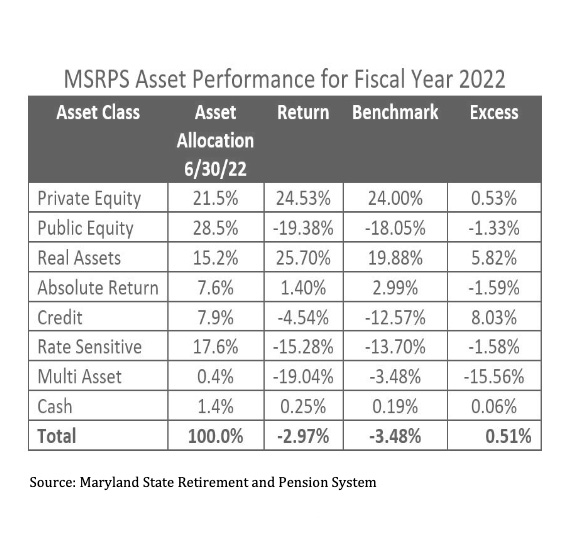

The Maryland State Retirement and Pension System’s investment portfolio lost 2.97%, net of fees, for the fiscal year ending June 30, but beat its policy benchmark’s loss of 3.48%. As they have been for many pension funds, the results were a sharp turnaround from last year, when the MSRPS earned record returns of 26.7%.

“As you would expect, given recent market conditions, investment returns are down from last year,” State Comptroller Peter Franchot, chair of the MSRPS board of trustees, said in a statement. “However, the system’s assets have held up better than most public plan peers.”

A news release from the pension fund attributes the loss to the ongoing volatility of global financial markets, inflation, rising interest rates, the COVID-19 pandemic and the Russia-Ukraine war. It also notes that bonds did not provide their typical protection in down equity markets, as both stocks and bonds lost more than 10% during the fiscal year.

However, the release says the fund’s portfolio performed significantly better than a traditional 60/40 allocation to publicly traded stocks and bonds, which it attributes to a diversified and risk-balanced asset allocation that is designed to weather market volatility extremes.

“It was a difficult fiscal year for public markets with both bond and stock prices falling,” CIO Andrew Palmer said in a statement. “The board’s diversified asset allocation policy anticipates unusual markets such as these and includes stabilizing assets classes to protect value.” Although the fund missed its new assumed actuarial rate of 6.8% for the fiscal year, which became effective July 1, the portfolio’s three-, five- and 10-year returns were 8.4%, 7.9% and 7.8%, respectively.

Although the fund missed its new assumed actuarial rate of 6.8% for the fiscal year, which became effective July 1, the portfolio’s three-, five- and 10-year returns were 8.4%, 7.9% and 7.8%, respectively.

The portfolio was weighed down by its public equity investments, which lost 19.38% during the fiscal year, and which missed their benchmark’s return by 133 basis points. Rate-sensitive investments also underperformed, losing 15.28% for the year, below their benchmark’s loss of 13.70%. And multi-asset investments lost 19.04%, well off their benchmark’s loss of 3.48%; however, the asset class accounts for only 0.4% of the portfolio’s total asset allocation.

Real assets and private equity were the top-performing asset classes for the pension fund, returning 25.70% and 24.53%, respectively. The real assets investments significantly outperformed their benchmark, beating it by 582 basis points, while the private equity investments beat their benchmark’s performance by 53 basis points.

Related Stories:

Maryland to Launch Retirement Program in Summer 2022

Maryland State Pension Returns 3.6% in FY 2020

Maryland Plan Misses Target, Lowers Assumptions

Tags: Andrew Palmer, COVID-19, fiscal 2022, Inflation, Interest Rates, Maryland, Maryland State Retirement & Pension System (MSRPS), Pandemic, Pension Funds, Private Equity, Real Assets