Currency fluctuations hit private equity returns in the third quarter of 2014, causing the sector’s first quarterly loss since 2012, according to data from Cambridge Associates.

The consultancy firm’s benchmark of private equity funds outside of the US reported a 5% loss in dollar terms between July and September last year, according to the most recent data collated. Cambridge said the weakness of the euro during the period hurt the returns significantly—in euro terms, the Global ex-US Developed Markets PE/VC index was up 3%. Europe is the primary private equity investment market represented in the benchmark.

All seven “meaningfully-sized” sectors in the index—consumer, energy, financial services, health care, IT, manufacturing, and media—posted negative returns for the quarter, Cambridge’s report said. “The three largest sectors—consumer, health care, and IT—represented nearly half of the index’s value and on a dollar-weighted basis [lost] 3.4%.”

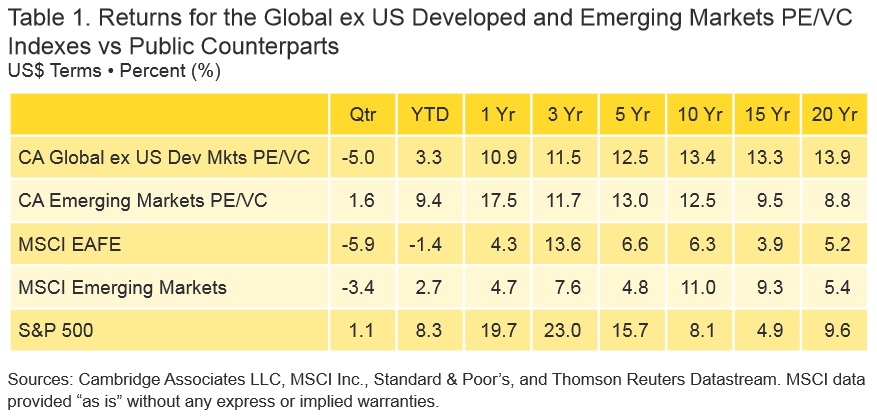

However, longer term, the Global ex-US Developed Markets PE/VC index has outperformed the S&P 500 significantly. Over 10 years, the S&P 500 gained 8.1% while the private equity benchmark gained 13.4%.

Recent data from Preqin indicated that fundraising in private equity slowed in the first three months of 2015, although funds still held record levels of capital yet to be deployed.

Related Content: Private Markets Beat More Records in Q1 & Private Equity’s Success Could Be its Investors’ Downfall