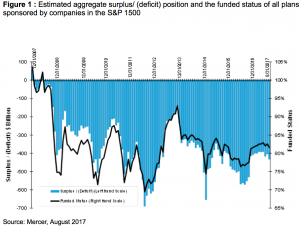

A report from Mercer finds the estimated aggregate funding level of pension plans for S&P 1500-sponsored companies decreased by 1% to 82% funded status for August.

The report attributes the dip to a decrease in discount rates partially offset by mixed equity markets. The estimated aggregate $432 billion represents a $28 billion increase compared to the deficit measured at the end of July. The aggregate deficit is also up $24 billion from the deficit measured at the end of 2016 ($408 billion).

The S&P 500 index saw a marginal increase, gaining 0.05% in August, while the MSCI EAFE index fell 0.31%. Ordinary discount rates for pension plans measured by the Mercer Yield Curve slipped 12 basis points to 3.64%.

“With rates down another 10 bps in August and about 40 bps over the year, growth asset performance has not been able to drive improvement in funded status.” said Scott Jarboe, a Partner in Mercer’s Wealth business. “We expect plan sponsors may be pondering contributions in September, which is the plan year close for calendar year plans, to improve funding levels and advance their destination while also defraying future PBGC costs.”

The estimated aggregate value of S&P 1500 company pension plan assets at the end of August were $1.92 trillion, compared with $2.35 trillion in estimated aggregate liabilities.

The estimated aggregate surplus/ (deficit) position and the funded status of all plans sponsored by companies in the S&P 1500 chart can be viewed below.