Institutional investors are growing unsatisfied with hedge fund performance and are increasingly skeptical of the quality of future returns, according to a survey by UBS Fund Services and PricewaterhouseCoopers (PwC).

The survey of investors overseeing a collective $1.9 trillion found that only 39% were satisfied with the performance of their hedge fund managers, and only a quarter of respondents said they expected a “satisfying level of performance” in the next 12-24 months.

This reflects the concerns of the California Public Employees’ Retirement System, which last month announced it was to wind down its hedge fund allocation. The pension cited complexity and costs as two reasons for the termination of the program.

Overall, allocations to hedge funds among the respondents are expected to remain static over the next two years, UBS and PwC said.

The report claimed this showed a change in expectations of what hedge funds are chosen to achieve. Investors no longer expect double-digit returns, but instead are content to settle for lower fees, better transparency, and low correlations with other asset classes.

Mark Porter, head of UBS Fund Services, said: “With institutional money now accounting for 80% of the hedge fund industry, they will continue seeking greater transparency over how performance is achieved and how risks are managed, leading to increased due diligence requirements for alternative managers.”

In contrast, the report indicated that investors were likely to increase infrastructure allocations and investment in other real assets.

“Despite the challenges of devising investment structures that can effectively navigate the dynamic arena of alternative markets, asset managers should remain committed to infrastructure and real assets which could drive up total assets under management in these two asset classes,” the report said.

“This new generation of alternative investments is expected to address the increasing asset and liability constraints of institutional investors and satisfy their preeminent objective of a de-correlation to more traditional asset classes.”

The survey also found that institutional investors were preparing to cut back on the number of managers in their alternatives portfolios in the next two years, with more than half planning to reduce the number of managers they work with in order to focus more on key relationships.

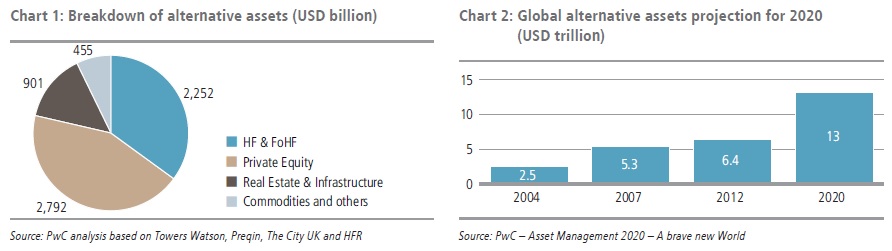

PwC and UBS forecasted that more than $13 trillion would be invested in alternatives by the end of 2020—more than double the figure at the end of 2012.

The survey was conducted in Q4 2013, and covered European, North American, and Asian insurance companies and pension funds.

Related Content:Hedge Funds, Six Years After Lehman & 2014: The Great Hedge Fund Convergence?