Using put options to hedge against equity market falls can prove a drag on overall returns more often than providing a boost, according to Russell Investments.

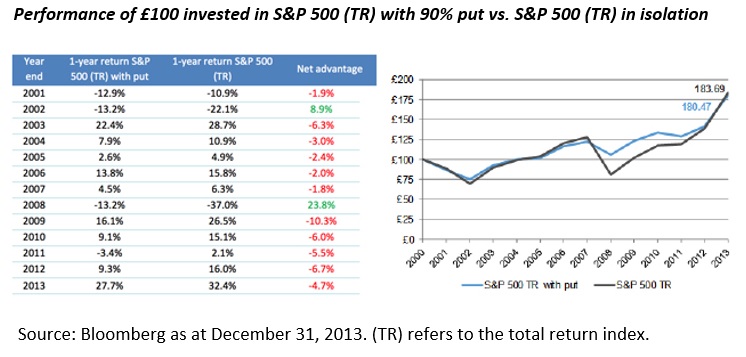

David Vickers, a senior portfolio manager on the firm’s multi-asset funds, said there was “rarely a free lunch” when it came to protection strategies. In 2008, investors who bought the S&P 500 index with hedging (protecting against the index falling below 90% of its starting value) would have beaten the return from the S&P 500 in isolation by 23.8%, Vickers said.

But he added that “in most years, adding protection would have underperformed a simple holding of equity in isolation”. Since 2001, combining the S&P 500 with a put option would have outperformed the index alone in only two calendar years (2002 and 2008).

“Despite the last 14 years having witnessed more than their fair share of significant market falls, you would still have been better off holding naked equity exposure over the period as a whole,” Vickers added. “Protection might have helped you sleep better over the period, but it would not have made better off.”

The fund manager said investors were better off using protection tactically “to complement your current portfolio positioning” in order to preserve the benefits of these holdings.

“If you buy insurance to protect against risk, by

definition you are passing it on to someone else,” he said. “Under such

circumstances you cannot expect to earn the reward for bearing that risk.”

Related Content:Convertible Bonds: Defense Against Downside Equity Risk