Bringing asset management in-house and negotiating lower fees helped pension funds outperform the market over a 20-year period, detailed analysis from CEM Benchmarking has shown.

CEM Benchmarking looked at the returns of more than 6,600 defined benefit pensions and sovereign wealth funds from around the world, covering the period from 1992 to 2013.

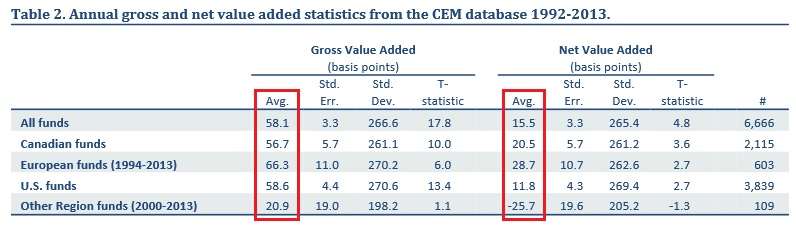

“Investing in investing has paid off.” —Alexander Beath, CEMThese asset owners on average added 58 basis points of performance above the market over that period, CEM found. However, after the effects of fees were factored in, this outperformance was eroded to just 16 basis points.

Author Alexander Beath said the results provided direct evidence of large pension funds adding value above passive investing.

“The outperformance over the market is small because costs eat up about 75% of the gross value added, but it’s there,” Beath said. “While this is great news for our clients who need to justify active investing in the face of efficient market adherents, what is really interesting is finding out why they are able to tilt the table in their favor and add value.”

Analysis of the survey’s data proved that bigger funds have made use of economies of scale to negotiate lower fees. “Funds increased their net value added by 7.6 basis points for every 10-fold increase in holdings due to lower investment management costs,” Beath wrote.

“The single most important characteristic of funds that beat the market is active investing.”He also found that the cost savings from bringing asset management in-house increased by 2 basis points for every 10% of total assets insourced.

However, Beath argued that the “single most important characteristic of funds that beat the market is active investing”. The analysis found that asset owners who adopt fully-active strategies outperformed fully-passive investors by 72 basis points a year, without factoring in fees. After fees, the outperformance was 39 basis points—$39 million of added value for a $10 billion fund, Beath said.

“With the passing of the global financial crisis, pension funds have been put under the microscope by regulators and stakeholders,” he added. “This requires them to justify their investment costs and practices, and this confirms what those in the industry know. Investing in investing has paid off.”

Value added by pension funds in different regions. Source: CEM Benchmarking.

Value added by pension funds in different regions. Source: CEM Benchmarking.

Related Content:A Public Pension Partnership: The Details & CalSTRS Restructures to Bring More Assets In-House