee at risk. Once again, any conscientious plan sponsor that tries to do right by their employees to address the fact that they are bearing unacceptable retirement risk, risks a lawsuit (because the needed financial engineering to correct this problem is complex, expensive, and perfect fodder for a rapacious law firm).

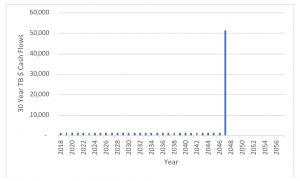

A TDF changes the allocation between stocks and bonds based on the participant’s age, but offers absolutely no guarantee on retirement outcomes. In effect, safe harbor is provided for process, not for outcomes. This follows because Treasury bonds are of the traditional payout form of interest-only coupons and principal repayment at maturity. Individuals who buy $50,000 face value of the 30-year Treasury bond today receive semi-annual coupon payments (e.g., 3% of principal annually, $1,500) starting immediately, with the principal amount ($50,000) repaid along with the last coupon in year 30 (see Chart 2). The US Treasury also offers Treasury inflation protected securities (TIPs), but they do not solve the challenge of mismatched cash flows relative to Chart 1. Individuals receive coupons before they need them (while they work and have income), and thus, must reinvest them at future uncertain interest rates. The principal is repaid in lump-sum 10 years before these 25-year-olds retire, leading to cash-flow mismatches and re-investment risk. Even if these payments were adjusted for inflation, they would not be sufficient—for savings invested long before retirement, standard-of-living risk is significant. The amount needed to maintain one’s evolving lifestyle while working, is likely to increase over this long horizon, potentially leaving retirees with inadequate savings to cover that higher lifestyle.

Chart 2: Cashflows from a Traditional Nominal 30 Year Treasury Bond (with a 3% Annual Coupon)

So, is all hope lost? Does being a good fiduciary mean CIOs should protect the sponsor from lawsuits and offer employees products they know will clearly not meet their retirement goal or do right by the employee and plan for a lawsuit? The US Treasury could address this Faustian bargain easily and issue a new, low-cost, liquid and safe ultra-long bond instrument Prof. Robert Merton (Nobel Laureate) and I call SeLFIES (Standard-of-living indexed, forward-starting, income-only securities). SeLFIES start paying investors upon retirement and pay real coupons only—say, $5—indexed to aggregate per-capita consumption—for a period equal to the average life expectancy at retirement, e.g., another 20 years. Instead of current bonds that index solely to inflation, SeLFIES cover both the risk of inflation and standard-of-living improvements.

SeLFIES are designed to pay people when they need it and how they need it, and greatly simplify retirement investing. A 25-year-old today would buy the 2058 bond, which would start paying coupons when she turns 65, in 2058, and keep paying for 20 years, through 2077 (as in Chart 1). In this way, even the most financially illiterate individual can be self-reliant with respect to retirement planning. For example, if investors want to guarantee $50,000 annually, risk-free for 20 years in retirement to maintain their current standard of living, they would need to buy 10,000 SeLFIES—i.e., $50,000 divided by $5—over their working life. The complex decisions of how much to save, how to invest, and how to draw down are simply folded into an easy calculation of how many bonds to buy. In short, the accumulation and decumulation decision are folded into a single, liquid, simple, low-cost and low-credit risk instrument. Besides, SeLFIES can be bequeathed to heirs.

SeLFIES do not address all issues, including longevity (to be addressed in the future), but go a long way toward improving retirement security. Further, if these instruments exist, the Department of Labor should offer safe harbor only to TDFs that have locked in more than the employee’s target retirement income. Through this simple innovation, plan sponsors are protected against high fee/improper investment lawsuits and employees are able to achieve their desired retirement goal with low risk and cost.

These securities are a good deal for governments, too. In fact, governments are the biggest beneficiaries. SeLFIES not only improve retirement outcomes for all DC plans, but also have spill-over benefits for the current administration and future ones. First, cash flows from SeLFIES reflect synergistic cash flows for infrastructure spending: namely, large cash flows upfront for capital expenditure, followed by delayed, inflation-indexed revenues, once projects are online. Financing infrastructure has been a challenge and a priority for the current administration. Second, SeLFIES give governments a natural hedge of revenues against the bonds, through value-added taxes (VATs).

However, governments are unlikely to change unless prodded, so CIOs of DC plans and their vendors (asset managers, recordkeepers, etc.) will need to lobby for this change, or continue to be sued for the current offerings which we know to be risky.

The looming crisis in DC plans of insufficient savings, inadequate access, financial illiteracy, and risky investment options relative to retirement goals, compounded by these lawsuits, needs to be addressed by timely innovation. SeLFIES can be created immediately by the US Treasury (or even corporations), and can greatly improve retirement outcomes for employees, while protecting CIOs from lawsuits, and allowing the industry to innovate to create better safe harbor products to ensure retirement security.

Arun Muralidhar is the author of “50 States of Gray: An Innovative Solution to the Looming Defined Contribution Retirement Crisis.” His opinion is independent but based on his work with Nobel Laureate Prof. Robert Merton.