Moody’s Investors Service has upgraded the credit ratings of California’s two giant public pension funds, giving them higher grades than the state itself.

Both the California Public Employees’ Retirement System (CalPERS) and the California State Teachers’ Retirement System (CalSTRS) moved from an Aa2 issuer rating to Aa3, the agency announced on July 7.

California’s improving balance sheet was the main driver of the upgrade, according to Moody’s rating action report, “because it increases CalPERS’ and CalSTRS’ ability to absorb funding shocks,” such as tardy employer contribution payouts.

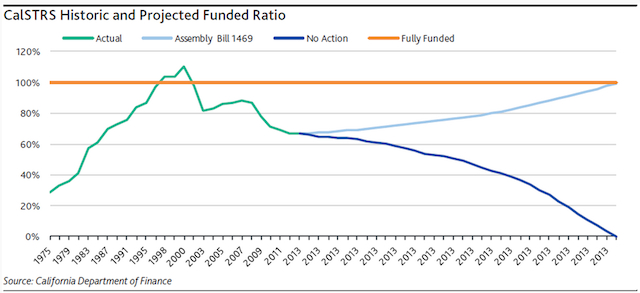

Furthermore, recent moves to close the systems’ funding gaps helped persuade Moody’s of their robust credit-worthiness. The state legislature passed a bill last month laying out a long-term plan to bring CalSTRS to full funded status by 2046. The pension’s CEO Jack Ehnes lauded lawmakers at the time, calling it “historic legislation” that “sets the defined benefit program on a sustainable course.”

CalPERS has raised employer contribution rates for each of the last three years to achieve a similar aim and account for longevity increases.

“While the funding ratios for both plans remain weak (70% for CalPERS and 66.9% for CalSTRS), the important steps taken by each plan to increase contribution rates are credit positive for the plans' long-term financial health,” Moody’s said.

This ratings change came as better news for the systems and state than Moody’s last action on CalPERS and CalSTRS’ credit grades. Citing “back-to-back market value declines,” in December 2009 the agency downgraded their long-term ratings from Aaa to Aa3, which persists today.

Related Content: Moody’s Targeting Pension 'Outliers' With Ratings Overhaul; New Jersey Faces Further Downgrade over Pensions