(August 20, 2013) – Economic analysts around the world fear the worst for the largest emerging market economies, so why has the asset class’s main index been outperforming the S&P 500 recently?

Figure 1 shows consensus GDP estimates for the largest nations in the group—Brazil, Russia, India, and China—have fallen continuously since October. In recent weeks, all these nations have received bad press on their economic data and investors have been moving out of their securities as a result.

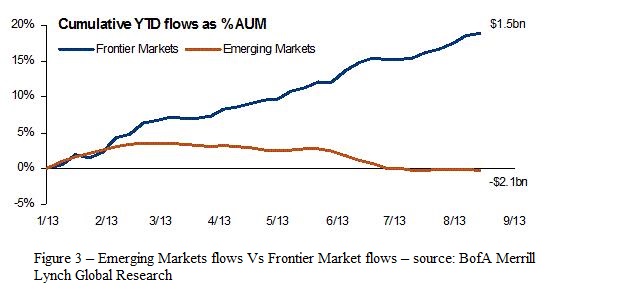

However, since the beginning of this month, the MSCI Emerging Markets Index has rebounded and actually outperformed the S&P 500. Figure 2 shows the ratio between the movements of the two indices. An upwards movement indicates the emerging markets index is performing better than its US counterpart.

Clearly, there is still a good way to go, however, and there may be another turnaround.

Analysts at Raiffeisen Capital Management said investorswanted to know whether they had seen the bottom of the asset class’s fall.

This morning, the asset manager said: “A precise prognosis is not possible, but there are some indicators and factors which seem to suggest that they have not bottomed out. Amongst other things, investor sentiment is not yet pessimistic enough (and is nowhere near rock bottom) and the commodity markets could also suffer further setbacks, in particular the oil price, which has recently shown absolutely no reaction to developments in the rest of the commodities sector (which is very unusual from a historical perspective).”

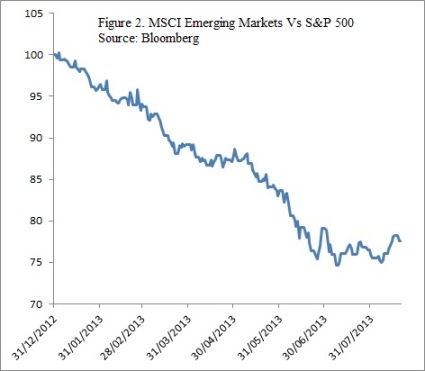

There may yet be another option for investors seeking the path-less-travelled. Figure 3 shows how inflows to frontier markets have decoupled from their emerging cousins. Some, it seems are prepared to take the plunge.