A fund focussing on Indian equities made the best returns in 2014, according to data from Preqin.

Arcstone Capital’s Cayman-domiciled Passage to India Opportunity Fund made 225.21% over the 12 months, beating second-placed venBIO’s Select Fund by more than 150 percentage points.

According to Arcstone’s website, the company “invests in a diversified portfolio of Indian companies, with a long-term investment horizon of approximately three years. Our portfolio is value-sensitive, concentrated in 10-20 companies, and has low turnover”.

Preqin analysed returns from more than 5,200 hedge funds worldwide.

The top five performing funds were all equity-based with

sixth place in the ranking being taken by a commodities fund—RCMA Asset

Management’s Merchant Commodity Fund—which returned 59.29%.

The top five performing funds were all equity-based with

sixth place in the ranking being taken by a commodities fund—RCMA Asset

Management’s Merchant Commodity Fund—which returned 59.29%.

Indeed, three-quarters of the 20 top performing hedge funds in 2014 employed an equity strategy, Preqin said. The median return throughout 2014 for the top 10 performing equity strategies funds was 59.03%, higher than any other strategy.

However, the difference between the top and bottom performing funds in this sector was 186.21 percentage points. This dispersion was the greatest of any strategy, but was mainly due to the outperformance of Arcstone’s Passage to India Fund.

Equity strategies have been the horse to back over the past three years, Preqin said. The median return over that period was 51.73%. However, the S&P 500 made 74.5% in the same three-year period, with the FTSE All Share making 51.4% on a total return basis.

The second best hedge fund performer over the three years to the end of 2014 was event-driven strategies with a 27.48% return, said Preqin. In 2014, however, this sector made a median return of 17.75%, putting it in fifth place of a group of six strategies.

Credit hedge funds came bottom on both the one and three-year results with median returns of 15.48% and 16.23% respectively. The best performing credit hedge fund—the STS Partners Fund run by Deer Park Road—made 26.09% over 2014.

It was also the strategy with the smallest dispersion of returns. The difference between the top and bottom credit hedge funds was 12.07 percentage points.

One major outlier in Preqin’s data was the return made in 2014 by a multi-strategy hedge fund. The Atrevida Multi-Strategy Charter Fund – Class D – Series 2 (RMBS Opportunity), managed by Atrevida Partners, made 3806.30%. The fund’s closest competitor was the FondSelect Global managed by Aktie Ansvar, which made 20.25% in 2014. Multi-strategy funds were not classified in the overall data sets by Preqin.

North American managers had the most success last year, Preqin said, with 42% of the best performing funds being based in the US. New York City housed the best of the best, with 13% of the top funds calling the Big Apple home.

European managers were the next most successful with 32% of the top funds based on that continent. Asia-Pacific managers were responsible for 17% of the best funds last year.

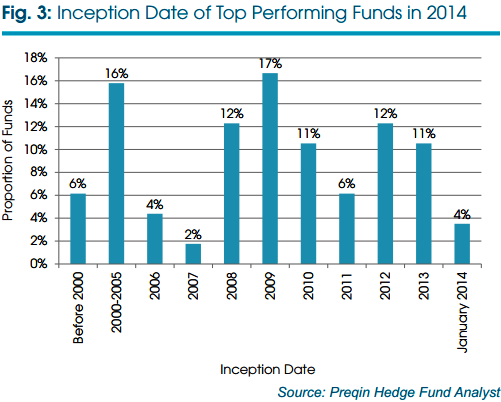

In terms of choosing a vintage, funds launched in 2009 had the best returns last year, the data showed, followed by those created in the five years from 2000.

Over a two-year period to the end of 2014, London-based

Stratton Street Capital had the best returns. Its Japan Synthetic Warrant Fund

– JPY Class made 133.90%, doubling the returns of the next best fund, the venBio

Select Fund LLC, which was also second place over one year.

Over a two-year period to the end of 2014, London-based

Stratton Street Capital had the best returns. Its Japan Synthetic Warrant Fund

– JPY Class made 133.90%, doubling the returns of the next best fund, the venBio

Select Fund LLC, which was also second place over one year.

All return figures are net of fees.

Related content: Guggenheim

Sells Hedge Fund Unit & How

Skillful Is Your Hedge Fund Manager?