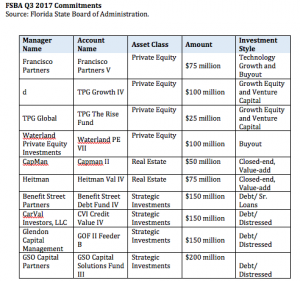

The Florida State Board of Administration (FSBA) has committed just under $1.1 billion to nine managers in the third quarter to invest in private equity, real estate, and strategic investments.

The FSBA, which oversees $195.6 billion in total assets, committed a total of $300 million to private equity investments. It committed $100 million to the TPG Growth IV fund, and $25 million to the TPG The Rise Fund, both which are managed by TPG Global; $100 million to the Waterland PE VII fund, and $75 million to the Francisco Partners V fund, managed by Waterland Private Equity Investments and Francisco Partners, respectively.

The FBSA also committed $125 million to real estate investments, including $75 million to the Heitman Val IV fund managed by Heitman, and $50 million to the Capman II fund managed by CapMan.

For distressed debt investments, the board of administration committed $650 million, including $200 million to the GSO Capital Solutions Fund III, which is managed by GSO Capital Partners; $150 million to the CVI Credit Value IV fund, managed by CarVal Investors; $150 million to the Benefit Street Debt Fund IV, managed by Benefit Street Partners; and $150 million to the GOF II Feeder B fund, managed by Glendon Capital Management, which is a new manager to the FSBA.

Tags: Florida State Board of Administration, Private Equity, Real Estate, Strategic Investments