Half of institutional investors would consider firing a manager that raises fees, a survey by the CFA Institute found.

Underperformance and breaches of data or confidentiality also rank highly among reasons for sacking a current partner, according to the survey’s respondents, which included 502 institutional investors from six countries.

“Investor demands have become significantly more dynamic,” said Paul Smith, president and CEO of CFA Institute. “Along with delivering performance, investment professionals must also provide transparency around fees and investment decisions, align their interests with their clients’, and provide robust data security measures.”

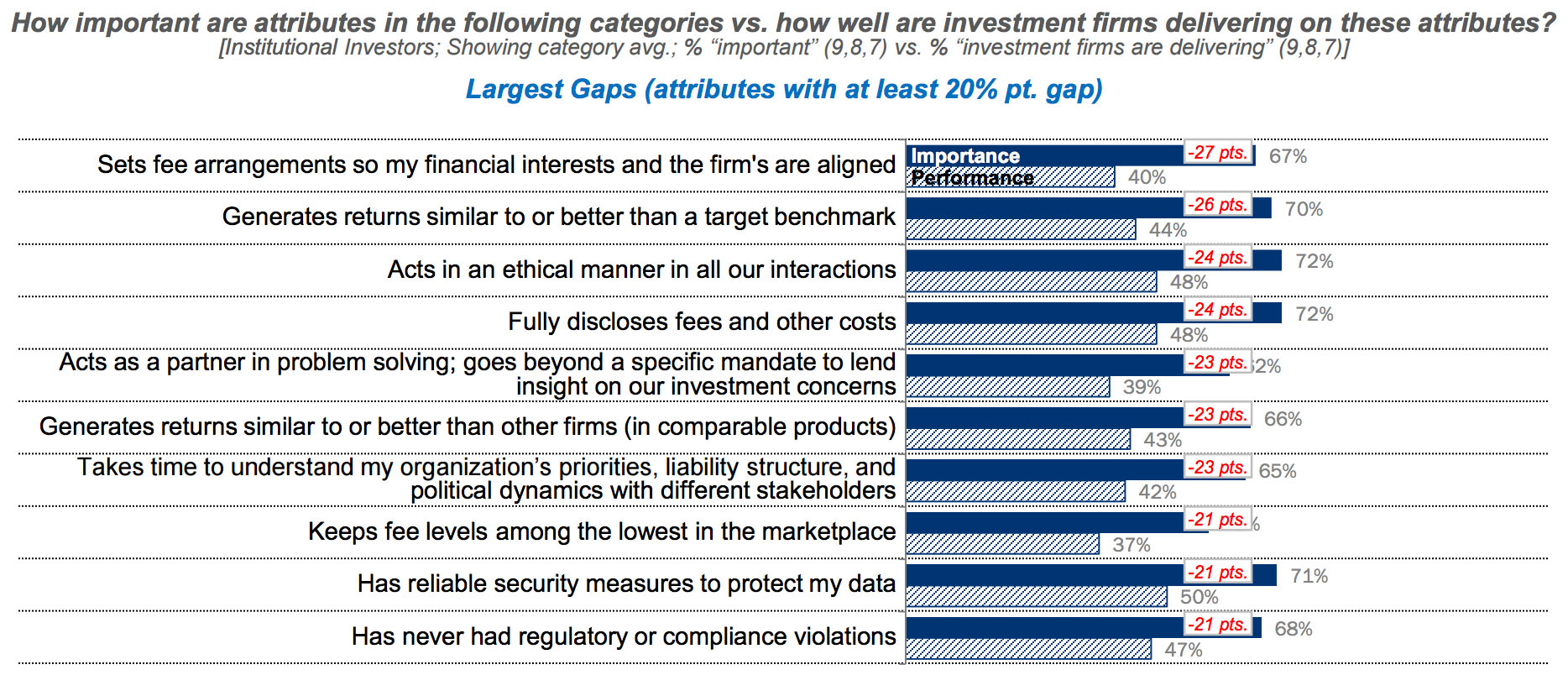

Nearly three quarters of investors surveyed said they want investment firms to act in an ethical manner at all times. Reliable security measures and benchmark-beating returns were also cited as important manager attributes, chosen by 71% and 70%, respectively.

Fee disclosure ranked more important than fee alignment, with 72% demanding full disclosures of costs, compared to 67% requiring that fee arrangements align the financial interests of the investor and the firm.

However, institutional investors said managers as a whole failed to meet these expectations. Just under half of firms fully disclosed fees and other costs, with only 40% setting fees that aligned interests. Respondents also said 48% of managers were ethical at all times, 44% generated returns similar to or better than a target benchmark, and 50% had reliable data security measures.

With these failings, only 41% of respondents said they would recommend a current partner to other investors.

When managers do meet performance, transparency, and security expectations, however, investors said they were willing to pay more. Other differentiating attributes respondents said were worth the extra fees included personalized services and getting to work with respected and well-qualified investment professionals.

However, investors said they would not pay more for ethical behavior, as managers should be held to a high standard regardless of fees.

“The bar for investment management professionals has never been higher,” said Smith.

Source: CFA Institute’s “Trust to Loyalty Survey”

Source: CFA Institute’s “Trust to Loyalty Survey”

Related: A Five-Year Plan for Asset Managers