David Holmgren, and the Art of the Deal

David Holmgren, the CIO of Hartford HealthCare, was underwhelmed by the investment options on the market as he strived to address key market risks in his portfolio last year. So Holmgren—a consummate innovator and standout for his ability to navigate partnerships—decided to help create the investment partnerships instead.

Hartford HealthCare became the first seed investor and source of external capital in two dynamic new strategies. The first is an Andean Social Infrastructure strategy launched by a leading infrastructure firm seeking to apply its expertise to the fast-developing Andean region. (The firm asked not to be named because of regulatory precautions about solicitation). The strategy will invest in projects necessary to a developing economy and backed by the state—schools, hospital, and sewage facilities, for example—and received an $85 million investment from Hartford HealthCare. And Arya, a hedge fund being launched by asset management giant Alliance Bernstein, saw an $80 million seed investment.

Rather than settle for the options on the market, Holmgren decided to catalyze investment vehicles much more in-line with Hartford HealthCare’s needs instead.

And the first seed investment in the vehicles brings more than vitally needed capital. It also serves as a source of investor validation and references for the emerging funds, with Holmgren poised to make introductions to larger and often slower-moving, less-dexterous pools of capital. For Hartford HealthCare, the funds hedge two key risks—economic hedge and risk mitigation—and moving quickly was vital to ensure they deliver on their full potential.

The challenge now for the partnerships will be to execute on their ambitious visions.

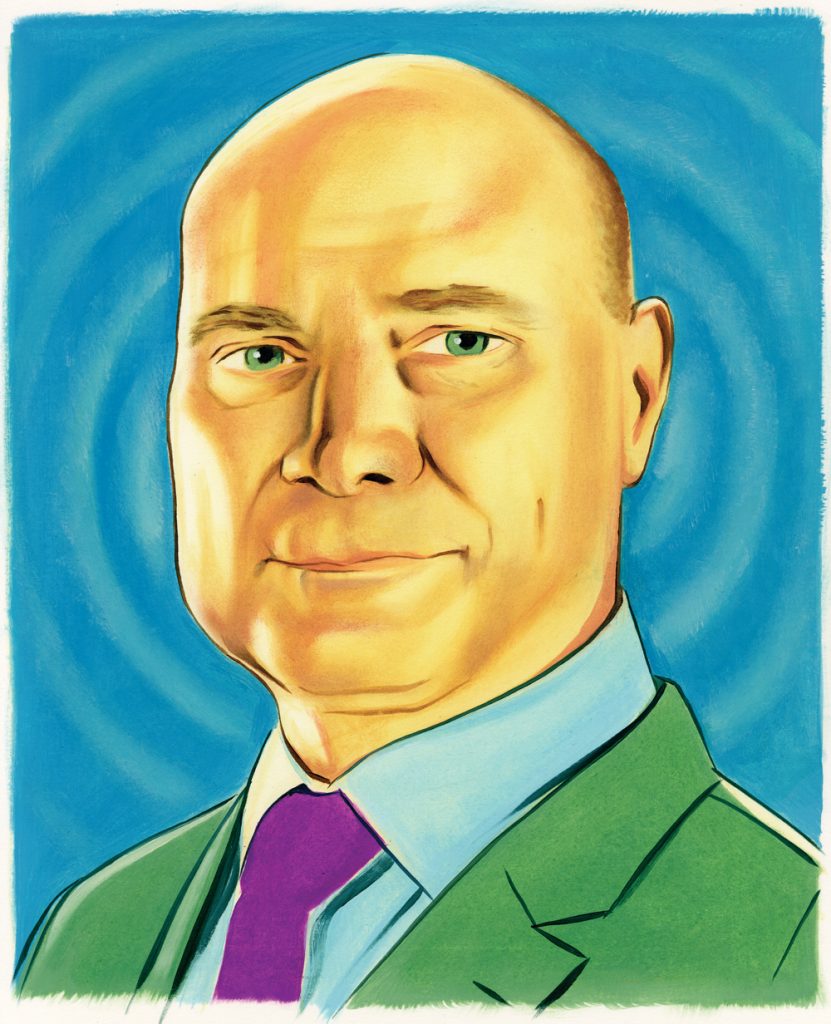

David Homgren, CIO, Hartford HealthCare. (Art by Chris Buzelli)

Into the Andes

For the Andean Social Infrastructure strategy, that means finding the best social infrastructure projects in countries including Columbia, Peru, and Chile in Public Private Partnership (PPP) frameworks. The strategy, which is targeting $350 million, serves as an economic hedge for Holmgren’s portfolio. First, the projects are not as economically sensitive or dependent on market cycles as commercial infrastructure, since guaranteed government agreements serve as the revenue streams for the developments. And the investment also serves as an inflation hedge, since the value of real assets rises in inflationary conditions.

Time to market is key in taking their established expertise and applying it to the rapidly emerging region, however. “The real exciting area of infrastructure is this untapped region which is so wonderful, the major shops are fighting to establish their South American infrastructure platform,” Holmgren told CIO. “But there is a real first-mover advantage, and you will not get these types of returns down the road once all the other asset managers plow into the market.”

That meant that Hartford HealthCare had to be nimble in helping to catalyze the partnership and helping jumpstart what can be a multiyear process of setting up a local presence for an investment shop. “To expedite their effort, we had to expedite our effort,” Holmgren said of the initial investment. “By being early and dynamic, we were able to partner with a household GP to start their new business line, which was possible on the heels of our existing relationship. So, partnerships are about creating that win-win solution: We got a game plan to deploy where and how we see it ideal to be positioned, and they get monies to start governmental contracts and a solid LP reference, which is huge in getting traction. Many great opportunities never get critical mass because the GP gets stuck in the Catch-22 of an allocator saying, ‘Call me back after you have a reference list.’”

A New Hedge Fund at an Asset Management Behemoth

Along with an economic hedge, risk reduction was another major priority for Holmgren, who is known for keeping a sharp eye on the risks in his portfolio. With many catalysts for the year, such as tax reforms, priced into the market, that meant maneuvering out of growth exposure into more market-neutral strategies. “We were looking at our year-end trading for basically locking in some of gains and holding money in specifically absolute return, market neutral hedge funds,” Holmgren said. The challenge, though, was that most of his very best managers in the space were approaching capacity and unable to take in new funds.

Enter Alliance Bernstein, a household name in asset management that was embarking on a major expansion in its alternative business with an ambitious multi-portfolio manager hedge fund. Alliance Bernstein’s springboard for the strategy was centered on some of the former team at Visium Asset Management’ Global fund, a top-performing hedge fund that unraveled in 2016 from insider trading charges at an affiliate’s fund.

But while the legal issues stemmed from Visium’s healthcare fund, the firm’s highly regarded global market-neutral, long/short fund was an unnecessary casualty. And Alliance Bernstein saw an opportunity to make a big push into the space by pulling together and putting its vast resources behind the Visium global long/short team.

Holmgren was impressed by Alliance Bernstein’s efforts. “It’s nearly impossible to pull together a team of this size. The amount of capital needed is mammoth,” Holmgren said. Nor is it easy for rival asset managers to push into the category. “The organizational infrastructure involved is a huge deterrent,” he said.

Adding to Holmgren’s confidence in the nascent fund: his prior investment and relationships in the Visium hedge fund. Bob Kim, now chief investment officer of the newly formed Alliance Bernstein Arya hedge fund, “was a portfolio manager of ours when he was the director of research, so all the portfolio managers used to report to him as the director of research when he was Visium,” said Holmgren. “A bit of our comfort in seeding them stemmed from that.”

That set the stage for an intensive process of due diligence. Hartford’s team interviewed eight of the fund’s 23 portfolio managers over multiple hour-long meetings, in addition to Holmgren having three separate meetings with Kim.

“He really put us through the ringer,” said Tomas Kukla, a director at Alliance Bernstein.

Kukla says the smaller size and focus of the Alliance Bernstein Arya fund compared to rivals—the fund plans to raise $4 billion and focus only on equity long/short strategies—will be a key to its success. The smaller size and focus on equities will allow the fund to be nimble, for example, by taking meaningful positions in smaller stocks not available to larger rivals. It will also seek to minimize investment professional turnover and maintain continuity, a challenge in a hypercompetitive industry where employee churn can be the norm.

Both strategies have their work cut out for them. The Andean Social Infrastructure strategy needs to secure and execute on the best projects as rivals are sure to charge into the market. And putting up the kind of performance that attracts investors to a top-tier multi-portfolio manager hedge fund within an asset management behemoth will require continuous innovation.

However, both funds will enjoy the benefit that comes with an innovative backer like Holmgren—a head start on the competition and a champion with other investors.