Asset managers are attempting to “fudge their way to success” through unclear performance reporting—and the problem is “getting worse,” according to Cerulli Associates research.

Some managers report back-tested data to fund selectors and consultants as actual fund performance, while others fail to clarify whether performance is net or gross of fees.

“Clarity—or lack thereof—is the issue,” said Tony Griffiths, senior analyst at Cerulli.

Asset managers have been known to rebrand products or alter mandates to disguise poor performance, consultants told the firm in interviews. Product data may change between a pitch and a final proposal “without explanation.”

Managers were also accused of aggregating assets to include segregated mandates, despite the opacity of these side-deals.

“Cerulli does not see the long-running prickly relationship between investment consultant and manager easing anytime soon, especially in the UK where demand for consultant-led fiduciary management services continues to grow and yet fiduciary management performance data are not widely available,” the analytics group said in its report.

Griffiths also expressed “some sympathy” with managers over consultants’ claims that they are “launching or adapting products based primarily on market demand.”

“Many firms feel that investment consultants set moving targets,” Griffiths said. “Managers are expected to build products and services based on personal convictions, while at the same time addressing the needs of the consultant; the suggestion being that products can be tweaked, but not tailored—a potentially impossible balancing act.”

Related:The Bar for Managers ‘Has Never Been Higher’ & Personality Metrics of Strong Asset Managers

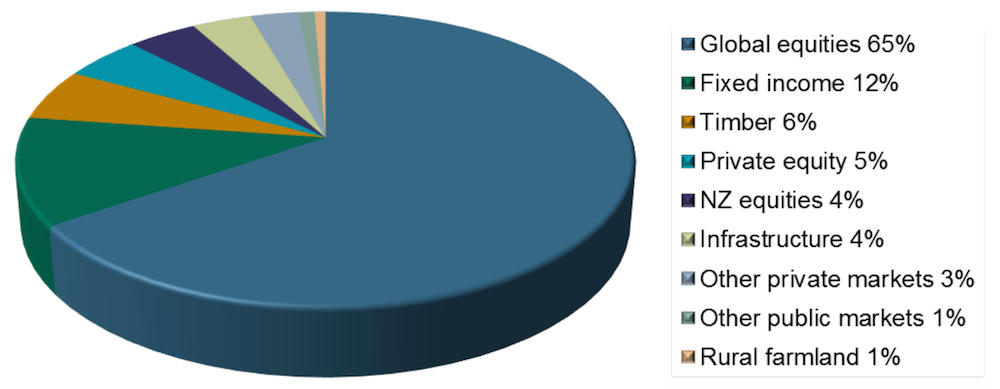

NZ Super’s portfolio as of

NZ Super’s portfolio as of