Hedge fund assets are projected to surpass $3 trillion by the end of 2016, as investors renew their faith despite declining returns, according to Deutsche Bank’s annual alternatives survey.

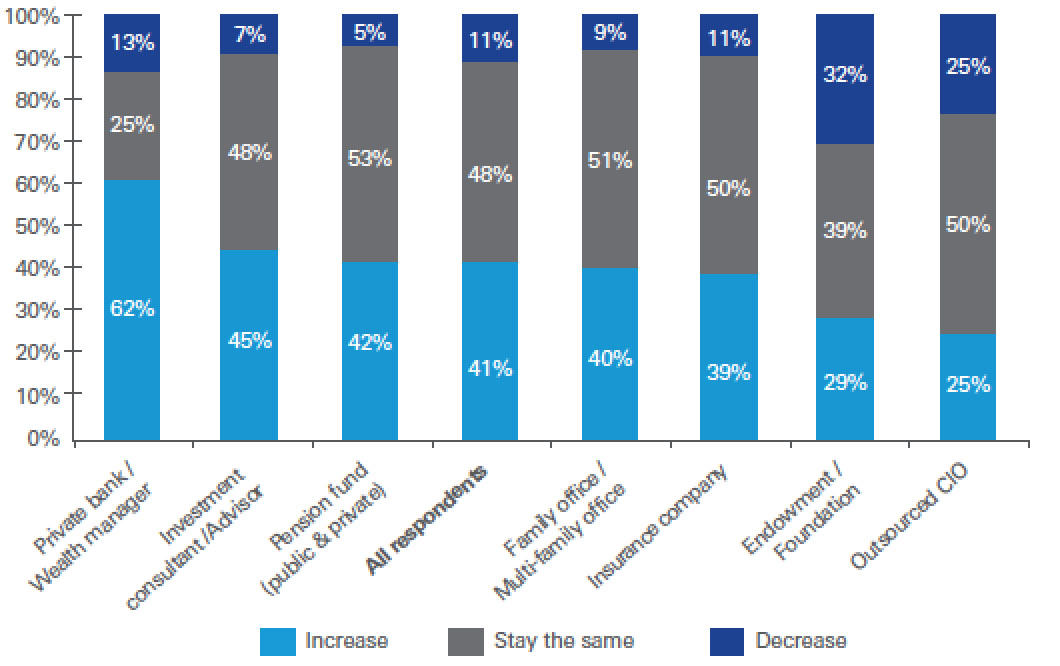

Some 91% of surveyed asset owners increased or maintained their allocations to hedge funds in 2015. In 2016, 41% planned to further grow their allocation, while 48% said they intended to keep it at the same level.

Such continued appetite was in spite of hedge funds’ average realized returns of 3% last year, a drop from 5.26% in 2014 and 9.29% in 2013.

“Despite a challenge year for global financial markets and for hedge funds, investors remain committed to their hedge fund programs,” said Ashley Wilson, global co-head of prime finance at Deutsche Bank.

This decline in performance was partly driven by a significant return gap between the best and worst performing hedge funds. While bottom quartile managers lost 2.8% on average, top quartile managers delivered double-digit performance. One out of five respondents said their top quartile funds achieved returns of 15% or more.

“The return dispersion seen in 2015 means that choosing the right manager and constructing the right portfolio is ever more critical,” said Anita Nemes, the firm’s global head of capital introduction. “Investors are concentrating and redesigning their portfolios in search of less correlated, diversified return streams.”

The average portfolio in 2015 contained 36 hedge funds, compared to 60 in 2008, Deutsche Bank found. More than half of respondents said they had less than 25 direct hedge fund investments, compared to 19% five years ago.

Overall, investors were optimistic about their hedge fund allocations, targeting returns of 7.49% for 2016.

Pension funds were among the biggest proponents of hedge funds, with 42% looking to increase their investments this year. Endowments and foundations, meanwhile, were less inclined toward hedge funds, with 32% planning to lower their allocations.

Equity long-short was projected as the best performing hedge fund strategy in 2016, followed closely by discretionary macro approaches.

Meanwhile, respondents predicted distressed credit, activist, and commodity hedge funds would perform the worst.

Planned allocation changes to hedge funds in 2016. Source: Deutsche Bank’s “Alternative Investments Survey.”

Planned allocation changes to hedge funds in 2016. Source: Deutsche Bank’s “Alternative Investments Survey.”

Related: Hedge Fund Flows Collapse in 2015; Hedge Fund Product Wave Set for 2016; Public Pensions Double Down on Hedge Funds