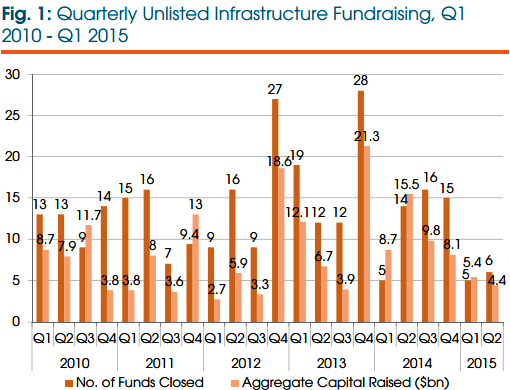

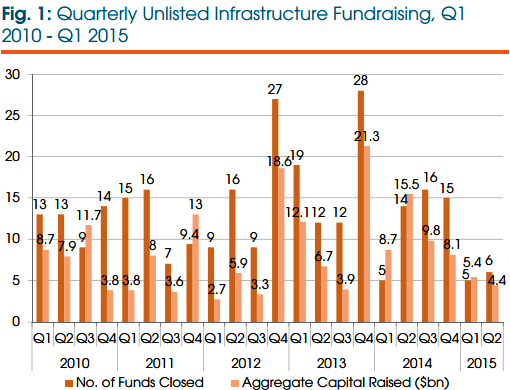

Unlisted infrastructure funds in 2015 have raised the second

lowest level of assets since the start of the decade and fewer than half the

average number of funds have successfully closed, Preqin data has shown.

Since the start of the year, just $9.8 billion has been

raised and just 11 funds around the world have closed, Preqin said in its

half-yearly review.

Source: PreqinThis compares to $24.2 billion and $18.8 billion raised in

2014 and 2013, respectively. In 2014, managers closed 19 funds; in 2013, 31

funds were closed.

Source: PreqinThis compares to $24.2 billion and $18.8 billion raised in

2014 and 2013, respectively. In 2014, managers closed 19 funds; in 2013, 31

funds were closed.

“Institutional investors are concerned about high valuations

for infrastructure assets and the impact this will have on the performance of

the asset class,” said Andrew Moylan, head of real assets products at Preqin. “These

concerns appear to be translating into reduced levels of commitments, and a

slower fundraising market.”

In May, consulting firm Cerulli found

a growing demand for infrastructure, combined with limited supply, was

forcing down return in the asset class—and putting investors off.

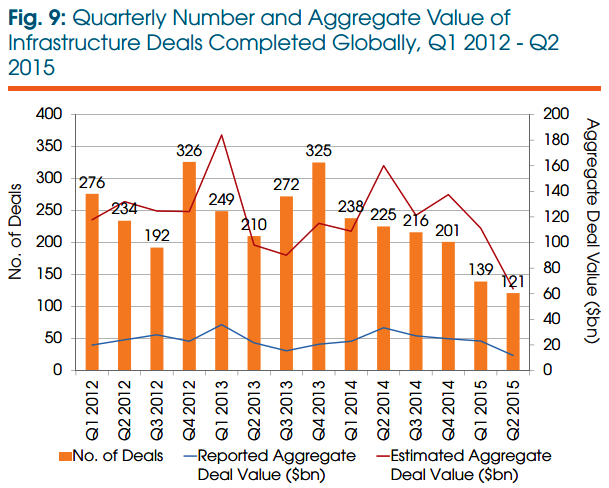

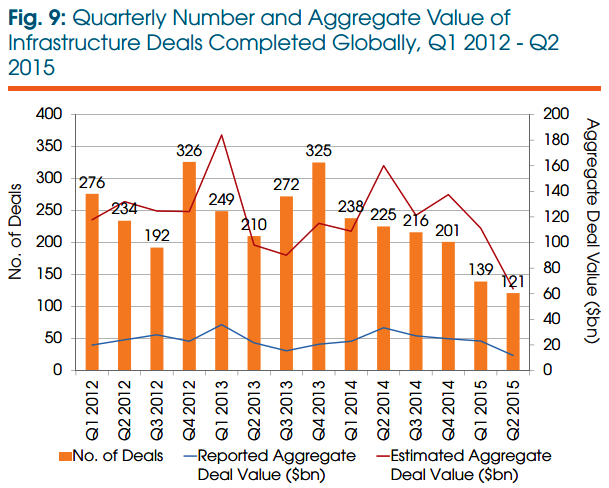

The number of deals completed has fallen sharply in 2015,

Preqin said. In the first half of the year, 260 deals were completed in the

sector, comparing to 463 a year earlier. As a consequence, the aggregate value

of deals was down this year too. From deals

ranging from an aggregate $200 billion to $300 billion in the first quarter of

2014, this year the range fell from around $200 billion to under $150 billion.

However, fund managers have not been put off, Preqin said,

with the highest number of products being marketed to investors this decade.

In 2015, 151 funds were being offered to investors. The

second highest number of funds on the market was in 2013, when 145 were

available. Despite this level of products, the level of assets being targeted

has remained relatively stable.

Source: PreqinThe combination of this high asset target and lack of

appetite from investors has had an impact on managers’ working practices.

Preqin noted that managers were spending an average 27 months on the road

gathering assets, which was the highest since they began using this metric in

2008.

Source: PreqinThe combination of this high asset target and lack of

appetite from investors has had an impact on managers’ working practices.

Preqin noted that managers were spending an average 27 months on the road

gathering assets, which was the highest since they began using this metric in

2008.

“While some managers have been very successful, competition

for investor capital is intense and with more than 150 funds being marketed,

many firms may struggle to meet their fundraising goals in the months to come,”

said Moylan.

PensionDanmark today announced it had allocated DKK4 billion ($594 million) to a fund from Copenhagen Infrastructure Partners. The Copenhagen Infrastructure II fund’s launch was announced in October last year, and following a successful close it now has roughly $2.2 billion in assets from 19 institutional investors from across Europe, making it one of the continent’s largest dedicated infrastructure funds.

PensionDanmark now has $2.5 billion invested in infrastructure, roughly $1 billion of which is managed by Copenhagen Infrastructure Partners.

Related: Is

Infrastructure Becoming Efficient? & Why

the Heathrow Express Is Insanely Expensive

Source: Preqin

Source: Preqin Source: Preqin

Source: Preqin