Global macro hedge fund strategies are enjoying a hot streak with institutional investors, just trailing long/short equity in popularity, according to Preqin data.

The firm revealed approximately 40% of investors had plans to add a global macro component—in the form of commodities, foreign exchange, fixed income, macro, and managed futures/CTA—to their hedge fund portfolios.

“The current state of the global economy and recent events worldwide make global macro strategies appealing to hedge fund investors,” Preqin’s report said. “The potential gains that global macro strategies offer have not been lost on investors, with many looking to target this space over the coming months.”

Falling oil prices, the strengthening of US dollar, and Greece’s debt crisis have been creating appealing opportunities for managers in this sector, according to the data firm.

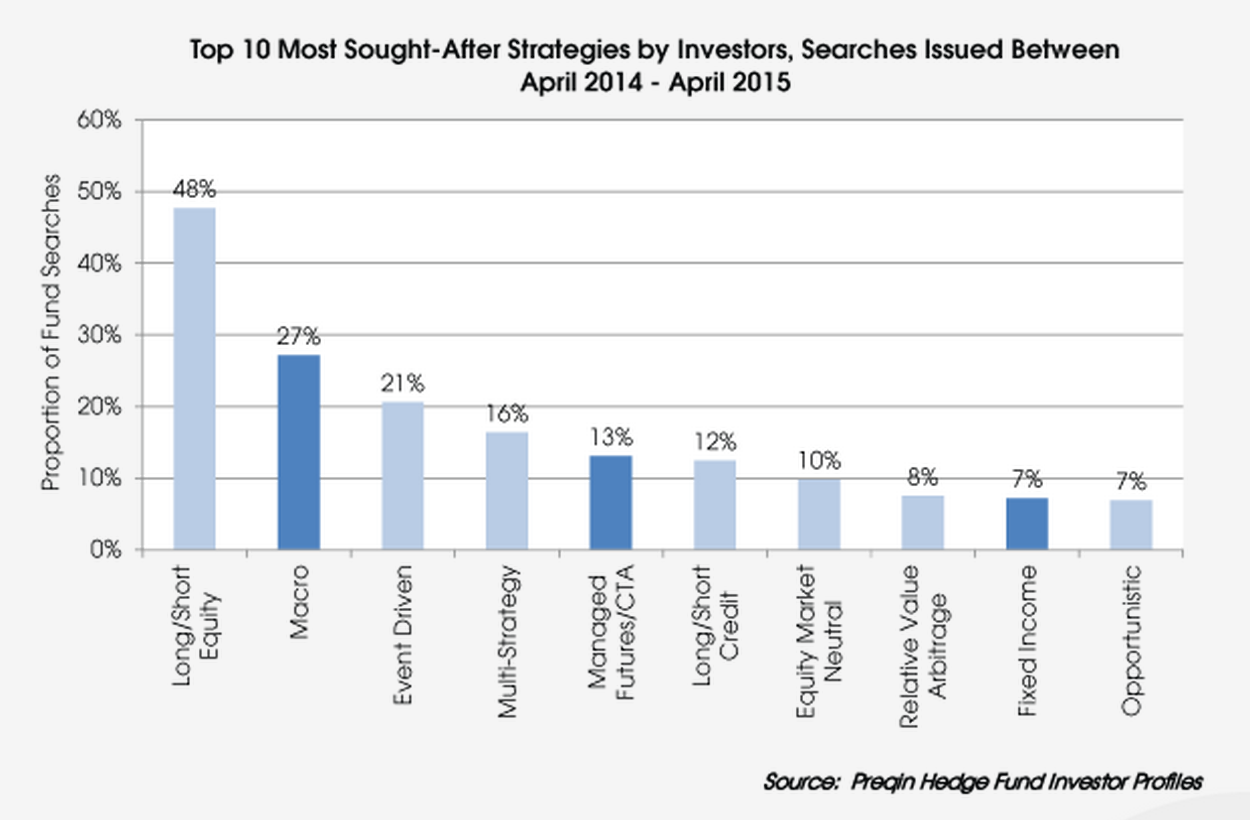

Over the past 12 months, 27% of investors said they had issued searches for pure macro funds, 13% for managed futures/CTAs, and 7% for fixed-income hedge funds.

In addition, the report said allocators actively searching for global macro funds were planning to invest, on average, a minimum of $125 million in new opportunities. Of interested investors, 57% were fund-of-hedge-fund managers and 40% were based in Western Europe.

According to Connecticut-based hedge fund advisory Boomerang Capital’s “Periodic Table of Hedge Fund Returns”—based on data for Credit Suisse hedge fund indices—managed futures and global macro strategies outperformed other funds of late.

In 2014, managed futures trumped all other others with average gains of 18.36%. The strategy also topped 2015 year-to-date returns at 7.32%. Global macro came in second, with a 4.46% averaged return for the same time period.

Despite increased investor appetite—and strong performance—for global macro, long/short equity remained the most sought-after strategy by institutional investors. Nearly 50% of institutional investors targeted the space from April 2014 to April 2015, according to the report.

Equity market neutral, relative value arbitrage, and opportunistic strategies were the least desired by investors, Preqin said, responsible for just 10%, 8%, and 7% of searches issued in the same time period, respectively.

Related Content: Don’t Blame the Hedge Fund Managers; The Best Performing Hedge Fund of 2014 Was…; Infographic: 2013 Periodic Table of Hedge Fund Returns