Real interest rates in the UK are forecast to remain negative for 40 years, according to analysis by Andy Haldane, the Bank of England’s (BoE) chief economist.

In a speech yesterday Haldane said the UK’s economy “appears to be writhing in both agony and ecstasy”: While economic growth is improving, inflation is low, and employment is rising, at the same time real wages are falling, productivity is stagnant productivity, and real interest rates are near zero.

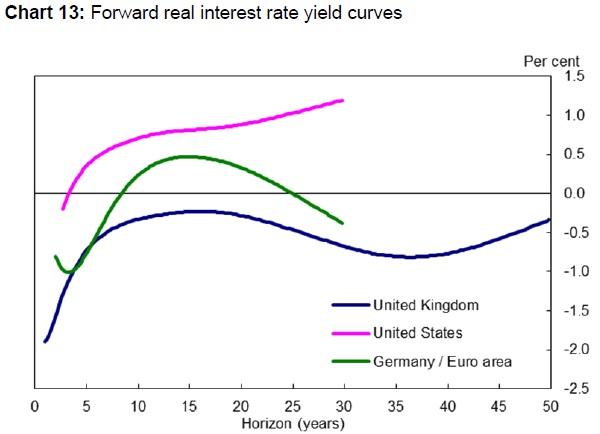

Haldane said that “five-year real interest rates expected in five years’ time have fallen by over 100 basis points” in the UK, the Eurozone, and the US. This was likely caused by repeated “downside surprises” as expected recoveries in certain data measurements failed to materialise.

This had resulted in “truly extraordinary” forecasts, he said—as illustrated by the chart below.

Haldane said the BoE’s rate-setting Monetary Policy Committee “has been forecasting sunshine tomorrow in every year since 2008”, with real wages, productivity, and real interest rates all expected to rise but with few (if any) increases materialising. The International Monetary Fund also repeatedly overshot in its predictions, he added.

Source: Bank of EnglandThe UK’s base interest rate has been 0.5% for more than five

years, while the US Federal Reserve and the European Central Bank have also

kept rates at record low levels for similar periods. As the Fed reduces its

quantitative easing programme, expected to end this month, investor attention

has turned to when central banks will begin tightening monetary policy by

raising rates—and by how much.

Source: Bank of EnglandThe UK’s base interest rate has been 0.5% for more than five

years, while the US Federal Reserve and the European Central Bank have also

kept rates at record low levels for similar periods. As the Fed reduces its

quantitative easing programme, expected to end this month, investor attention

has turned to when central banks will begin tightening monetary policy by

raising rates—and by how much.

Haldane said the 40-year negative rate forecast may reflect a shift towards safe haven assets by investors spooked by recent geo-political tensions.

“The implications for future growth might then be relatively benign, either because these risks are short-lived or because they do not affect companies’ investment plans,” he said. “In other words, the pattern of real rates might still be consistent with a recovery.”

However, he also warned of “an alternative hypothesis” that the forecasts “reflect pessimistic expectations about future growth prospects”, which would require base rates to remain lower for much longer than is expected by any central bank analyst.

“This would carry more far-reaching and negative implications for the economy, more in line with the secular stagnation hypothesis,” Haldane said. Rising inequality, falling educational standards, rising debt, and high youth unemployment all play into this hypothesis, he added.

“Recent evidence, in the UK and globally, has shifted my probability distribution towards the lower tail. Put in rather plainer English, I am gloomier,” Haldane said. “That reflects the mark-down in global growth, heightened geo-political and financial risks and the weak pipeline of inflationary pressures from wages internally and commodity prices externally. Taken together, this implies interest rates could remain lower for longer, certainly than I had expected three months ago, without endangering the [BoE’s 2%] inflation target.”

Related Content:LGIM: Central Banks Are Wrong on Inflation