The premium earned from holding smaller company stocks has eroded over time, according to research by advisory firm Gerstein Fisher.

Its research showed the small cap premium had been much weaker in the past 20 years than in previous periods.

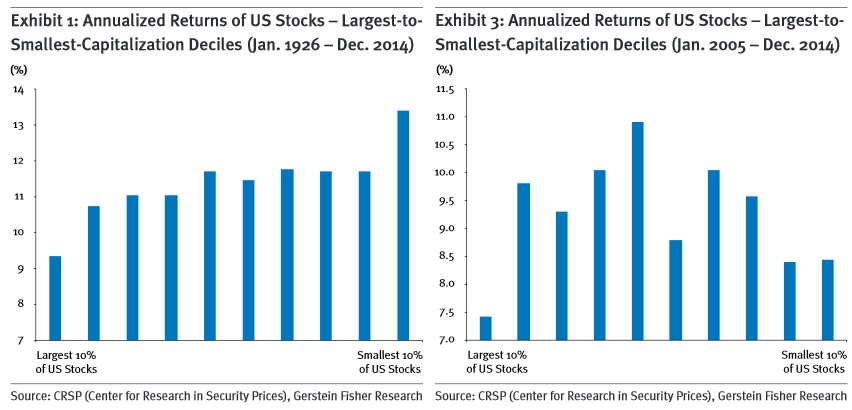

Between 1926 and 2014, the smallest decile of listed companies in the US returned more than 13% a year, compared to roughly 9% for the largest companies, Gerstein Fisher CIO Gregg Fisher wrote in the report, “Sizing Up the Size Premium”.

“There is more established evidence that the size premium is weaker after 1980. In our view, this is the biggest challenge to the existence and persistence of the size premium.” —Gregg Fisher, Gerstein FisherBut since the first major study to identify the small cap premium—Rolf Banz’s “The Relationship Between Market Value and Return of Common Stocks” in 1981—Fisher said the excess return from the smallest companies had collapsed to around 1 percentage point.

“Looking over the period from 1926 through the end of 2014—nearly a century of data—there has been an almost monotonic relationship between firm size and return, where smaller-capitalization stocks have earned higher returns,” Fisher said.

Since 1994, however, the outperformance of small caps had been spottier. “This result is consistent with what we would expect when analyzing a shorter time period in which the data can be more idiosyncratic,” Fisher said.

Shorter-term data from the past decade showed the smallest companies only outperformed the largest slightly—and other groups of companies in between all performed better.

“This reveals what we think is the shorter-term risk inherent in factor investing, particularly when investments are focused on a single factor,” Fisher said.

Although the small cap premium was still positive over this period, the evidence presented by Gerstein Fisher and other studies was “the biggest challenge to the existence and persistence of the size premium”, Fisher stated.

However, he maintained that the

premium was still “exploitable… even after accounting for trading costs and

other market frictions”.

However, he maintained that the

premium was still “exploitable… even after accounting for trading costs and

other market frictions”.

“Even with a modest small cap premium,” Fisher said, “we believe there is a benefit in holding small cap stocks as a distinct tilt in an equity strategy for the diversification of returns that are different than those of larger-cap stocks.”

Related:Too Big to (Not) Fail; Big Doesn’t Mean Better for Hedge Funds; Should One Size Fit All Managers?