Thanks to declining interest rates and a boost in global equities, Danish pension fund ATP experienced a mighty surge in the first quarter.

The fund returned 21.7% in the first three months of 2019, a DKK20 billion ($3 billion) harvest thanks to state and mortgage bonds as well as global and domestic stocks, erasing 2018’s 3.2% loss.

Even Bo Foged, the pension plan’s acting chief executive officer, was surprised.

“We have realized an unusually good result for the first quarter of 2019 and delivered a very high return, which is highly satisfactory,” he said. “With this having been said, we can also look forward to generally lower investment returns in the years to come and at the same time we are seeing greater fluctuations between quarters.”

Foged said ATP will continue its “disciplined approach” to its portfolio construction and risk management as the focus is long-term.

Given the good news, the fund has now returned an aggregate 17%, 20.3%, and 15.8% over the past one, three, and five years, with only three of the past 20 quarters yielding negative results.

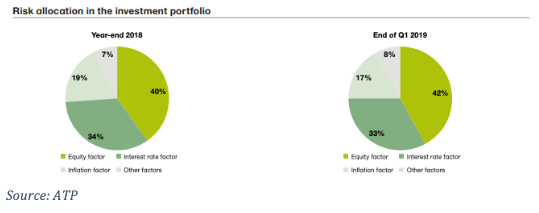

ATP shifted its asset mix a bit since 2018’s downdraft. It rebalanced its factor-based risk allocation by moving 2% and 1% from its inflation and interest rate sectors to equities and other areas. The fund was 42% equities, 33% interest rate-coordinated, 17% inflation-linked, and 8% in other factors on March 31.

In its most recent annual report, the fund said its factor framework “enables comparison of all investment activities on the same basis, which is particularly important when it comes to alternative illiquid investments.” A portfolio revamp occurred in 2015.

As for the classes themselves, ATP invests in government and mortgage bonds, foreign and global equities, credit, private equity, real estate, infrastructure, inflation-related instruments, and other assets.

Denmark Pension’s 2018 Ended Badly

Ex-Ontario Teachers’, ATP CIO Set to Launch New Firm’s First Product

CEO of Danish Pension ATP Resigns After Pressure over Tax Scandal