Managers almost never have true carte blanche.

So assessing manager performance as if they did—standard practice at the moment—doesn’t make a whole lot of sense, according to two quants specializing in factor research.

Long-only stipulations, risk bands, turnover limits, etc. create a gap between the strategy an asset owner expects a manager to implement and how it actually functions in their portfolio, research analysts Sanne De Boer (QS Investors) and Vishv Jeet (Axioma) argued in a July 13 paper.

De Boer and Jeet looked specifically at factor-based quantitative equity strategies (not surprising for a pair boasting two operations research Ph.Ds, an econometrics master’s, an engineering degree, and handful of other credentials between them).

“Investment constraints distort a portfolio’s intended factor tilts and change its exposure to stock-specific risk,” they wrote. “As a result, standard factor attribution leaves part of the portfolio’s realized performance unexplained… For purely systematic investors, this may constitute a distraction in performance discussions with clients.”

And even with clients that accept imperfect alignment between theory and practice, over the long term that skew could amount to a systematic bias in return forecasts.

Their solution: Identify those systematic and reliable skews introduced by the most common constraints, and build them into the attribution model.

For example, a long-only parameter on a momentum strategy would mean only relatively large cap stocks could contribute to “downside” alpha. Without the ability to short a security that’s locked into a downwards trajectory, simply excluding it from the portfolio would only add meaningful alpha if it was a very big stock. So Jeet and De Boer accounted for weighted market capitalization in assessing stock-specific contribution to a long-only factor-tilted portfolio’s performance.

Source: De Boer & JeetLikewise, the authors found that scheduled

rebalancing—typically intended to control transaction costs—amplifies the role

of gradual value or momentum shifts while almost ignoring those on fast

trajectories.

Source: De Boer & JeetLikewise, the authors found that scheduled

rebalancing—typically intended to control transaction costs—amplifies the role

of gradual value or momentum shifts while almost ignoring those on fast

trajectories.

“The bet on a value factor may become dominated by possible ‘value traps’, stocks that are perennially cheap and therefore may have entered the portfolio a long time ago,” the analysts pointed out. “In the presence of some restraint on turnover, there will be no reason to replace them by similarly valued stocks that only recently became a bargain. Standard factor attribution will not capture this bias.”

De Boer and Jeet’s method, of course, aimed to do so. They included an additional variable to account for the trailing change (say, over three months) of stocks’ exposure to factors at hand.

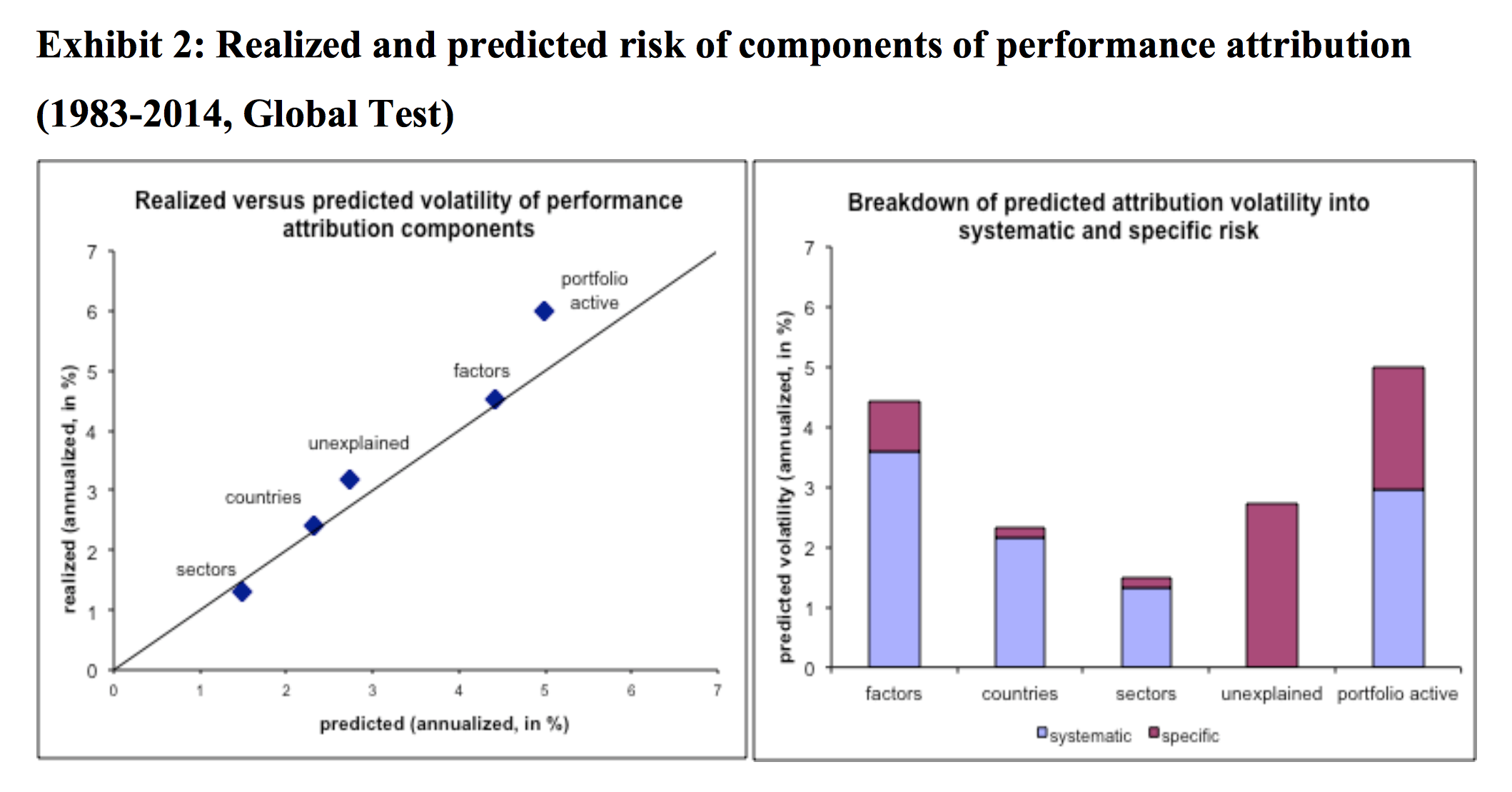

Applying their tricked-out model to a 30-year backtest, the authors found—relative to a standard method—substantial and consistent cuts in performance attributed to either stock selection or utter mystery.

Still, the paper concluded with a caution against wholly tossing out the traditional approach, but instead supplementing it with constraint-aware features. De Boer and Jeet described a “very specific purpose” for their model: “It allows purely systematic investors to fully reconcile realized performance with their factor tilts, for internal discussion or client reviews… From all this, a compelling narrative linking factor tilts with performance should arise, which is what attribution is about.”

For an in-depth look at Sanne De Boer and Vishv Jeet’s model, theorems, and proofs, read their paper “Factor Attribution and the Impact of Investment Constraints”.

Related:AIMCo: Better Performance Attribution = Better Performance & A Better Tactic for Hedge Fund Analysis