The San Diego County Employees Retirement Association (SDCERA) is to begin a hunt for an internal CIO after its board voted to restructure its internal organisation.

In a meeting on Friday, board member Dianne Jacob put forth a motion to restructure the $10 billion pension’s governance model to a “classical/linear structure”, outlined by consulting firm Cortex.

The motion was voted through 8 to 1.

The move comes just two months since the board agreed—by one vote—to retain the services of OCIO Salient Partners. In October, Jacob moved to oust the company from running the assets of the county pension fund, but was defeated.

On Friday, Jacob told the board that when she joined in 2004, the fund had an internal CIO and this, she said, was the “correct” way of doing things.

David Deutsch had been the SDCERA CIO until his resignation in March 2009, when Lisa Needle took over as acting CIO until May 2011.

Jacob said the internal CIO structure, which reported to a CEO and through to the board was “best practice” and this had been demonstrated over several presentations during the meeting. However, Jacob said the board had become preoccupied with the compensation the CIO would be awarded and they had come to believe it could not afford sufficient quality with what they could offer in salary.

Indeed, board members aired their views on Friday about how much the county would be willing to pay. The matter concerned Dick Vortmann, who said he did not want SDCERA to end up with “the best of the rest” if the fund was not allowed sufficient budget to hire someone with the requisite skillset to manage investments.

Jacob said the annual salary would be in the $200,000 to $300,000 a year range. She referenced the $4.5 million that was agreed for the four year contract with Salient and said the county “would probably baulk at that.”

During the meeting over Thursday and Friday last week, the board was visited by a range of investment managers including Bridgewater Associates and representatives of pensions running different governance models to SDCERA, including Jagdeep Baccher CIO at Regents, University of California and Girard Miller, CIO at Orange County Employees Retirement System.

During a prolonged debate after the motion was put forward, David Myers was the only member to vote against it. He said the vote to retain Salient Partners had been taken in a “knee-jerk” fashion, which had not been to the benefit of members. He said the board was again being rushed into making a decision on a new internal structure.

Another member, Dan McAllister, said collecting more data and information on the matter would just bring them back to where they were now. Myers refused this point and said that nothing should be voted upon until the county had agreed a compensation level.

Other members said nothing could be guaranteed at this stage, with Jacob adding that the fund had a “governance problem” and it needed a “governance solution”.

Board Chairman “Skip” Murphy voted with the motion, but said if the county did not agree to a pay package that would attract the right candidate, he was “in a world of hurt”.

The chairman said the CIO would be afforded the “vast majority” of delegation with just a few points remaining with the board to oversee.

On the matter of Salient partners being retained as an OCIO, the board agreed that the new structure would not “preclude one model or another” and one manager could easily be used to run the fund’s $10 billion just as well as “47 managers”.

They agreed that the asset mix would be discussed once an internal CIO was in place.

Related content: By One Vote, San Diego to Keep OCIO Salient Partners

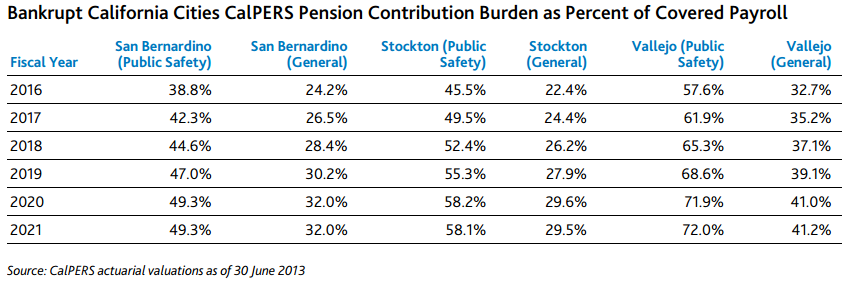

The ratings agency calculated that San Bernardino’s adjusted

net pension liability for the 12 months to the end of June 2014 was $731

million—nearly 10 times its outstanding debt.

The ratings agency calculated that San Bernardino’s adjusted

net pension liability for the 12 months to the end of June 2014 was $731

million—nearly 10 times its outstanding debt.