Delayed investment activity from fund managers is causing a significant impact on the New Hampshire Retirement System’s (NHRS) private equity pacing plan for 2019, according to a report recently issued by the plan, according to a report from NEPC, the NHRS’ investment consultant. investor.

The timing of the fund manager’s inaugural capital call for an investment vehicle constitute the vintage year of the fund, meaning commitments executed in 2018 but have had no drawdowns yet will take be calculated into the pension’s 2019 pacing.

The consultant recommended that the pension complete between $300 million to $400 million of new commitments per vintage year for the next several years. “Roughly $365 million of commitments already made will be considered 2019 vintage, leaving room for $50 [million to] $75 million in new, as yet unnamed allocations,” the advisor noted in a report.

The NHRS completed $275 million in commitments between private equity and debt funds, with $150 million committed to the energy sector, $50 million to the buyouts/co-investment strategies, and $75 million to growth-oriented vehicles.

The expected impact of the mitigated 2019 pacing plan on the NHRS’ return profile has yet to be determined, a spokesperson for the pension told CIO. The spokesperson did not identify the funds which are expected to begin their drawdowns in 2019, but reports from the investor indicate that the pension made commitments to Industry Ventures Partnership Holdings V LP ($50 million), Thoma Bravo Fund XIII ($50 million), Warburg Pincus Global Growth ($50 million), Bluebay DLF III ($50 million), Clareant European Direct Lending Fund III ($50 million), and Monroe Capital Private Credit Fund III ($50 million).

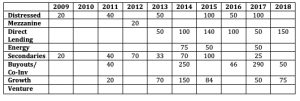

The pension’s activity throughout the past decade can be seen below:

The NEPC expressed several concerns about some of the NHRS’s private markets investments. The consultant said that Avenue Special Situations VI, a fund focusing on distressed situations, never developed per the investment thesis and is winding down. Gramercy DOF II and DOF III have failed to meet expectations, and challenges in the emerging market continue to burden the vehicles’ returns. Former concerns regarding SL Capital, Ironwood, RFE. and industry ventures have seen performance improvements, are near expectations, and no longer a concern.

Tags: NEPC, New Hampshire Retirement System, Pension, Private Equity