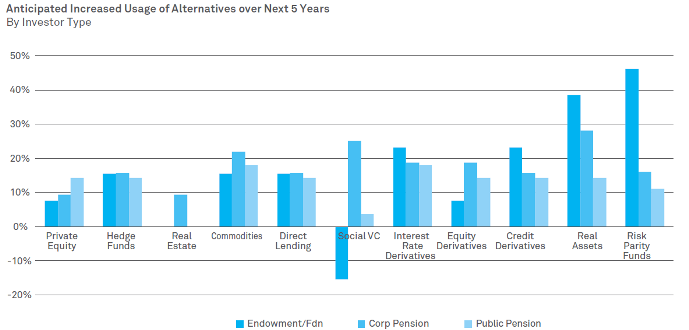

(February 18, 2014) — Risk parity and real assets are to be the largest beneficiaries of the institutional investor push into alternatives, research from BNY Mellon has found.

In a survey of international investors, mostly with more than $1 billion in assets, a clear shift to certain asset classes was shown to be about to take place. The survey was the latest in a series run by the global custodian with Nobel Prize-winning economist Harry Markowitz.

Endowments and foundations declared they would be making the largest push of any investor into any asset class. Just 23% said they were investing in risk parity at the time of the survey, with 69% saying they intended to allocate to the approach. Some 31% of corporate pension funds said they had allocations to the approach, but 47% said they planned to allocate to it. Public pensions said 21% of them had allocated to risk parity, with 33% saying they would be using the asset class in the future.

Overall, the greatest intended support came for real assets, outside of property investment.

Across the three categories of investors, there was an 82 percentage point shift in sentiment towards these assets. The largest commitment again came from endowment and foundations—from 62% currently allocating to 100% saying they would be committed to the asset class soon—but corporate pension funds announced a 29 percentage point shift, to 88% pledging a commitment. Public pension funds showed a smaller move towards the asset class, with a 15 percentage point shift to 86%, but these investors currently have the largest group committing to real assets, the survey said.

The BNY Mellon paper also reported that “56% of Canadian investors indicated they always invest in real assets (infrastructure, project finance, etc.) compared to just 17% from Europe, Middle East, and Africa, and 20% from the US”.

The authors noted that this be due to Canada’s large oil reserves and other natural resources.

The third largest shift came from investors’ sentiment towards interest rate changes. BNY Mellon reported a 60 percentage point shift towards interest rate derivatives across all investors, with endowments and foundations saying 100% of them would be using the instruments, up from 77% now.

The only alternative asset class to lose favour—in aggregate—with investors was social venture capital. Endowments and foundations said although 46% of them were invested in the approach now, just 31% of the community would retain their allocation. BNY Mellon surmised that this may be due to concerns about lower expected returns.

However, corporate and public pension funds saw promise with these investments. The number of corporate pensions allocating to social venture capital is set to rise from 28% to 53% in the coming years, while the percentage of public pension funds investing in the sector is set to rise from 21% to 25%.

Related content: Future Fund to Boost Real Assets, Slice Alternatives & What Do You Want from your Real Assets?

Source: BNY Mellon