Though investment consultants are under attack for failing to innovate, asset owners may also be at fault for enabling their stagnation, according to research.

Such lack of innovation may be due to the nature of the contracts that asset owners have with consultants, according to Gordon Clark of Oxford University and Ashby Monk of Stanford University.

“Enabling and facilitating decision-making is not quite the same as setting the parameters for an effective short- or long-term investment strategy.” —Clark and MonkMost standard contracts are open-ended, the paper said, with room for ambiguity in duration, precise nature of the provided services, and specific fees. Instead of nailing down the details, most contracts rely on conventional norms to fill in the rest of the agreement.

According to the authors, the ambiguity could provide both investor and consultant room to maneuver through the risks and uncertainties of the markets.

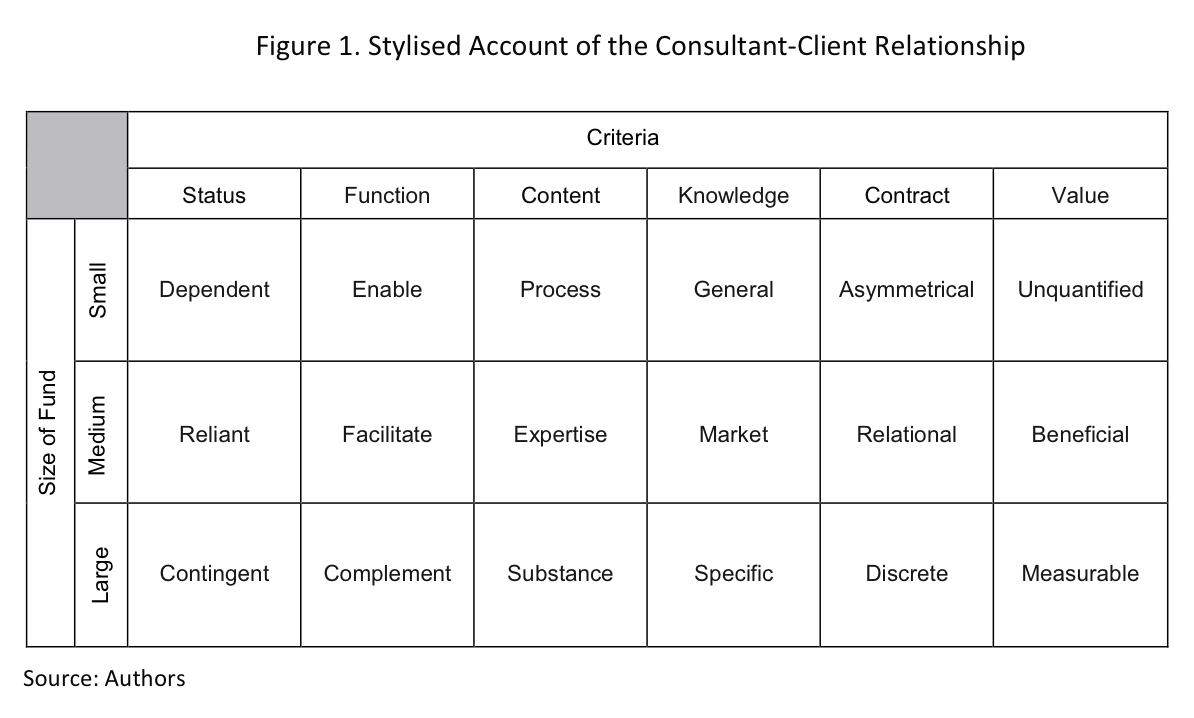

These unrestricted contracts also mean consultants serve different roles for funds of varying sizes to fulfill their specific needs, the research said.

For smaller funds, consultants are likely to play an integral part of how investment decisions are made, according to Clark and Monk, while they tend to act more as facilitators for middle-sized funds.

And for large funds, consultants are sources of independent insight—“a not-entirely-welcome reality check on the aspirations of the fund’s senior executives,” the authors said, requiring them to have more specific roles and responsibilities.

However, the same ambiguity in contracts could also explain why consultants may not be incentivized or motivated to “promote, innovate, and change in the face of market dislocation,” the paper said.

In addition, a standard contract between asset owners and advisers is silent on the topic of performance, according to the research.

“Enabling and facilitating decision-making is not quite the same as setting the parameters for an effective short- or long-term investment strategy,” the authors said. “Investment consultants are deliberate in setting boundaries on their responsibilities in this regard.”

The authors claimed this ambiguity was hampering the ability of asset owners to deal with new market realities that emerged after the financial crisis.

“Where market disjuncture breaks with past industry practices and the available scope for incremental adaptation, asset owners may be forced to confront their own inadequacies and the costs and consequences of conventional behavior,” Clark and Monk said.

The paper said small funds are likely to outsource both strategy and implementation functions, medium-sized funds would form a closer relationships with consultants to be more engaged in their decision-making, and large funds would specify advisers’ roles to add value to the investment staff’s knowledge.

Read Clark and Monk’s “Contested Role of Investment Consultants: Ambiguity, Contract, and Innovation in Financial Institutions”.

Related Content: How Do You Solve a Problem Like Consulting?