US-based foundations suffered lackluster returns in the 2014 fiscal year due to muted global equity markets, while increasing their payout rates, according to Commonfund.

In a joint study with the Council on Foundations, Commonfund found foundations’ 2014 returns were less than half of that in the year prior.

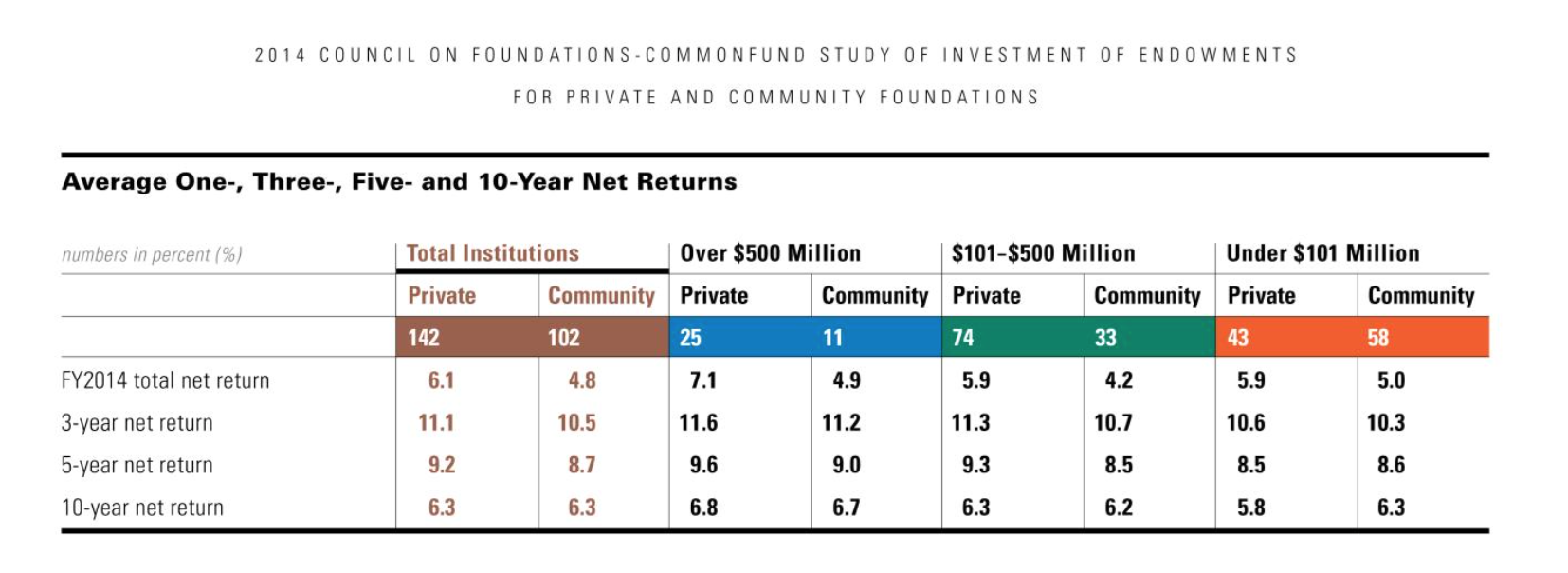

Specifically, 142 private foundations reported an average return of 6.1% for 2014, down from 15.6% for 2013. The 102 community foundations—organizations raising funds for charitable grants—averaged 4.8% in returns for 2014, compared with 2013’s 15.2%.

Over the longer term, private foundations tended to report better performance than their community counterparts, the report said.

For the trailing three- and five-year periods, private foundations gained an average of 11.1% and 9.2%, while community foundations averaged 9.2% and 8.7%, respectively.

Despite lower returns in 2014, nearly 60% of both types of institutions reported increasing their grant making or mission-related spending, according to the report.

Commonfund found private and community foundations upped their spending by an average of 21.1% and 33.9% respectively.

“This research shows that foundation leaders continued to invest in communities through steady mission-related grant making, even though their 2014 returns were affected by subdued global equity markets,” said Vikki Spruill of the Council on Foundations and John Griswold of Commonfund.

Furthermore, the average annual spending rate for both private and community foundations in 2014 was essentially unchanged since the year prior, holding steady at 5.4% and 4.8% respectively.

“It is clear that foundations are maintaining or increasing their grant making dollars to support essential services at a time when public spending is under pressure,” Spruill and Griswold said.

According to the report, domestic equities produced the highest return for foundations in 2014, at around 10%, followed by alternatives generating around 4% in gains.

Participating private foundations were most heavily allocated to alternative strategies—at 44% in 2014—while community foundations were most allocated to US equities at 34%.