Quebec’s C$241 billion ($182 billion) pension fund is broadening its already large infrastructure portfolio.

La Caisse de dépôt et placement du Québec announced Monday a co-investment deal for infrastructure projects in Mexico. The move is part of a new partnership with a consortium of Mexican institutional investors, including three of the country’s largest pension managers.

“We are creating an innovative investment platform that is ideally positioned to find and invest in the best Mexican infrastructure projects.”The newly created platform will invest up to $2.1 billion over the next five years, pursuing opportunities in energy generation, transmission and distribution, as well as transportation and public transit.

La Caisse said it would commit $1.1 billion in investments, adding to an infrastructure portfolio already worth more than $8.3 billion. The fund added it aims to double the size of this portfolio by 2018.

“When we look around the world, especially in the infrastructure sector, Mexico stands out as an exceptional country to invest in,” said Michael Sabia, president and CEO of La Caisse. “We are creating an innovative investment platform that is ideally positioned to find and invest in the best Mexican infrastructure projects.”

The Mexican investing consortium will contribute the remaining $1 billion.

La Caisse announced earlier this year a $4 billion investment in Quebec public transport. The deal was the beginning of a wider plan to finance infrastructure projects for the Canadian province.

At the time, ratings agency Moody’s aired concerns that the fund was exposing itself to “operational and reputational risks associated with the performance of public infrastructure projects, risks that would have otherwise rested with the provincial government.”

Sabia, meanwhile, referred to the deal as a “win-win” partnership.

“Today’s agreement will allow us to increase our exposure to infrastructure while concretely putting our expertise to work for Quebec’s economy,” he said in January. “These investments will generate returns that help to secure Quebecers’ retirement for the future.”

Related: Canadian Pension Pens $4B Infrastructure Deal & Moody’s Warns Canada’s Caisse over Infrastructure

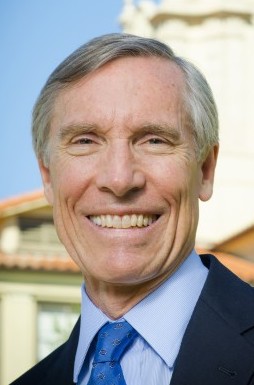

David Oxtoby, President, Pomona College

David Oxtoby, President, Pomona College