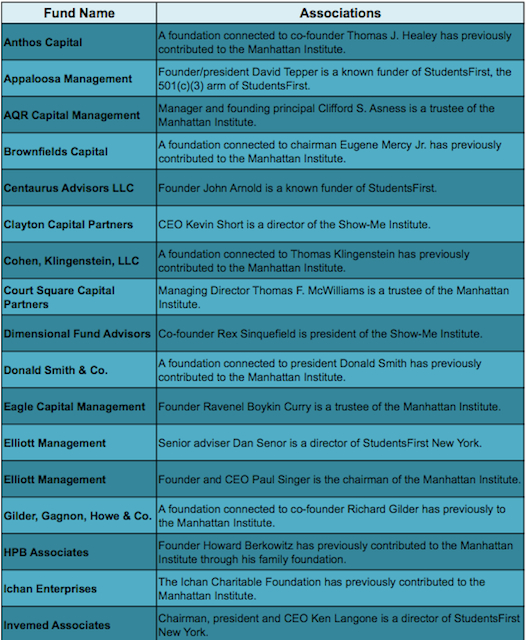

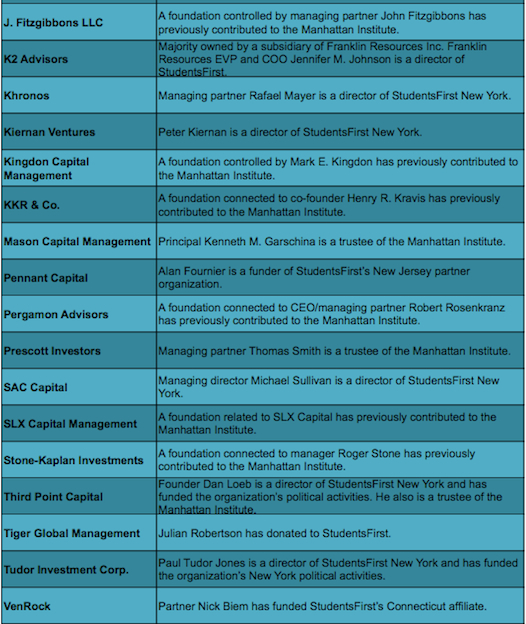

(April 18, 2013) - The American Federation of Teachers (AFT) calls it a "watch list": 34 asset managers who it claims support think tanks and organizations bent on dismantling the defined benefit (DB) pension system for educators.

All other factors being equal, the AFT encourages pension trustees to invest with, for example, the pension-neutral buyout fund KPS Capital Partners rather than, say, Kohlberg Kravis Roberts. According to the union's report, founder Henry Kravis has contributed to the Manhattan Institute—a non-profit think tank which champions replacing public DB plans with fund-as-you-go defined contribution (DC) systems.

While termed a "watch list," the publication has already spurred decisive action from one member included. Yesterday, Dan Loeb, founder of the much-hyped hedge fund Third Point Capital, canceled plans to speak on corporate governance at today's Council of Institutional Investors conference.

Loeb is a co-founder of StudentsFirst New York, the regional branch of an education reform organization, according to his profile for an upcoming alternatives conference. StudentsFirst's policy agenda says that the group lobbies for states to "honor their existing obligations to defined benefit pension plans" but also "move from defined benefits to retirement plans that are more sustainable and can be immediately accessed by all teachers.

According to Reuters, certain pension funds had threatened to confront him at the Washington, DC event.

In a letter to the council's chair reviewed by aiCIO, Loeb cited "incorrect statements about my position on the issue of defined benefit pension plans" which had "derailed" the "critical conversation we planned to have about improving corporate governance."

"Contrary to reports," he continued, "I have never taken a position against DB plans nor has any philanthropic organization I lead. In fact, my support for and contribution to DB plans is demonstrated by maximizing returns for union members who rely on us to deliver their pension goals."

A spokesperson for AFT seemed puzzled by Loeb's denial. "StudentsFirst has been very public about its opposition to DB plans," the union representative told aiCIO. "I mean, it says so right there in the policy statements."

At 1.5 million members, the AFT is the second-largest education union in the US. Many of the asset managers it targets are of similar stature: Kravis, Loeb, AQR Capital Management co-founder Clifford Asness, and an SAC Capital managing director made the list, among others.

"This is about transparency—a right to know," said AFT President Randi Weingarten. "America's workers and pension trustees deserve to know if the asset managers they are investing their hard-earned retirement savings with are also aligned with organizations advocating for the elimination of those same pension plans."