When it comes to hedge funds, higher fees don’t necessarily guarantee higher returns—but they might provide more consistency.

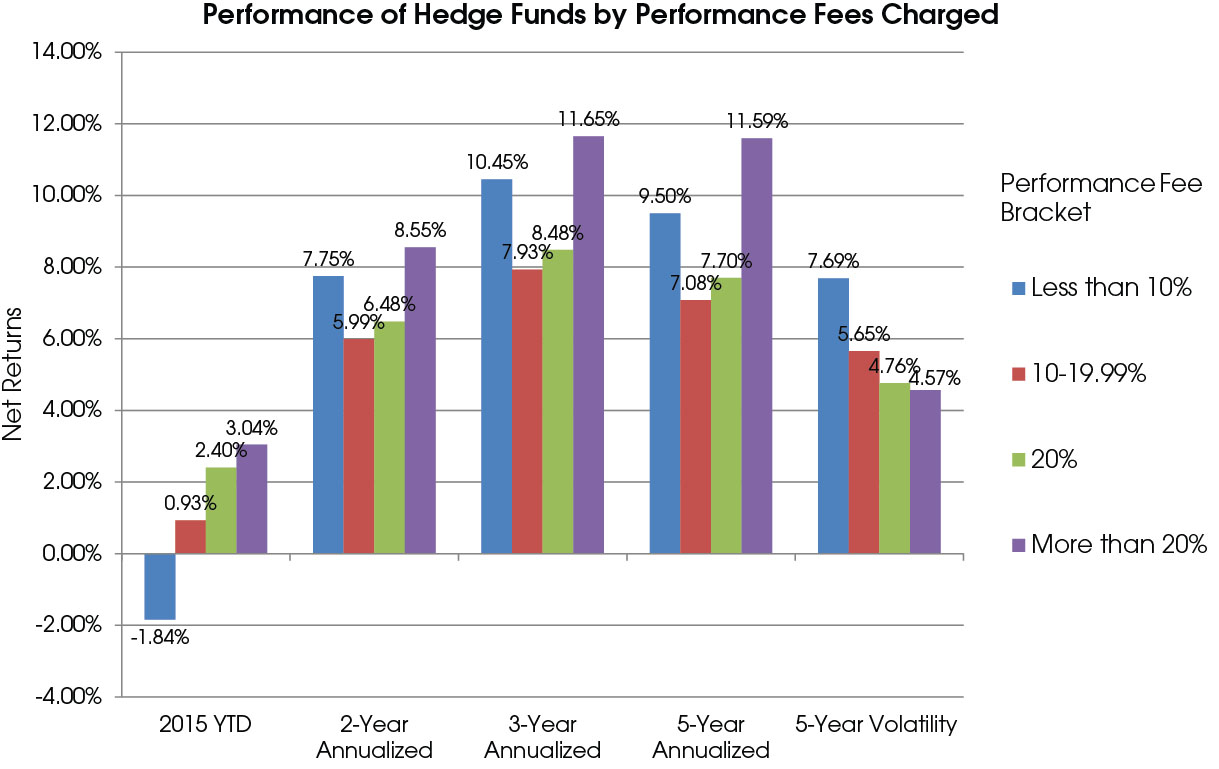

In a new report, Preqin analyzed how hedge funds stacked up when compared by fee structure. Funds were broken down into four groups: Those that charged performance fees of less than 10%, between 10% and 20%, 20%, and greater than 20%.

According to the study, the cheapest hedge funds were among the highest performing. Funds with performance fees under 10% outstripped hedge funds charging fees of 20% and 10% to 20% on a two-, three-, and five-year annualized basis, with returns of 7.75%, 10.45%, and 9.5%, respectively,

However, these returns were bested by the most expensive hedge funds. Funds charging performance fees in excess of 20% had two-, three-, and five-year annualized returns of 8.55%, 11.65%, and 11.59%, respectively.

Hedge funds with fees between 10 and 20% were the lowest performing in every measurement except one-year returns, with funds that charged 20% performing only slightly better.

But while higher fees didn’t always yield stronger returns, they did appear to promise more consistency.

Though the second-highest performing overall, hedge funds that charged less than 10% were also the most volatile, with a five-year volatility of 7.69%.

As fees went up, hedge funds were increasingly stable, Preqin reported. Most consistent were funds charging more than 20%, which had a five-year volatility of 4.57%.

Source: Preqin

Source: Preqin

Related: High Performance Fees ≠ High Performance & The True Cost of Active Management