Prefatory note: Regulations may constrain the factors considered or actions taken by some investors. The views discussed in this article are not intended as investment advice.

The protests across the United States and the rest of the world stemming from the killing of George Floyd on May 25 were a wake-up call for many in the (predominantly white and male) investment industry. Many investors are beginning to realize a need to participate in conversations on race, diversity, and equity to ensure capital is allocated justly and corporate practices are supportive of a more equitable and diverse society.

This need isn’t just underpinned by a clear moral imperative; the industry has a vested self-interest as well. Put simply, evidence shows that diverse asset management teams outperform. We believe this is driven by their broader understanding of the marketplace and a combination of different cognitive styles, which enable the development of more creative solutions to complex problems. This is why Mercer has been assessing diversity and cultural indicators as part of its manager research and ratings.

However, if investors really want to address systemic racism and an accordant lack of diversity within financial services, they need to do much more than simply get their own houses in order. Where deemed consistent with their mandate, they must also develop a stronger understanding of the intersections between race and economic systems and the importance of capital allocators in supporting positive change in those economic systems that benefits their stakeholders and society at large. In exploring these issues, this article is divided into four sections:

- Acknowledge the intersection between socioeconomic inequality and systemic racism.

- Acknowledge the link between investor (in)action and socioeconomic inequality.

- Engage with companies on issues related to socioeconomic inequality

- Allocate capital with explicit consideration of equity issues.

While the recent wave of corporate and investor commitments to, for example, donate to racial justice causes or recruit from historically black colleges and universities is much welcomed, much more needs to be done to address systemic problems. By following some of the guidance in this article, we hope investors can build on recent action and help to create a more just and equitable society in the process.

1. Acknowledge the intersection between socioeconomic inequality and systemic racism.

Institutional investors are beginning to focus on socioeconomic inequality (defined here as differences in both income and wealth between social groups) since it can undermine long-term returns by depressing aggregate demand, reducing growth, and creating political unrest. Indeed, in the frame of environmental, social, and governance (ESG) investing, inequality could prove to be a keystone issue for “social” investing in the same way that climate change has been a keystone issue for “environmental” investing. Yet much of the focus on socioeconomic inequality to date has centered on global differences in income and wealth (e.g., between developed and developing countries) rather than intranational differences, and the connection between socioeconomic inequality and race is sometimes glossed over.

Recent social unrest in the US has shone a bright spotlight on the complex link between socioeconomic inequality and racial injustice. By way of brief background, income inequality has been increasing for the entire US population over the past 50 years. This has hurt people across the racial spectrum. However, this is only part of the story; it doesn’t take a lot of detailed analysis to recognize that people of color have been disproportionately impacted by this trend, as evidenced by the significant disparity in income and wealth between white and Black families.

The roots of this racial disparity are deep and have been extended from slavery and other legislated forms of discrimination (e.g., Jim Crow laws) by forms of socioeconomic discrimination such as mortgage redlining, school segregation, and mass incarceration. Systemic racism persists due in large part to this discriminatory history and the ongoing legacy of socioeconomic impairment experienced by Black, Indigenous, and people of color (BIPOC) families.

Take, for instance, redlining, the now illegal banking practice of refusing loans to people based on where they live and which typically targeted majority Black neighborhoods. This policy resulted in the effective exclusion of Black families from the homeownership market for decades and has been a significant contributor to the wealth gap. For reference, homeowners have 45 times higher net worth than non-homeowners and the rate of homeownership among Black families is significantly lower than the rate among white families. Add to this the fact that home values in historically redlined neighborhoods have appreciated less than in “greenlined” neighborhoods, and even Black families that have been able to obtain homes have tended to benefit less from home value appreciation than white families.

Given the significant intersectionality between socioeconomic inequality and race in the US, it is clearly difficult to address one issue without also addressing the other.

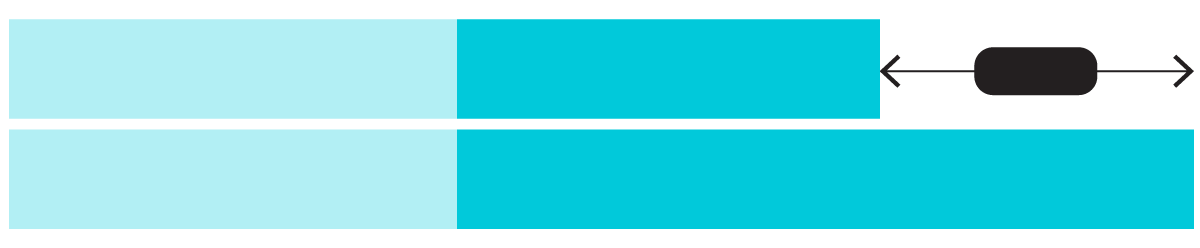

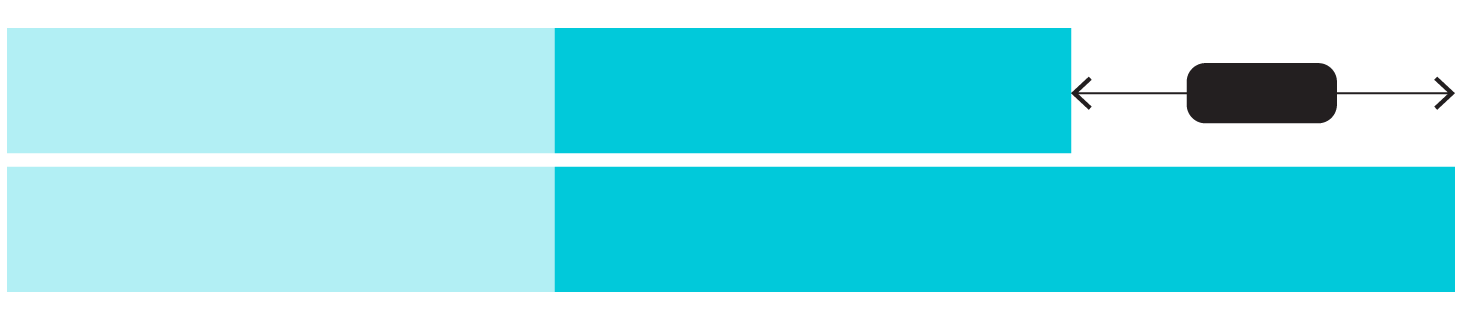

Median Family Income by Race or Ethnicity of Respondent

Black or African American

Non-Hispanic

$35,000

+73%

White Non-Hispanic

$61,000

Source: 2016 Survey of Consumer Finances, Federal Reserve Board

Median Family Net Worth by Race or Ethnicity of Respondent

$17,100

Black or African American Non-Hispanic

+900%

$171,000

White Non-Hispanic

Source: 2016 Survey of Consumer Finances, Federal Reserve Board

Family Net Worth by Homeownership Status

$5,000

Rent or Other

+4,528%

$231,400

Owner

Source: 2016 Survey of Consumer Finances, Federal Reserve Board

2. Acknowledge the link between investor (in)actions and socioeconomic inequality.

A host of corporate practices commonplace today have been implicated in research as potentially exacerbating socioeconomic inequality, both globally and in the US. Investors have implicitly or, in many cases, explicitly supported these practices by: allocating capital to companies that have been implicated in widening the income and wealth divide, voting favorably for management proxy resolutions which authorize company actions that may cause greater inequality, or not addressing the issue of inequality in private engagements with corporate management teams. A list of some of these practices follows, along with a brief description of their relevance to systemic racism and related corporate diversity issues:

- Executive compensation. Executive compensation is already a contentious issue in many jurisdictions where investors are voting for “say on pay” proxy resolutions and against egregious pay packages for underperforming CEOs. However, when it comes to economic inequality, the issue of executive compensation is less about a few outliers and more about a widening gap between executives and average workers. Quoting from the Economic Policy Institute: “From 1978 to 2018, CEO compensation grew by 1,008%; the compensation of a typical worker, meanwhile, rose just 12%. The ratio of CEO-to-worker compensation was 278-to-1 in 2018—far greater than the 20-to-1 ratio in 1965.” In addition to issues related to general socioeconomic inequality, very little of this increase in executive pay has accrued to BIPOC families, serving to widen the racial wealth gap. For example, per the COQUAL, Black people account for only 3.2% of senior leadership roles at large companies in the US and less than 1% of Fortune 500 CEO positions, versus about 12% of the total population.

- Tax avoidance. Many corporations use offshoring in “tax havens” and other strategies to reduce their overall tax burden. While many of these practices are legal based on current national laws and international agreements, they can create reputational risk for companies and overinflate historical earnings as international tax loopholes close. These practices also expand inequality by depriving public systems—focused on such things as education, health and human services, and infrastructure—of much needed fiscal support. As BIPOC families are disproportionately low income, they currently rely on these public systems more so than white families. By avoiding paying taxes, corporations are reducing that support.

- Leadership diversity. Leading employers in terms of employee satisfaction and attractiveness to young talent tend to have more diverse leadership. And companies with ESG metrics, including those related to diversity, embedded in the CEO’s agenda tend to grow. Yet, as previously noted, representation of people of color in leadership remains low.

- Lobbying. Investors have increasingly been asking corporations, particularly those in fossil fuel industries, to disclose their lobbying expenditures and activities in relation to climate change to ensure such efforts are supportive of their public claims to take climate risk seriously. A similar dynamic is at play in relation to racial diversity. Some corporations, including some which have spoken out recently against racial injustice, have donated to “527” groups which drove racial gerrymandering of legislative boundaries.

- Employee benefits. Employers are important channels for individuals to access benefits such as health insurance and retirement savings plans. Yet people of color are less likely to have access to these benefits. According to Bureau of Labor Statistics (BLS) data, Black men have a lower labor force participation rate than men in general and Black men and women have a higher rate of unemployment. Additionally, employed Black people are more likely to work in service industries, where hourly jobs with less comprehensive benefits are more common. These jobs also tend to be “essential” in the fight against COVID-19, contributing in part to the worse health outcomes experienced by BIPOC people during the pandemic thus far.

While the above is not a comprehensive list, it is representative of the various corporate practices which could be altered to help address socioeconomic inequality and the intersectional issue of systemic racism.

3. Engage with companies on issues related to socioeconomic inequality.

The finance industry runs on information. Right now, too little information is provided by companies related to the age, gender, or racial makeup of their employee populations. While there are acknowledged difficulties in interpreting standardized metrics across companies and sectors—even basic ones such as turnover rates or CEO pay ratios—disclosure of more generalized or qualitative information (e.g., methods and processes used by company management to ensure human capital is being effectively managed as an asset) is also rare.

Many investors, like the members of the Human Capital Management (HCM) Coalition, recognize the importance of such information and have urged individual companies and the US Securities and Exchange Commission (SEC) to enhance related disclosure requirements. Indeed, even board directors have indicated that these issues are a priority. Nevertheless, these conversations appear to have occurred with limited urgency given the current poor state of voluntary HCM metric disclosure.

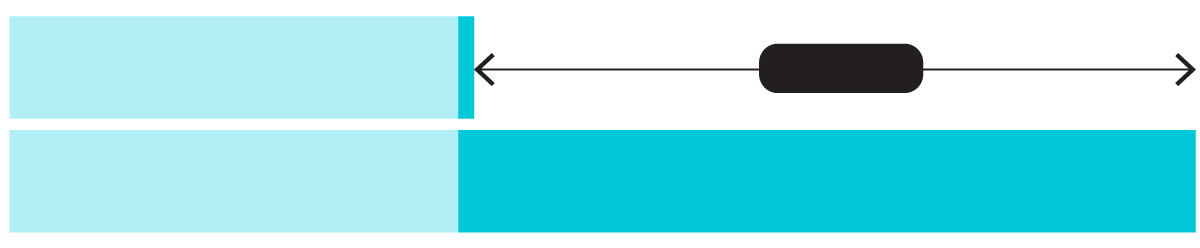

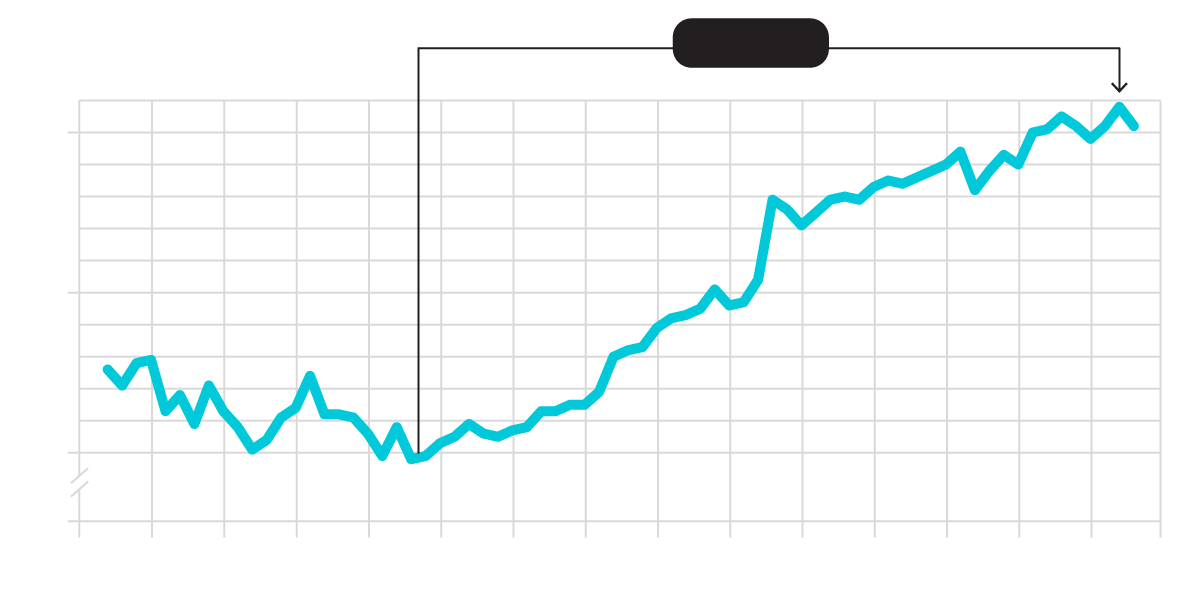

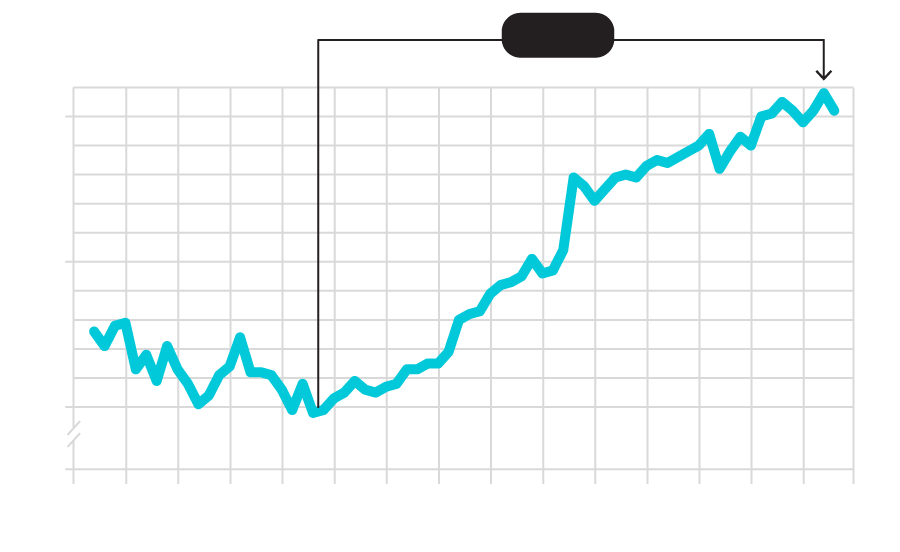

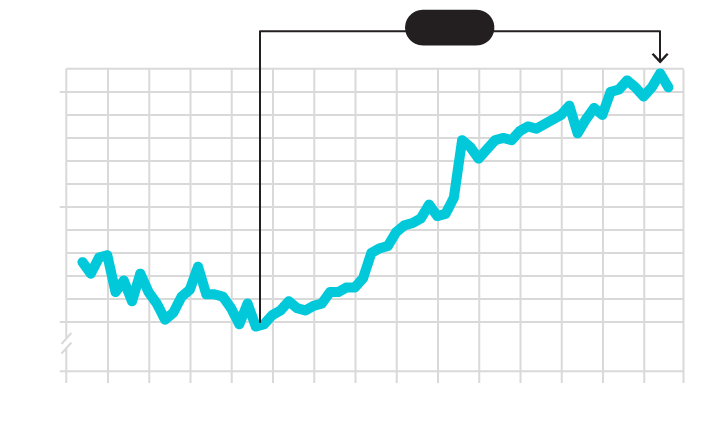

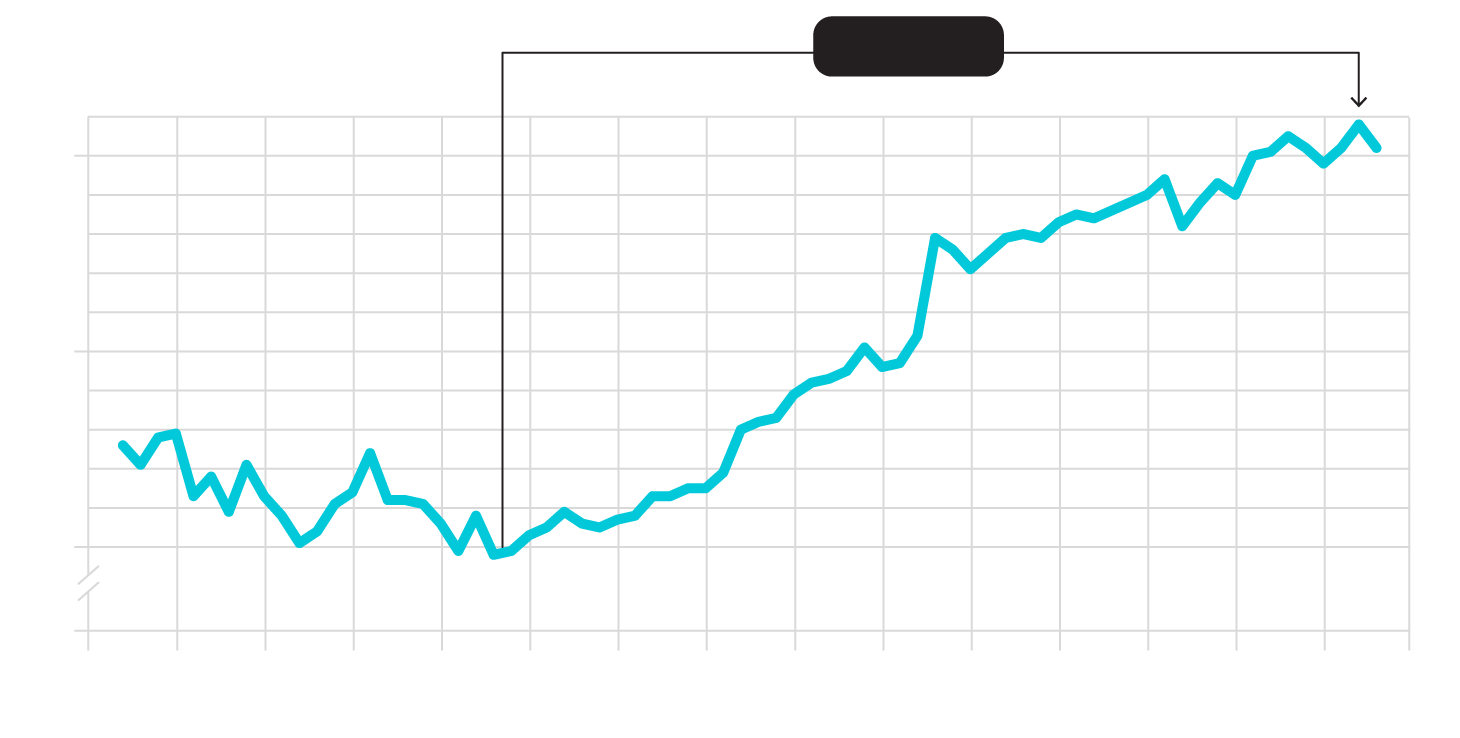

Income Gini Ratio of Families by Race of Householder, All Races

+31.6%

0.45

0.40

0.35

0.0

2020

1950

1960

1970

1980

1990

2000

2010

Source: FRED

“Directors ranked human capital management (65%) and diversity (54%) as the top ESG concerns for their organizations. These are largely driven by investor scrutiny, as evidenced by the presence of both diversity (74%) and human capital (65%) as the two top ESG issues boards discussed with investors. Recognizing this increased investor focus, 49% of boards are working to improve reporting and 61% have open discussions about the most-material ESG matters when they meet with investors.” —NACD Public Company Board Governance Survey 2019

This gap in information is concerning not only because it obfuscates progress toward company-level and broader social diversity goals, but because it represents a missed opportunity for both corporations and investors. Risks and opportunities related to HCM are some of the largest companies face today, and it is often unclear the extent to which they are being assessed or managed. If all the corporations which have recently made outward statements supporting racial justice agreed to enhance their disclosure of diversity and HCM metrics, this would be a notable victory.

However, investors also need to recognize that enhanced disclosure, though important, is a starting point, not an end. If investors truly want to be transformational and drive systems change, they should expend more effort on evaluating corporate actions which may be contributing to socioeconomic inequality. Beyond what goes into company financial filings and diversity/sustainability reports, investors could be asking their investees critical questions about the range of corporate practices discussed above, such as the following:

- Executive compensation. Are current executive pay levels/ratios justifiable in light of systemic inequality and company performance on ESG metrics and/or HCM measures given the importance of these factors to long-term financial outcomes?

- Tax avoidance. Does the organization disclose its tax strategy, is it prepared to manage reputational risk from tax avoidance, and does it have a plan for onshoring capital in the event loopholes are closed? How does the organization’s tax strategy align with its need for a strong and diverse home-country talent base and a domestic infrastructure which is well-maintained?

- Leadership diversity. What company programs and policies are in place to promote diversity and equity of pay and opportunity from the ground level up to the very top? How does the company measure and disclose the success of these efforts?

- Lobbying. Does the company align its lobbying efforts, including donations from affiliated political action committees (PACs), with its stated commitments to social issues, its community, and broader stakeholders?

- Employee benefits. Are benefit plans being delivered equitably to people of color in the employer’s workforce? Are benefits in relation to COVID-19 being updated to reflect the impact of the pandemic on front line workers, who are disproportionately people of color?

4. Allocate capital with explicit consideration of equity issues.

Beyond questioning corporate practices which might lead to heightened socioeconomic inequality, investors should also be channeling more capital to diverse-owned and operated businesses. Again, this isn’t just a social necessity, it is also good for returns.

- Build a pipeline of diverse managers and talent. Investors sometimes cite a low number of qualified diverse-owned candidates or managers or diversity-themed funds in the marketplace as an impediment to channeling capital, but this does not reflect reality. Engaging in industry groups such as the National Association of Securities Professionals (NASP) and the National Association of Insurance Commissioners (NAIC) is a great way to start identifying investment opportunities and supporting the development of diverse talent.

- Be intentional about allocating to diverse managers. Make sure your existing manager selection processes do not bias against diverse-owned firms and/or consider explicitly including diverse-owned firms in more searches. Going further, investors could also learn from the long history of so-called “emerging manager” programs run primarily by public pensions in the US and replicate some of those models in their own portfolios.

- Invest for impact. Investors could look to support initiatives such as the Black Opportunity Fund launched this year in Canada or to invest in the array of other fund strategies targeting minority run businesses.

- Incorporate stakeholder considerations into investment processes. The COVID-19 pandemic has also called into focus the value of companies investing in the health and well-being of their workforce and supply chains and has increased the importance of assessing if company products and services are aligned with achieving the 17 Sustainable Development Goals laid out by the United Nations, including reduced inequality. Taking a more pluralistic view of company management aims (e.g., focusing on stakeholder outcomes rather than just shareholder returns) has been a winning strategy through the pandemic thus far and can lead to better long-term financial performance. Investors have an opportunity to capture these positive outcomes by extending their time horizons and using ESG assessment approaches to evaluate the impact of companies on their various stakeholder groups.

This is by no means a comprehensive list of actions for investors interested in attempting to address systemic inequality and the intersectional issue of systemic racism. Certainly, the provision of more detailed diversity data by investors and corporations is a great place to start. But disclosure also needs to be supported by more dialogue on these topics across the investment community and between investors and corporate management teams. There also needs to be a shift in corporate practices which may be exacerbating inequality, accompanied by shifts in the flow of investor capital to more diverse and stakeholder-centric businesses if true systemic change is going to take place.

Alex Bernhardt, a director with the Marsh & McLennan Advantage group, is a noted innovator in sustainable finance. Prior to joining the Advantage group, Alex led Mercer’s Responsible Investment team in North America, where he provided strategic advice to a wide variety of investor clients related to impact investing, climate risk management, and emerging manager programs.

Monika Freyman is the head of responsible investment for Mercer Canada. Her focus is to drive the creation of solutions and implementable responsible investment consulting advice to address market needs expressed by pension plans and participants across the country.

This feature is to provide general information only, does not constitute legal or tax advice, and cannot be used or substituted for legal or tax advice. Any opinions of the author do not necessarily reflect the stance of Institutional Shareholder Services or its affiliates.

Related Stories:

Op-Ed: ‘Widening the Aperture’—A Key to Enhancing Minority Recruitment

Op-Ed: Building a More Diverse Next Gen: Proprietary Sourcing Extends Beyond Deal Flow

Op-Ed: What Helped Me Become an Allocator as an African American Woman

Tags: Diversity, Inclusion, Investment, Mercer, opinion, race, racism