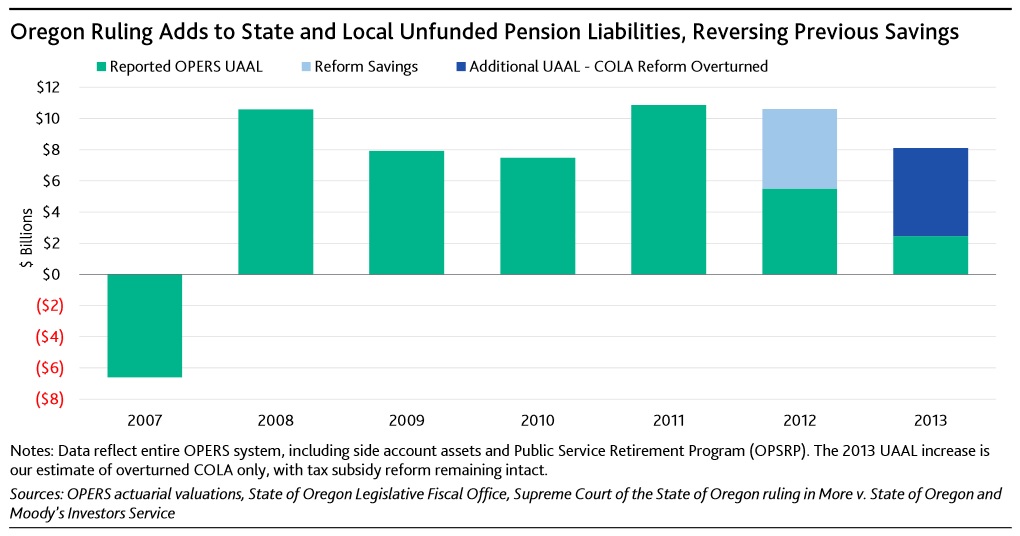

The Oregon Public Employees’ Retirement System (OPERS) will see its liabilities balloon by more than $5 billion following a court ruling that quashed reforms introduced in 2013.

Retirees were previously given an inflation-linked increase—referred to as cost-of-living adjustments—capped at 2%, but in 2013 the state’s legislature reduced this cap to 1.5%, and applied it to all benefits. The Supreme Court of the State of Oregon ruled on April 30 that OPERS could not apply this reduction to benefits earned prior to the new cap being introduced.

According to a report by credit rating agency Moody’s, the savings from the reduced cap had already been incorporated into actuarial valuations and state and local government budgets.

The ruling presents new OPERS Executive Director Steve Rodeman, who was appointed in September, with a major problem: Roughly $5 billion in combined pension liability reductions are set to be wiped out at the next valuation. Employer contributions are also set to increase substantially from 2017, Moody’s said.

UAAL: unfunded actuarial accrued liability. COLA: cost-of-living allowance.

UAAL: unfunded actuarial accrued liability. COLA: cost-of-living allowance.

Moody’s also warned that the ruling could set a dangerous precedent for other states such as Illinois and New Jersey. The state supreme court in Illinois is currently considering changes to pension promises that have yet to be enforced, while in New Jersey retirees have challenged the removal of all index-linking from public pensions.

OPERS was 96% funded at the end of 2014, according to the pension’s website, with a funding shortfall of $2.75 billion. This included the $5 billion of savings.

The Supreme Court’s ruling on the OPERS changes can be read here.

Related Content: Oregon Lawmakers Push to Empower Pension Investment Office