Fund managers are wary of valuation bubbles in both equities and bonds, but are continuing to position for positive growth in the developed world, according to a survey.

Bank of America Merrill Lynch’s (BoAML) survey of managers at the start of this month showed a net 84% believed bonds to be overvalued. Meanwhile, 13% of managers believed equity valuation bubbles were the biggest tail risk for markets, up from just 2% in March.

However, Manish Kabra, European investment strategist at BoAML, said investors were still positioned positively in equities and real estate. More than half of managers believed both equities and bonds to be overvalued, Kabra added, but this had not led them to change their risk appetites.

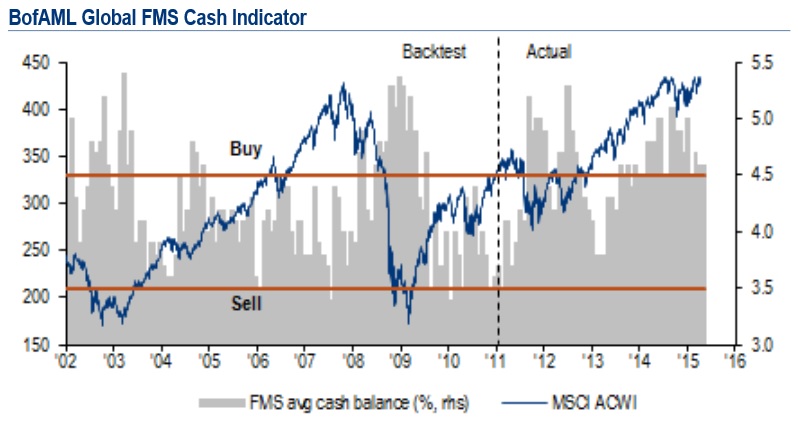

Source: BoAML Fund Manager Survey. “Buy” and “Sell” refer to BoAML’s “cash rule” for trading equities when cash levels hit certain points.In addition, Kabra said high levels of cash could still be

put to use in the equity markets, indicating prices could go higher still. On

average, managers in the BoAML survey were holding roughly 4.5% in cash in

their portfolios, and have done since mid-2013. “High valuations are keeping

asset allocators in increased levels of cash,” Kabra added.

Source: BoAML Fund Manager Survey. “Buy” and “Sell” refer to BoAML’s “cash rule” for trading equities when cash levels hit certain points.In addition, Kabra said high levels of cash could still be

put to use in the equity markets, indicating prices could go higher still. On

average, managers in the BoAML survey were holding roughly 4.5% in cash in

their portfolios, and have done since mid-2013. “High valuations are keeping

asset allocators in increased levels of cash,” Kabra added.

Among Europe-based managers, BoAML said a net 10% believed the region’s equity markets to be overvalued, compared to March when a net 3% believed they were undervalued. Nearly three quarters of managers said they expected better corporate profits in the next financial year, however.

Investor appetite has cooled slightly towards European equities, BoAML reported, although managers are still mostly positive and intend to be (or are already) overweight to the region.

Kabra said investors were returning to “normalized optimism” on Europe as the continent’s main index, the EuroSTOXX 50, was becoming crowded. He added that managers perceived the euro to be undervalued, with the survey reporting its lowest reading on the currency’s valuation since 2003, but “the positioning is not there” to reflect this sentiment.

“The domestic growth outlook is quite high but fiscal policy is still seen as restrictive,” Kabra said. He added that investors were likely to remain positive towards the dollar trade and anything related to it, despite its high valuation, owing to the belief that the Federal Reserve will increase interest rates later this year.

“Investors are seeing value but positioning for it,” Kabra added. “They don’t want to fight against what the central banks are doing.”

Related Content:Investors Shun US Stocks as Rate Rises Loom & QE Pricing Investors Out of Market, CFA Claims