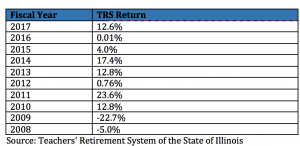

The Teachers’ Retirement System (TRS) of the State of Illinois has reported a 12.6% rate of return, net of fees, for the fiscal year ended June 30, exceeding the system’s investment benchmark of 11.4%.

The return brought the TRS’s asset total to $49.4 billion. Gross of fees, the TRS return for Fiscal Year 2017 was 13.3%, while the total investment income, net of fees, was $5.5 billion. The 30-year investment return for TRS currently is 8.1%, net of fees, which exceeds the system’s long-term investment goal of 7%.

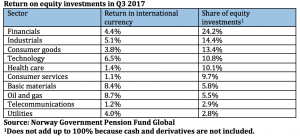

Within the overall investment portfolio, the equity portfolio performed the best, recording a 19.8% return, net of fees, Dave Urbanek, TRS’ director of communications told CIO. The equity portfolio consists of domestic equity, which returned 20%; international equity, which returned 22%; and private equity, which returned 17.4%.

Although TRS’ funded status improved slightly during the year to 40.2% from 39.8%, the unfunded liability increased to $73.4 billion, from $71.4 billion at the end of Fiscal Year 2016.

Urbanek said the funded status improved because of the portfolio’s investments had a good year, but attributed the increase in the unfunded liability to the state of Illinois not giving TRS its full funding contribution.

“For both FY 2018 and the upcoming FY 2019, the state contribution is or will be $2.9 billion short of a ‘full funding’ amount,” said Urbanek. He also pointed out that the increase in the funded status from fiscal year 2016 to 2017 was very small, which means the total investment income of $5.5 billion in 2017 more than cancelled out the dollar amount increase in the unfunded liability.

“Nonetheless,” said Urbanek, “it means we’re treading water financially and still only have $0.40 for every dollar we should have in assets to pay off the system’s long-term obligations.”

The system’s three-, five-, and 10-year returns were 6.1%, 9.9%, and 5.4%, respectively, compared to its benchmark, which returned 6.1%, 9.3%, and 5.3% over the past three, five, and 10 years, respectively.

TRS Executive Director Dick Ingram in a statement that the net-of-fees 30-year rate-of-return of 8.1% is the most important number in the system’s fiscal year 2017 investment data. TRS’ investments have earned positive returns in eight of the past 10 years, with the two years of negative returns realized during the worldwide financial crisis of 2008 and 2009.

The TRS is the 27th-largest public pension system in the US, and serves 412,500 members.

Tags: Fiscal Year, Illinois Teachers’ Retirement System, Pension