The Government Pension Fund Global returned 3.2%, or NOK192 billion ($23.53 billion), in the third quarter of 2017, edging out its benchmark by 0.1%.

The fund’s equity investments returned 4.3%, unlisted real estate returned 2.7%, and fixed-income returned 0.8%. The fund had a market value of NOK7.952 trillion kroner ($970 billion) at the end of the quarter, and was invested 65.9% in equities, 31.6% in fixed income, and 2.5% in unlisted real estate.

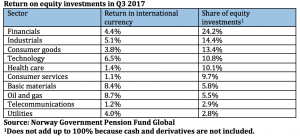

Oil and gas companies delivered the best return in the third quarter at 8.7%, due to higher oil prices in the wake of increased demand for oil, a normalization of global oil stocks, OPEC’s quota discipline, and lower production of shale oil in the US. Basic materials returned 8.4%, which was driven by higher prices for metals and chemicals on increased demand and supply problems.

North American stocks returned 3.4% for the quarter, and made up 38.2% of the equity portfolio. US stocks, which were the fund’s single-largest market with 35.9% of its equity investments, returned 3.2%, or 4.6% in local currency, while European stocks returned 5.5% and accounted for 37% of the fund’s equities. The UK, which was the fund’s largest European market with 9.7% of its equity investments, returned 4.9%, or 2.9% in local currency.

Stocks in Asia and Oceania, which accounted for 21.8% of the fund’s equity investments, returned 3.7%. Among those, Japanese stocks returned 3.7%, or 5.3% in local currency, and made up 8.9% of equity investments, while China’s stock market, which makes up 3.2% of the fund’s equity investments, returned 10.4%. Emerging markets returned 6.4% and accounted for 10.2% of the equity portfolio.

Technology stocks returned 6.5%, with long-term trends continuing to fuel expectations for future earnings and returns in the sector, the fund said. Semiconductor manufacturers in particular contributed to the return, boosted by strong demand and limited supply. Meanwhile, consumer services stocks were the worst-performing stocks, returning 1.1%. Media companies made a negative contribution as a result of declining ad revenue, and traditional TVs struggle to compete with new alternatives.

Among individual stocks, the fund’s investment in oil company Royal Dutch Shell made the most positive contribution to its third-quarter return, followed by technology companies Tencent, and Apple. The fund’s worst-performing stocks were consumer goods company Nestlé SA, health care company Teva Pharmaceutical Industries, and industrial company General Electric.

Tags: Government Pension Fund Global, Norway, Pension, Q3