Canada’s 11 largest pension funds collectively manage $2.4 trillion, but they widely diverge on their commitments to achieving decarbonization, according to Shift Action for Pension Wealth and Planet Health, a Canadian pension climate advocacy group.

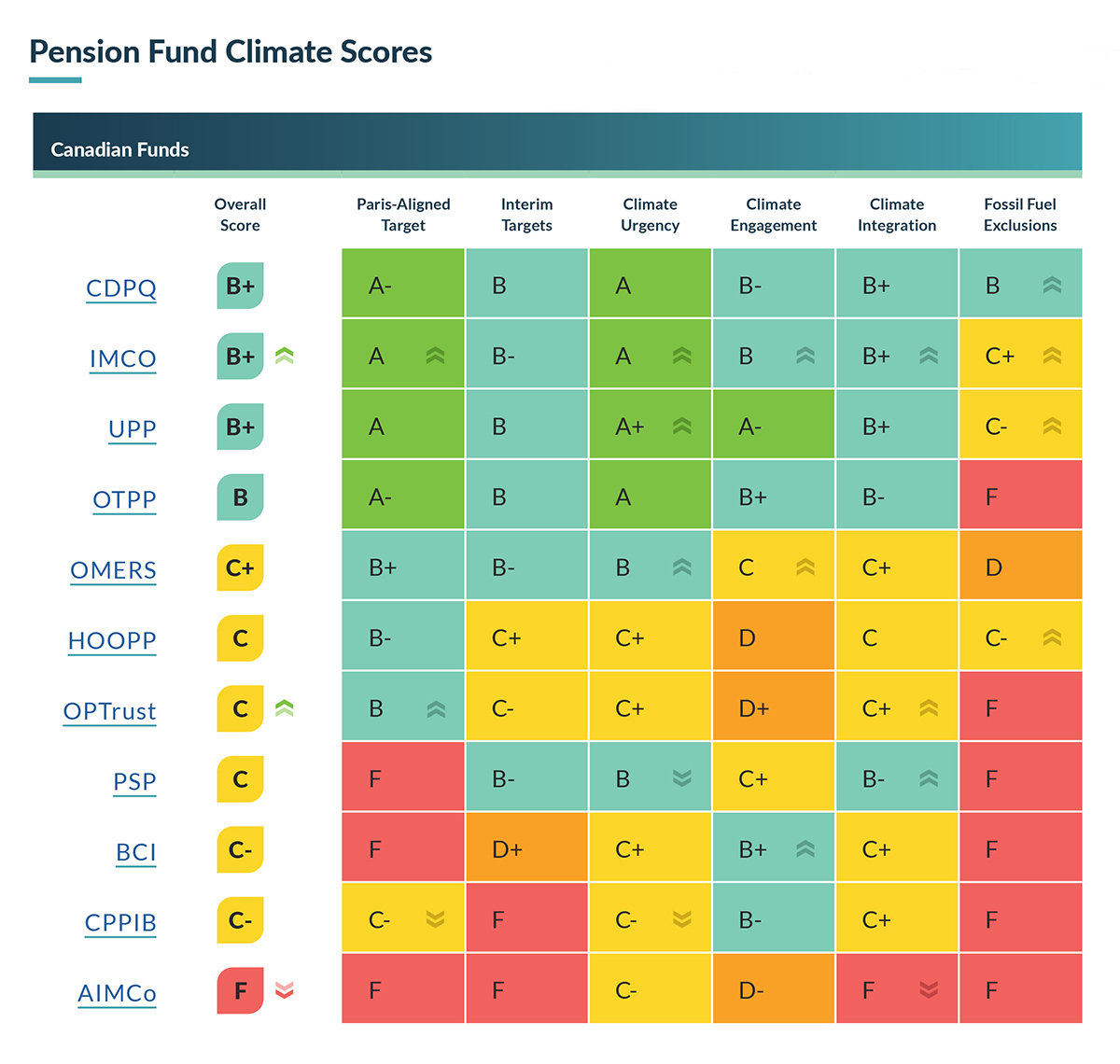

Shift’s third annual Canadian pension climate report card was released Wednesday, scoring each pension fund on its commitments. Each pension fund was graded on a scale of A to F on their Paris-aligned targets, interim targets, climate urgency, climate engagement, climate integration and fossil fuel exclusions.

Caisse de dépôt et placement du Québec took the top spot in the report card, with an overall grade of B+. The Investment Management Corp. of Ontario and the Toronto-based University Pension Plan also received a B+.

The Ontario Teachers’ Pension Plan received a B grade, while the Ontario Municipal Employees Retirement System had an overall grade of C+. The Healthcare of Ontario Pension Plan, OPTrust and the Public Sector Pension Investment Board were all graded C.

British Columbia Investment Management Corp. and the Canada Pension Plan Investment Board both received grades of C-, and the Alberta Investment Management Co. received an F.

Source: Shift Action for Pension Wealth and Planet Health

Shift also graded two international funds; Stichting Pensioenfonds ABP of the Netherlands and Andra AP-fonden of Sweden (better known as AP2). Both received overall grades of A-.

Related Stories:

Canada Pension Plan Increases Green, Transition Investments by 20% to C$79B

Canada’s CDPQ Invests C$200M in Swedish EV Battery Developer

CDPQ, Canada Growth Fund Invest in MKB Energy Transition Fund

Tags: ABP, AIMCo, AP2, BCI, Canada, CDPQ, CPP Investments, HOOPP, IMCO, Maple 8, OMERS, OPTrust, OTPP, Pensions, PSP Investments, Shift, UPP