Reforms to the UK’s individual annuity market will result in more capacity for bulk annuity transactions, Aon Hewitt has claimed.

“The expected decrease in the number of annuities written in the individual annuity market has led to increased capacity in the reinsurance market.”—Martin Bird, Aon HewittIn a wide-ranging report into the de-risking sector, the consultancy giant said reinsurers operating in the UK could benefit from the abolition of compulsory annuitisation for defined contribution pension savers, as announced by Chancellor George Osborne last year.

“Following the announcements in the Budget 2014 and the new regime of flexibility, the expected decrease in the number of annuities written in the individual annuity market has led to increased capacity in the reinsurance market,” said Martin Bird, head of risk settlement at Aon Hewitt.

“This is good news for pension schemes, as reinsurers seek to replace the longevity risk they were expecting to take on from the individual annuity market with longevity risk transferred from defined benefit pension schemes and insurers in the bulk annuity market—offering a more competitive market and attractive terms.”

Longevity risk transfers saw a surge in popularity last year, with the BT Pension Scheme breaking records with a £16 billion longevity swap. The Bell Canada Pension Plan also got in on the act earlier this year with a C$5 billion longevity swap with Sun Life. Today, the Prudential Insurance Company of America (PICA) announced its first longevity reinsurance transaction with UK-based insurer Pension Insurance Corporation. The deal will see PICA provide reinsurance to Pension Insurance Corporation for longevity risk associated for more than 6,700 pensioners.

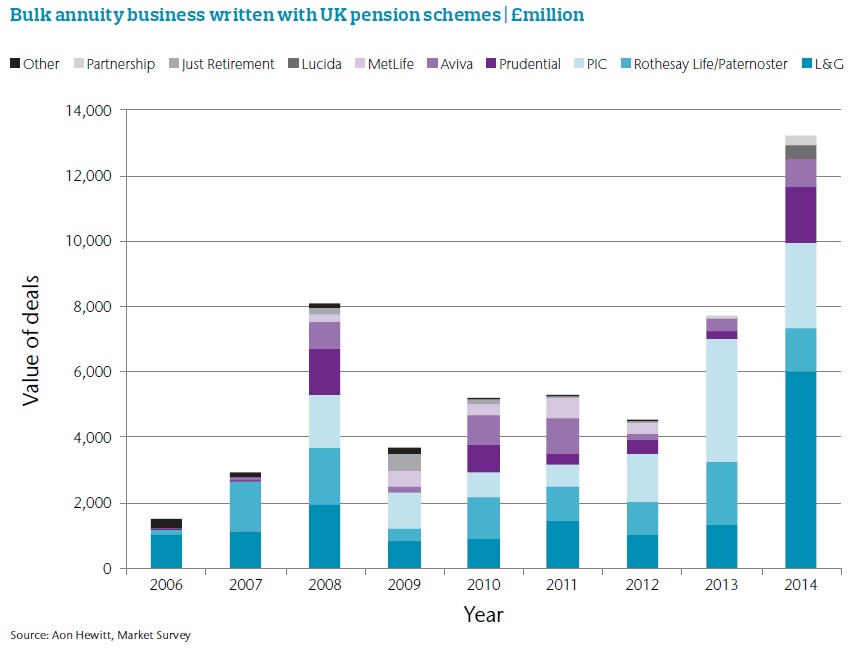

Aon Hewitt’s report showed that buy-in and buy-out transactions in the UK reached a record £13.2 billion in 2014, up by 69% on 2013’s total. The figure included major transactions involving chemical company AkzoNobel and car parts manufacturer TRW Automotive.

Both of these deals were backed primarily by Legal & General (L&G). The UK-based insurance group took on £5.5 billion of the £6.1 billion of liabilities transferred in the two transactions, as it dominated the UK market. L&G took on roughly £6 billion in 2014, beating Pension Insurance Corporation into second place.

“The fact that this new high was reached despite the further

deterioration in bond yields in the second half of 2014, which pushed up

pension costs, shows that recently the size of the bulk annuity market has been

driven more than ever by a small minority of large transactions,” said Paul

Belok, risk settlement adviser at Aon Hewitt.

“The fact that this new high was reached despite the further

deterioration in bond yields in the second half of 2014, which pushed up

pension costs, shows that recently the size of the bulk annuity market has been

driven more than ever by a small minority of large transactions,” said Paul

Belok, risk settlement adviser at Aon Hewitt.

Outside of the UK, Matt Wilmington, also a risk settlement adviser at the consultant, said there was a small window of opportunity for US pensions to provide lump sums to employees at a discount of 7%-10% to the underlying liability. This is due to the Internal Revenue Service publishing calculation methods for lump sums based on old mortality data.

In Europe, Wilmington said there was “patches of settlement activity in the Netherlands and in the Nordics” but de-risking was yet to take off to the same degree as in the UK and US.

“There are a number of reasons for this, not least a continued difference in view between insurers and pension plans on realistic rates of longevity improvements,” Wilmington said. “As this gap starts to narrow and the market matures to a similar extent as it has in the UK and North America we expect to see significantly more interest – providers are certainly keeping a close eye on all of the major markets in Europe.”

Related Content:Will the UK Budget Make Pension Buyouts Cheaper? & De-Risking Breaks (More) Records