Barclays Global Investors. Citigroup Asset Management.

FRM. Ignis. Remember them?

Once mainstays in the global asset management

industry, these names have been merged into or acquired by larger companies.

The thirst for consolidation in this industry seems unquenchable—and there is

no end of targets.

A report from Moody’s in December said 2015 was

destined to be a bumper year for mergers and acquisitions in global asset

management. Regulation, fee pressure, and a move towards passive investing were

supposedly forcing smaller managers to take shelter in the arms of their larger

brethren.

Yet similar reports were written in 2013, 2011,

and 2009, and the number of managers remains largely the same. Why?

“It is a very fragmented industry,” says Stefan

Dunatov, CIO of the UK’s Coal Pension Trustees. From the dozen or so asset

managers with more than €1 trillion under management—only a handful of which

are based in Europe—there is a quick drop off to the mid-tier companies.

“In spite of the talk of impending consolidation,

it never actually happens,” Dunatov continues. “As soon as one asset manager is

bought by a competitor, another springs up in its place.”

“People like to own what they do, so they create new firms. Investors are sure they can find alpha and skill, so they go looking for them.”

—Stefan DunatovFor every acquisition—BNY Mellon buying Cutwater

Asset Management, Schroders buying Cazenove Capital, Natixis buying DNCA—there

are new boutiques springing up. Somerset Capital, Ardevora Asset Management,

Woodford Investment Management, and TwentyFour Asset Management have all

launched successfully in the UK in recent years. (Having an imaginative name is

evidently not a priority when starting out on your own.)

The companies being acquired tend to be more

established firms with multiple asset classes in their product range (think

Aberdeen’s acquisition of Scottish Widows Investment Partnership, or Standard

Life’s purchase of Ignis Asset Management), while the new boutiques specialise

in a narrow field of expertise, usually because they are launched by fund

managers moving out of the behemoths.

“People like to own what they do, so they create

new firms,” Dunatov says. “Investors are sure they can find alpha and skill, so

they go looking for them. It’s both supply and demand-driven.”

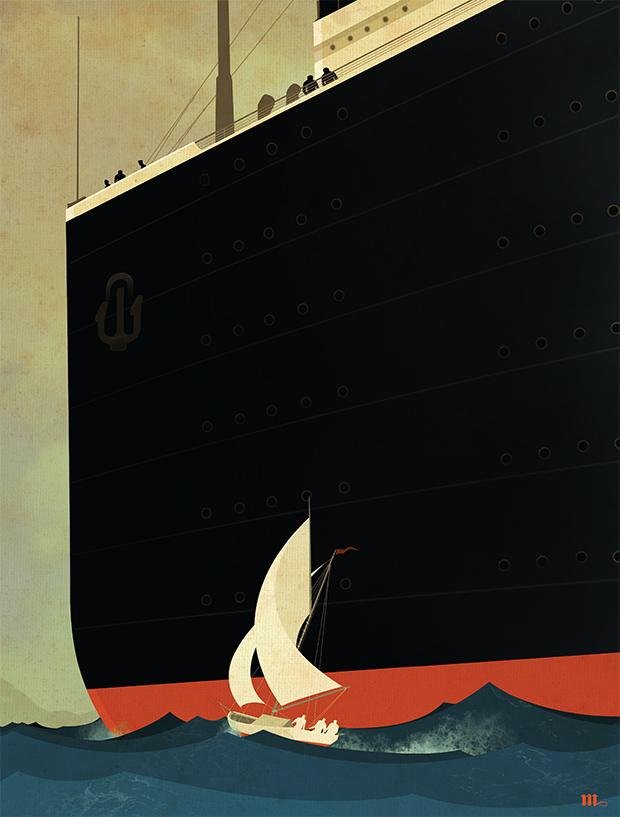

Art by Bill Mayer

Art by Bill Mayer

In his view, “the market structure of fund

management is evolving.” In the years ahead we may see an industry dominated by

a “Big Four” or “Big Six” as is the case in other financial services sectors,

Dunatov argues, “with a lot of companies in the middle and a very long tail of

very small companies, with large amounts of turnover.”

What it might mean for institutional investors?

Given the choice, what would you prefer: Behemoth or boutique?

Size isn’t everything. Investment process, track record,

manager conviction, and several other factors will come into the mix before investors

consider a company’s scale. But far from being irrelevant, the size of a

potential asset management partner is definitely part of an asset owner’s

assessment and due diligence work.

For Stefan Ros, CIO of SPK, Sweden’s pension fund

for the banking sector, having a larger entity running a mandate has several

benefits.

Firstly, there is the obvious advantage of greater

support for the individual fund managers. “It is important they have internal

resources so they can achieve what they want to,” explains Ros. “For example, a

global equity manager requires more resources: you wouldn’t want just one

person sitting in an office doing all the analysis from his desk—it wouldn’t be

credible. But for a smaller regional manager, it could be.”

The benefits of scale are not just limited to a

pension’s existing mandate, however.

“We are quite a small organisation, so our

relationships with fund managers are very important to us,” Ros says. “If we

have a large fund manager running a specific mandate, then we are also

interested in other areas: other asset classes, capabilities, and services—for

example, producing analysis or asset-liability matching.”

Tolu Osekita agrees. The former CIO of the

Northamptonshire and Cambridgeshire pension funds also believes making the most

of relationships with big asset managers is important, particularly to smaller

pensions.

“We ran a small in-house investment team, which

meant we had to leverage our external relationships to get research done—you

can only do that with big firms,” he recalls. “We were looking at smart beta a

couple of years ago: we didn’t want something off the shelf; we wanted to build

our own. We couldn’t have that conversation with small boutique managers, but

with our large firms we could sit down to ask them to run an analysis and build

a report.”

Scale can be important for particular asset

classes or investment strategies, Osekita adds. For passive management, a large

firm like Vanguard with more than $3 trillion (€2.7 trillion) in assets can

bring efficiencies to its index-tracking funds as well as participating in

stock lending as a trusted provider. The benefits are then passed on to clients

in the form of ultra-low fees.

The same goes for illiquid asset classes, Osekita

argues, where “size is an advantage because you get better deals, which often

lead to better returns”.

“With liability-driven investing it’s a similar

story,” he adds. “Size matters because you’re buying an off-the-shelf product,

and it needs scale.”

There is also the IBM factor: “You don’t get fired

for buying IBM”, as the saying goes (even if the tech giant’s stock is down 17%

in the past 12 months).

“With a large manager, there is more certainty

that the company you’re employing will still be there in five or ten years,”

says Jeff Levi, partner at consulting firm Casey Quirk. “If you have a strategy

reliant on large managers you can get access to a lot of resources, and create

tailored mandates.”

However, not everyone buys the resources argument.

Chetan Ghosh, CIO of the Centrica Pension Schemes, claims the expansive

compliance, IT, and legal teams of the biggest groups are “a luxury.”

“Compared to what you want from your

manager—returns—the company infrastructure can’t be a driver of your

selection,” he says. “Even when you’re selecting a manager to just get beta

exposure, the same argument applies: you wouldn’t just pick a large manager for

the scale. You can look for better beta than that.”

Dunatov flips that argument around, agreeing that

larger companies have greater compliance and legal resources, “but they often

don’t have the best people managing the funds. But how much does that actually

matter?”

Stability, reduced costs, access to intellectual

capital—the big boys certainly have their distinct advantages. So why are there

still so many boutiques?

The answer may be as simple as

alpha generation. While scale is certainly an advantage for a passive manager,

the bigger an active fund gets, the harder it becomes for the manager to

outperform.

“Managers of smaller firms have the hunger to do well, and their interests are seen as being more aligned with those of the firm as it is their own neck on the line.”

—Dunatov“All things being equal, for active mainstream

assets a smaller manager with focus and conviction tends to outperform over

time,” says Osekita. “At Northamptonshire and Cambridgeshire, our best

performing manager was one we seeded from scratch, and it outperformed every

other manager in the portfolio consistently for 10 years. There is definitely a

lot of evidence pointing to an inverse correlation between size and

performance.”

Another important correlation at boutique managers

is between their own success and the success of the client. Centrica’s Ghosh

prefers to use boutiques and smaller managers for this reason.

“We have found that, for continuity, it is better

to stick with boutiques,” Ghosh says. “A lot of the larger firms don’t have the

remuneration or packages that are sticky enough to make the good managers stay.

I thought these firms would find a way to keep the managers that they

considered to be crucially important, but a recent case at one of our managers

proved it wasn’t the case.”

There are reasons other than remuneration why

managers flee behemoth groups for something smaller, of course—Bill Gross being

case in point. But for the most part, emerging and boutique firms’ compensation

schemes work to asset owners’ advantage.

“Often these smaller firms are run by managers who

have left larger firms,” Dunatov adds. “They have the hunger to do well, and

their interests are seen as being more aligned with those of the firm—and by

extension, the clients’—as it is their own neck on the line.”

Casey Quirk’s Levi believes alignment of

objectives forms part of an asset manager’s overall credibility, along with

investment strategy and the communication of its process. “This is where size

comes in,” he says. “When you talk to large firms you might be really far away

from the centres of thought and research. At smaller firms, there is often a

sense that you have access to the entirety of the business. The mandates often

mean more as well, so they will do more for the client.”

However, small firms—and in particular

startups—cannot always cope with sizeable mandates from larger asset owners.

Splitting a big equity allocation between several small managers is an option,

but as Dunatov queries, what would a large number of small mandates do to an

overall portfolio, even if they do outperform? “Do they move the needle? That

is certainly a factor for consideration,” he says.

Scalability was

one of the factors cited by Ted Eliopoulos, CIO of the California Public

Employees’ Retirement System (CalPERS), when announcing his intention to wind

down its hedge fund allocation. Few European funds can match CalPERS’ $300

billion (€272 billion) of assets, but at any size, asset owners would hope that

their managers can at least keep pace with the growth of their overall

portfolio.

“The decision is not necessarily between the behemoth and the

boutique—you want a blend in your portfolio,” says Osekita. In general, he

says, smaller managers are better placed for mainstream alpha-chasing active

mandates, while larger managers tend to be preferable for passive strategies,

smart beta, or illiquid alternatives.

There is, of course, a third way. Centrica’s Ghosh

speaks positively of the “multi-boutique” structure favoured by the likes of

BNY Mellon, Hermes, Natixis, Affiliated Managers Group (AMG), and BNP Paribas.

Often in this model, specialist groups are allowed to operate autonomously but

with the back office support of a larger firm. AMG in particular keeps a low

profile despite its stakes (sometimes minority ones) in smaller, top performing

operations such as AQR, Veritas, and Pantheon.

“The decision is not necessarily between

the behemoth and the boutique—you want a

blend in your portfolio.”

—Tolu Osekita“There is an increasing trend of skilled managers

heading towards multi-boutique set-ups,” Ghosh says. “That way they are direct

owners, but with a certain security. In these set-ups, we feel it is less

likely the firm will suffer a ‘corporate event’ and have a key manager leave.

Happy fund managers—with a stake in the direction of the company—are more

likely to stay.”

It is becoming “more important to have a minimum

size” for asset managers, particularly in the alternatives space, according to Casey

Quirk’s Levi. He points out that some of the largest operators in alternatives

are the big global firms such as BlackRock, PIMCO, and Goldman Sachs, which are

not necessarily well known for those capabilities. As a result of the growing

resources of these companies, “traditional players in the middle ground are

getting squeezed out”, Levi says—echoing Stefan Dunatov’s prediction of the

future shape of the asset management landscape.

Evidence is mounting that the biggest managers are

getting bigger. Aberdeen’s acquisition of Scottish Widows Investment

Partnership has created an £84 billion group (€114 billion), the biggest in the

UK, according to data gathered by the Investment Association, an asset

management trade group.

Separate data from Preqin on private equity, hedge

funds, and unlisted real estate has shown that funds in these areas are on

average getting larger. The bigger, more established names are raising ever

more capital at the expense of smaller or mid-tier players. Blackstone’s Real

Estate Partners VIII fund closed in the first quarter of 2015 having raised a

record $14.5 billion. The previous record of $13.3 billion was also held by

Blackstone.

This dominance by larger groups may be a

reflection of the IBM effect, but whatever the cause it is most certainly not

the whole story.

As SPK’s CEO Peter Hansson explains, “there is an

art” to selecting fund managers—“it’s not a machine that can output who to

invest with.” There are multiple factors to consider, not least the context of

the individual asset owner, and choosing the right fit can take months of work

and hours of meetings.

“The point not to forget is that this industry is

built on greed,” says Dunatov. “People think they should be looking for alpha

and others think they can provide it.”

“People are always chasing skill, whether it is

there or not,” he concludes—and this can apply to any fund manager, boutique or

behemoth.

—Nick Reeve &

Elizabeth Pfeuti

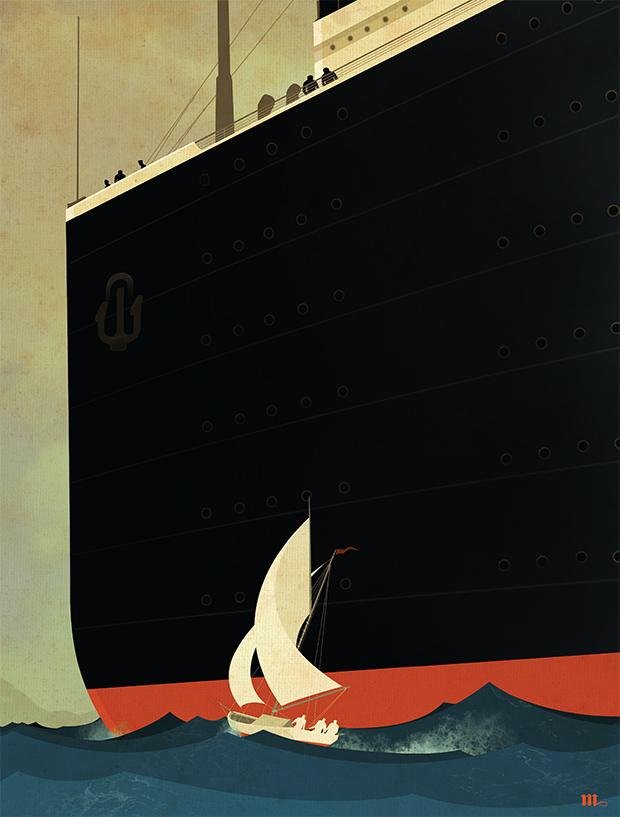

Art by Bill Mayer

Art by Bill Mayer