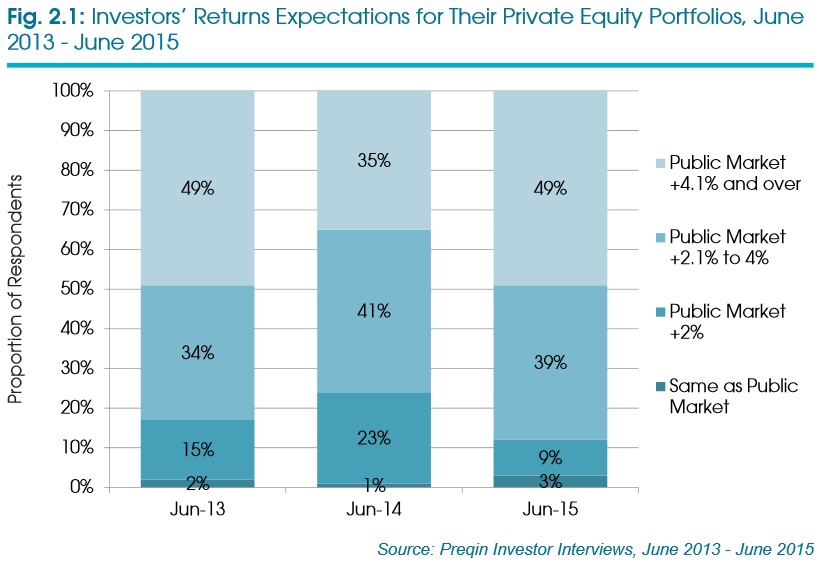

The majority of private equity investors expect outperformance of more than 4 percentage points above public markets from their allocations to the sector, research from Preqin has found.

A survey of more than 100 institutional investors in June this year showed 49% were expecting such outperformance, compared to the 35% with similar expectations in June 2014. A further 39% quizzed this year felt their allocations should outperform listed stocks by 2 to 4 percentage points.

“The competitive fundraising market has led to increased efforts from general partners in nurturing a healthy relationship with their investors.”“Between 2013 and 2014, a notable period for bull market conditions with significant stock market highs, there was a decrease in the proportion of investors that expected their private equity portfolios to beat the public market by more than 2%,” Preqin reported.

The uptick in expectations may have been driven by “the apparent success of respondents’ private equity investments in the last 12 months,” the data firm suggested.

While the performance of private

equity funds has undoubtedly improved in the short term—roughly a third of

respondents (35%) said their expectations were surpassed in the past 12 months,

compared to just 12% in June 2014—investors in different regions varied in

their satisfaction with managers.

While the performance of private

equity funds has undoubtedly improved in the short term—roughly a third of

respondents (35%) said their expectations were surpassed in the past 12 months,

compared to just 12% in June 2014—investors in different regions varied in

their satisfaction with managers.

In North America, 35% of investors said performance “exceeded expectations”, compared with 43% in Asia and 50% in Europe. Investors outside of these regions were the least satisfied: just 25% reported better-than-expected returns for the year to June 30.

Paradoxically, while Europe had the most satisfied investors, it also had the greatest proportion of dissatisfied private equity buyers: 19% said their allocations had “fallen short of expectations”.

As the private equity sector grapples with increased scrutiny of fee practices, Preqin claimed that “the competitive fundraising market, with more than 2,200 private equity funds seeking commitments, has led to increased efforts from general partners in nurturing a healthy relationship with their investors, in order to secure more re-ups in the future.”

However, 40% of investors said alignment of interests could still be improved when it came to management fees, and 32% said the same for performance fees.

Preqin’s report showed continued signs of difficult conditions for the sector’s operators, however. Unused cash rose to $965 billion in June, nearly half the total estimated capital invested in private equity. In a July interview with “Wall Street Week”, industry luminary David Rubenstein argued that this capital was likely to be deployed as soon as there was a market correction—much like that seen at the end of August.

Fundraising fell in the first half of 2015 compared with the same period last year: $253 billion was raised by 509 funds, down from $272 billion in 656 funds in the first six months of 2014. Preqin speculated that the record amount of dry powder held by private equity funds was likely to blame for this, as performance and money returned to investors have continued on an upward trend.

Related: Is Private Equity in the Bubble of all Bubbles? & From All Sides, Pressure Mounts Over Private Equity Fee Practices